National Grid 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

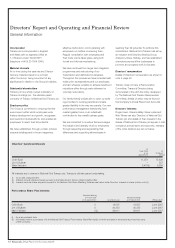

2Transco plc_Annual Report and Accounts 2003/04

Introduction

Overview of Transco

Transco is a part of National Grid Transco,

an international energy delivery business.

Transco owns, operates and develops Britain’s

natural gas transmission and distribution systems,

which deliver gas to around 21 million consumers.

Our business operations are divided into

three segments:

UK gas distribution, which comprises

Transco’s local transmission and distribution

pipeline business in Britain and is organised

into eight regional networks;

UK gas transmission, which operates the

national transmission system (NTS) and which

is managed jointly with National Grid Transco’s

electricity transmission activities; and

other activities, which mainly comprises

Transco’s regulated gas metering activities.

This operating review focuses on the

performance of individual business segments,

including a consideration of the business

environment within which each of our businesses

operates, the operational performance of that

business and the financial performance of each

business segment. In the opinion of management,

it is appropriate to consider the financial

performance of each business segment in the

context of its operational performance and

related business issues for the period concerned.

The financial review beginning on page 7 primarily

focuses on the financial impact of matters that

do not arise from operating performance or are

better discussed in the wider Group context and

is not intended to be duplicative of the operating

review. Consequently, it focuses on items in our

Group accounts which we believe are the most

material, such as interest, taxation, exceptional

items and Group cash flows.

The operating review and the financial review

should be read together to obtain a complete

understanding of our results of operations and

financial condition during the years under review.

Adjusted profit measures

Management use ‘adjusted’ profit measures in

considering the performance of the Group’s

operating segments and businesses. References

to ‘adjusted operating profit’, ‘adjusted profit

before taxation’ and ‘adjusted earnings’ are

stated before exceptional items.

The Directors believe that the use of these

adjusted measures better indicates the underlying

business performance of the Group than the

unadjusted measures because the exclusion

of these exceptional items provides a clearer

comparison of results from year to year. This is

because this method of presentation removes

the distorting impact of these items in order to

enhance comparability with the reporting

practices of other UK companies.

Exceptional items, which are not included in the

adjusted measures referred to above, are defined

as material items that derive from events that fall

within the ordinary activities of the Group, but that

require separate disclosure on the grounds of size

or incidence for the accounts to give a true and

fair view. Such exceptional items include, for

example, material restructuring costs. Page 7

contains a discussion of the nature of these

exceptional items.

History and development of the business

In October 2002, National Grid Group plc merged

with Lattice Group plc and was renamed National

Grid Transco plc. Lattice was one of the three

successor companies to what was formerly British

Gas plc. Its principal business was Transco, the

owner and operator of the substantial majority of

Britain’s gas transportation system.

The UK gas industry was nationalised in 1948

and the British Gas Corporation was established

in 1973. British Gas was incorporated as a

public limited company in April 1986 and the

Government sold substantially all of its

shareholding in it to the public in December

1986. In 1997, Centrica, which was then primarily

a supplier of gas to end users, was demerged

from British Gas which was renamed BG.

BG retained the gas transportation and storage

businesses, the majority of the exploration and

production as well as the international

downstream and a number of smaller

businesses. In December 1999, BG completed

a financial and restructuring programme which

resulted in the creation of a new parent company,

BG Group, and involved separating its UK

regulated business, Transco, from its other

businesses. This created a ‘ring-fence’ around

Transco designed to ensure its financial,

organisational and managerial independence.

In October 2000, Lattice was demerged from

BG Group and comprised Transco, together with

start-up telecommunications and non-regulated

infrastructure services businesses.

Regulatory environment

Transco’s businesses are regulated by the Office

of Gas and Electricity Markets (Ofgem). Ofgem

operates under the direction and governance of

the Gas and Electricity Markets Authority (GEMA),

which makes all major decisions and sets policy

priorities for Ofgem.

Transco is the holder of a gas transporter licence

for Britain in respect of its gas transmission,

distribution and metering businesses. The

regulatory framework is set out in this licence.

Transco is subject to two price controls for

transmission activities that both run to 31 March

2007. The Transmission Owner price control

covers assets and related expenditure. The

System Operator price control covers the

operation of the transmission system, including

balancing of the transmission system and

constraint management; providing incentives to

promote efficiency. The actual balancing costs

derive from services and actions set out in the

Network Code, a legal document that defines the

obligations, responsibilities and roles of the

industry participants. Distribution activities are

also covered by price control regulation. From

1 April 2004, each of Transco’s eight regional

networks became subject to separate price

controls covering their activities. Although the

separate price control formulae were due to run

to 31 March 2007, Ofgem has recently announced

its intention to extend them by an additional year.

The form of the price controls is discussed in

more detail on pages 3, 4 and 5. The annual

transportation charging statement sets out the

transportation charges for market participants

for both transmission and distribution. Ofgem

approves the methodology used to determine

transportation charges.

Over the last year and as part of its consultations

concerning Network Monopoly Price Controls

and the electricity distribution price review, Ofgem

has proposed changes to the regulatory

framework that applies to all energy network

monopolies, including Transco. Proposed

developments include the introduction of a five

year retention of benefits from savings in

operating costs, capital expenditure efficiencies

and asset disposals, irrespective of when they

occur during a price control period (currently,

the benefits of cost saving initiatives are returned

to customers when a price control is reset). In

respect of pension costs, Ofgem has indicated

that it sees these as a normal operating cost of

the business. Furthermore, Ofgem has suggested

Directors’ Report and Operating and Financial Review

Operating Review