National Grid 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report and Accounts 2003/04_Transco plc 3

Operating Review_continued

that, with effect from 1 April 2002, any efficiently

incurred over or underfunding of pension

schemes as compared to those assumptions

made by Ofgem when price controls were set,

will ultimately be passed to consumers. It is

expected that the details of how this mechanism

will work, together with any adjustments that

Ofgem may wish to make in respect of historic

pensions issues, will be clarified later in 2004.

UK gas distribution

Background information

Our UK gas distribution business comprises

almost all of Britain’s gas distribution system.

The gas distribution system is organised into eight

regional networks and consists of approximately

170,000 miles of distribution pipelines and is the

largest gas distribution system in Europe. Gas is

transported on behalf of approximately 70 active

gas shippers from the NTS through the distribution

system to around 21 million consumers.

As well as gas transportation, Transco is

responsible for the safety, development and

maintenance of the transportation system and

operates the national gas emergency service.

Regulation

On 1 April 2002, the activities of Transco’s

distribution business became subject to a

separate five-year price control formula

(‘distribution price control formula’). With effect

from 1 April 2004, this single price control

formula was disaggregated into eight separate

price control formulae (‘networks price control

formulae’) to cover the activities of the eight

regional distribution networks.

The new networks price control formulae take the

same form as the distribution price control formula,

with a maximum allowed revenue assigned to each

network. Each formula retains the 65% fixed, 35%

variable revenue associated with transportation

volume changes, a mains replacement incentive

mechanism and the pass through of prescribed

rates and gas transporter licence fees.

Each network has been allocated a regulatory

value associated with its distribution assets, using

an estimate of Transco’s distribution business

regulatory value as at 1 April 2002. The allocation

was done in a manner to minimise unnecessary

regional differentials in transportation charges.

The networks price control formulae also

incorporate the same cost of capital assumptions

at a real pre-tax rate of 6.25%.

To set the new networks price control formulae

it was also necessary to allocate allowances for

operating costs, capital expenditure, replacement

expenditure, regulatory depreciation and

transportation volumes. Projected replacement

expenditure continues to be divided 50:50

between regulatory capital and regulatory

operating expenditure, thereby ensuring that the

cost of the iron mains replacement programme

does not fall wholly on today’s customers, but is

shared with future customers. The regulatory

treatment of replacement expenditure contrasts

with the accounting treatment where all such

costs are expensed (see critical accounting

policies – replacement expenditure on page 10).

Each network is subject to its own mains

replacement incentive mechanism and retains 33%

of any outperformance against Ofgem’s annual

cost targets as additional profit, or alternatively,

bears 50% of any overspend if it under-performs.

In 2003/04, operating under the distribution price

control formula, Transco made an estimated

£10 million of additional profit from this mechanism.

Financial performance

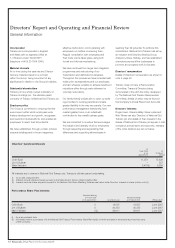

UK gas distribution turnover for the year ended

31 March 2004 was £2,245 million, compared

with £2,089 million in 2002/03.

Principal factors behind the £156 million increase

in turnover comparing 2003/04 to 2002/03 were:

an increase in revenue recovered under the

distribution price control formula of £84 million,

primarily because of a 5% price increase

implemented in October 2003 which added

£79 million, combined with an increase in

underlying volumes which added £21 million,

but offset by an £11 million reduction because

of relatively mild weather; and

a £72 million increase in other, relatively low

margin income, primarily because of increased

work for National Grid Transco’s other

businesses, such as increased workload

undertaken by Transco’s emergency service

on behalf of National Grid Transco’s regulated

and non-regulated metering businesses.

UK gas distribution adjusted operating profit for

the year ended 31 March 2004 was £729 million,

compared with £554 million in 2002/03.

UK gas distribution operating profit for the year

ended 31 March 2004 was £653 million,

compared with £443 million in 2002/03.

Exceptional charges which explain the difference

between adjusted operating profit and operating

profit are discussed in the context of all

exceptional items of the Group on page 7.

The £175 million increase in adjusted operating

profit comparing 2003/04 to 2002/03 was mainly

a result of an £84 million increase in formula

income, a £103 million reduction in controllable

operating costs and a £17 million reduction in

replacement expenditure. This was offset by a

net increase in depreciation and amortisation

of capital contributions of £11 million and a

£23 million charge for UK gas distribution’s

share of the Lattice pensions deficit.

UK gas distribution’s replacement expenditure

(repex) for the year ended 31 March 2004 was

£388 million compared with £405 million in

2002/03. The £17 million reduction comparing

2003/04 to 2002/03 was associated with the

start of the iron mains replacement programme

with 2003/04 representing the lowest year of

expenditure planned until 2007.

UK gas distribution’s controllable costs in

2003/04 were £103 million lower than 2002/03

and 7% lower than the 2003/04 allowance

projected by Ofgem as part of the five-year

distribution price control formula which

commenced in April 2002. The reduction was a

direct result of the implementation of restructuring

plans announced in September 2002, coupled

with continued investment in technology, and

the centralisation of activities, aided by synergies

from the Merger of National Grid and Lattice.

Operating performance

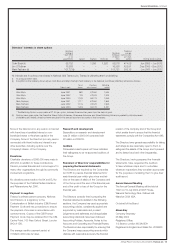

Gas throughput was 706 TWh in 2003/04

compared to 708 TWh in 2002/03. If the

weather had corresponded to seasonal normal

temperatures, it is estimated that gas throughput

would have been 731 TWh in 2003/04 compared

to 730 TWh in 2002/03.

While there has been underlying growth of

1.9% in demand from small users (2002/03 2.0%

demand growth), 2003/04 saw a 3.5% reduction

in underlying demand from business and other

large users (2002/03 1.6% reduction). This is

attributed to higher gas prices, power stations

being off-line and recession in a number of

manufacturing sectors.