National Grid 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

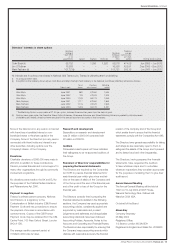

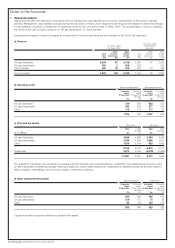

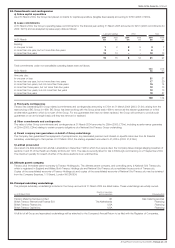

6. Pensions

Pension cost

Transco participates in the Lattice Group Pension Scheme (the Scheme). Lattice Group plc charges its subsidiary undertakings with an allocation

of the total Scheme cost. The costs in respect of the Scheme are set out below:

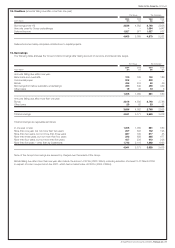

12 months 12 months

ended ended

31 Mar 2004 31 Mar 2003

£m £m

Charged against operating profit 93 71

Charged within net interest 26 1

Total cost 119 72

There were no outstanding or prepaid pension contributions at 31 March 2004 (31 March 2003: £nil).

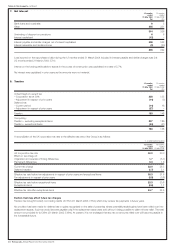

Pension Scheme

Substantially all of the Group’s employees are members of the Scheme. The Scheme provides final salary defined benefits for employees who joined

the Lattice Group up to 31 March 2002. A defined contribution section was added to the Scheme from 1 April 2002 for employees joining the Lattice

Group from that date.

The Scheme is funded with assets held in a separate trustee administered fund. It is subject to independent valuations at least every three years, on

the basis of which the qualified actuary certifies the rate of employer’s contributions which, together with the specified contributions payable by the

employees and proceeds from the Scheme’s assets, are expected to be sufficient to fund the benefits payable under the Scheme.

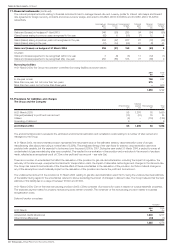

The latest full actuarial valuation of the Scheme was carried out by Watson Wyatt LLP at 31 March 2003. The projected unit method was used and

the principal actuarial assumptions adopted were that the annual rate of inflation would be 2.5% and that future real increases in pensionable

earnings would be 1.5%. Investments held in respect of pensions before they become payable would average 4.9% real annual rate of return, and

investments held in respect of pensions after they become payable would average 2.6% real annual rate of return and that pensions would increase

at a real annual rate of 0.05%. The aggregate market value of the Scheme’s assets was £10,141m and the value of the assets represented

approximately 92% of the actuarial value of benefits due to members calculated on the basis of pensionable earnings and service at 31 March 2003

on an ongoing basis and allowing for projected increases in pensionable earnings and pensions.

The results of the actuarial valuation carried out at 31 March 2003 showed that based on long-term financial assumptions the contribution rate

required to meet the future benefit accrual was 23.7% of pensionable earnings (20.7% employer’s and 3% employees’). Employer’s contributions

were increased from 8.5% to 20.7% with effect from 1 April 2003. This contribution rate will be reviewed when the next independent actuarial

valuation is carried out, which will be no later than 31 March 2006. The ongoing contribution rate does not include an allowance for administration

expenses. These contributions are reviewed annually. From 1 April 2003 the rate used for the recovery of administration costs was 1.4% of salary,

from 1 April 2004 the rate was 1.6% of salary. Employers are currently, therefore, paying a total contribution rate of 22.3%. The actuarial valuation

revealed a deficit of £879m gross (£615m net of tax) in the defined benefit section on the basis of the assumptions adopted by the actuary. It has

been agreed that no funding of the deficit identified in the 2003 actuarial valuation will need to be provided to the scheme until the outcome of the

actuarial valuation at 31 March 2007 is known. At that point, the National Grid Transco group will pay the gross amount of any deficit up to a

maximum amount of £520m (£364m net of tax) into the scheme. Transco’s share of these payments is £468m (£328m net of tax). For the period

prior to these lump sum deficiency contributions being paid, the National Grid Transco group has arranged for banks to provide the trustees of the

Scheme with letters of credit. The main conditions under which these letters of credit could be drawn relate to events which would imperil the

interests of the scheme, such as Transco plc becoming insolvent or the National Grid Transco group failing to make agreed payments into the fund.

A further valuation was carried out at 31 March 2003, to calculate the charge in accordance with Statement of Standard Accounting Practice 24.

The principal assumptions adopted were price inflation of 2.5%; pension increases in payment of 2.55%; general pensionable pay escalation of 3.5%;

and a discount rate of 6%. The principal results of this valuation were the need to recognise a regular cost based on 21.4% of salary (excluding

administration costs) and a deficit of £468m, which is being spread over the average expected future service lives of employees in the Scheme

amounting to 14.1 years.

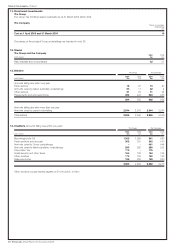

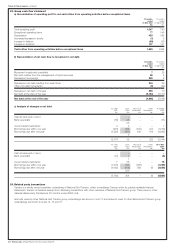

FRS 17, Retirement Benefits

In November 2000, the Accounting Standards Board introduced a new accounting standard FRS 17 ‘Retirement Benefits’, replacing SSAP 24

‘Accounting for Pension Costs’. FRS 17 is fully effective for periods beginning on or after 1 January 2005, though disclosures are required in the

financial years prior to its full implementation. As Transco’s share of the underlying assets and liabilities of the Scheme cannot be identified separately,

Transco would account for pensions under FRS 17 as if the Scheme were a defined contributions scheme and is not required to make the full

disclosures under FRS 17. The pension charge which Transco would have incurred in the 12 months ended 31 March 2004 amounted to £161m

(12 months ended 31 March 2003: £115m) of which £42m (12 months ended 31 March 2003: £43m) related to redundancies. Lattice has not yet

determined the methodology which it would use to charge pensions costs to its subsidiary undertakings following the full adoption of FRS 17.

Notes to the Accounts_continued

Annual Report and Accounts 2003/04_Transco plc 23