National Grid 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 Transco plc_Annual Report and Accounts 2003/04

Notes to the Accounts_continued

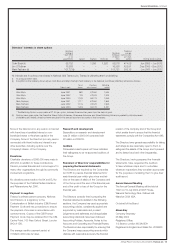

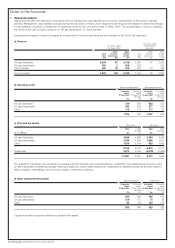

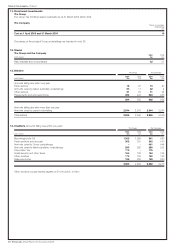

4. Payroll costs and employees

a) Payroll costs

12 months 12 months

ended ended

31 Mar 2004 31 Mar 2003

£m £m

Wages and salaries 350 402

Social security costs 31 31

Pension costs 93 71

474 504

Less: Amounts capitalised (14) (9)

Payroll costs included in replacement expenditure (59) (56)

Payroll costs included in exceptional operating items (6) –

395 439

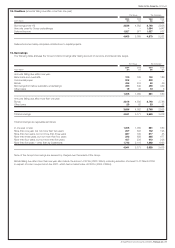

b) Number of employees

12 months 12 months

ended ended

31 Mar 2004 31 Mar 2003

Average Average

Number Number

United Kingdom 11,792 13,489

31 Mar 2004 31 Mar 2003

Number Number

United Kingdom 11,341 12,397

In addition to the payroll costs above, there were severance costs of £62m (12 months ended 31 March 2003: £104m) included within other

operating charges – exceptional items.

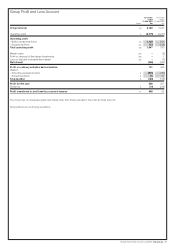

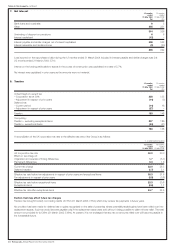

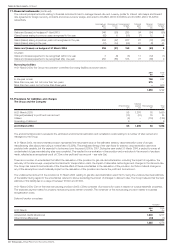

5. Directors’ emoluments

The aggregate amount of emoluments paid to Directors in respect of qualifying services for the 12 months ended 31 March 2004 was £2,040,131

(12 months ended 31 March 2003: £2,015,408). The amount paid in respect of compensation for loss of office in the 12 months ended 31 March

2004 was £599,011 (in the 12 months ended 31 March 2003: £nil). Directors’ emoluments include amounts in respect of accrued bonus which

had not yet been approved at the date of these accounts.

A number of the current Directors are also directors and employees of National Grid Transco plc or a subsidiary undertaking of that company and

are paid by these companies.

As at 31 March 2004, retirement benefits were accruing to 6 Directors under a defined benefit scheme and one Director under a defined contribution

scheme. The aggregate emoluments for the highest paid Director were £492,004 for the 12 months ended 31 March 2004 (12 months ended

31 March 2003: £332,241); and total accrued annual pension at 31 March 2004 for the highest paid Director was £188,600 (31 March 2003:

£91,700). The amount of contributions paid in respect of defined contribution pension schemes was £19,800 (12 months ended 31 March 2003:

£12,960).

Details of Directors’ interests in shares are contained on pages 12 and 13.