National Grid 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

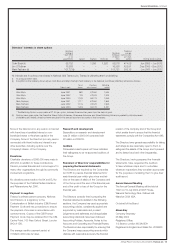

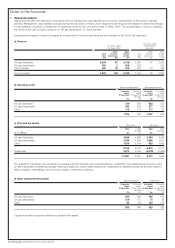

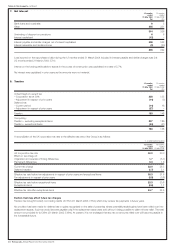

2. Operating costs

12 months 12 months

ended ended

31 Mar 2004 31 Mar 2003

£m £m

Depreciation 423 385

Payroll costs (note 4(a)) 395 439

Other operating charges

– Purchases of gas 86 108

– Rates 240 235

– Replacement expenditure 388 405

– Exceptional operating items (note 3) 77 146

– Other non-exceptional operating charges 466 529

1,257 1,423

2,075 2,247

Operating costs include:

Research and development costs 48

Operating lease rentals:

– Plant and machinery 11 15

– Other 15 14

Auditors’ remuneration:

Statutory audit services

– Annual audit (i) 0.4 0.4

– Regulatory reporting 0.2 0.2

Further audit related services 0.3 –

Other non-audit services (ii) –3.1

(i) The audit fee for the Group and the Company are not materially different.

(ii) Other non-audit services for 2002/03 includes £2.2m paid to the former consulting business of PricewaterhouseCoopers which was sold to IBM United Kingdom Limited

on 30 September 2002.

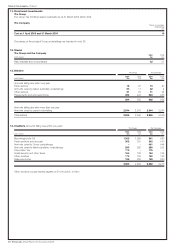

3. Exceptional items

The Group has categorised the following items as exceptional items under UK GAAP because, by either their size, incidence or because they are

specifically prescribed, they need to be separately disclosed for the accounts to show a true and fair view.

Paragraph 20 of Financial Reporting Standard (FRS) 3 ‘Reporting Financial Performance’, requires that certain items be disclosed after operating profit

and these are shown below as ‘non-operating exceptional items’. These items comprise: a) costs associated with a fundamental reorganisation which

in the case of the Group, relate to the transaction costs of the Merger; and b) profit on disposal of fixed assets (including the gain on sale of other

fixed asset investments).

Other exceptional items are shown below as ‘operating exceptional items’ and the Directors believe require separate disclosure, as permitted by FRS 3,

within operating profit to show a true and fair view. These items include: Restructuring costs; Merger costs arising from the recognition of employee and

property costs arising as a direct result of the Merger; and environmental provision which are all disclosed by virtue of their size.

a) Operating

12 months 12 months

ended ended

31 Mar 2004 31 Mar 2003

£m £m

Restructuring costs (i) 90 100

Merger costs (ii) –46

Environmental provision (iii) (13) –

77 146

(i) The restructuring costs for the 12 months ended 31 March 2004 consist of £11m costs associated with the proposed disposal of distribution networks and other

charges of £79m. The other charges, and the charges for the 12 months ended 31 March 2003, primarily relate to planned cost reduction programmes. (12 months

ended 31 March 2004: £66m after tax, 12 months ended 31 March 2003: £70m after tax).

(ii) The Merger costs for the 12 months ended 31 March 2003 represents employee and property costs associated with the Merger of National Grid and Lattice

(£39m after tax).

(iii) Following the completion of site investigations, the environmental obligations in respect of those sites have been reduced by £13m (£13m after tax).

b) Non-operating

12 months 12 months

ended ended

31 Mar 2004 31 Mar 2003

£m £m

Merger costs (iv) –8

Profit on disposal of investments (v) –(1)

Loss on disposal of tangible fixed assets (vi) –6

–13

(iv) The after tax cost of the Merger in the 12 months ended 31 March 2003 was £6m.

(v) The after tax profit on disposal of fixed asset investments in the 12 months ended 31 March 2003 was £1m.

(vi) The after tax loss on disposal of tangible fixed assets in the12 months ended 31 March 2003 was £4m.

Notes to the Accounts_continued

Annual Report and Accounts 2003/04_Transco plc 21