Motorola 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

recorded immediately when the transaction is no longer expected to occur. Foreign exchange financial

instruments that hedge investments in foreign subsidiaries are marked-to-market, and the results

are included in stockholders’ equity. Other gains or losses on financial instruments that do not qualify

as hedges are recognized immediately as income or expense.

Use of estimates: The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make certain estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contin-

gent assets and liabilities at the date of financial statements and the reported amounts of revenues

and expenses during the reporting period. Actual results could differ from those estimates.

Reclassifications: Certain amounts in prior years’ financial statements and related notes have been

reclassified to conform to the 2000 presentation.

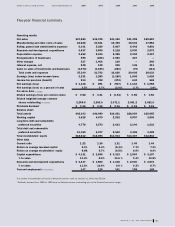

Motorola Credit Corporation

Motorola Credit Corporation (MCC), the Company’s wholly owned finance subsidiary, is engaged

principally in financing long-term commercial receivables arising out of equipment sales made by the

Company to customers throughout the United States and internationally.

MCC’s interest revenue is included in the Company’s consolidated net sales. Interest expense

totaled $153 million in 2000, $72 million in 1999 and $37 million in 1998, and is included in manu-

facturing and other costs of sales.

Long-term finance receivables of $2.6 billion and $1.7 billion (net of allowance for losses on

commercial receivables of $233 million and $292 million, respectively) at December 31, 2000

and 1999, respectively, are included in other assets. As of December 31, 2000, approximately

$1.7 billion of the $2.8 billion in gross

long-term finance receivables relates

to one customer.

The company provides financing

to customers in connection with equip-

ment purchases and for working capital.

At December 31, 2000, the Company

had outstanding unfunded commitments

of $494 million.

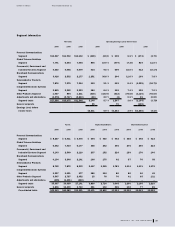

Information by segment and geographic region

Beginning with the first quarter of 2000, the Company added two operating segments for financial

reporting purposes. The Broadband Communications Segment combines the operations of General

Instrument Corporation with the Company’s cable modem and telephony business. In addition, the

Integrated Electronic Systems Sector, which was previously included in the Other Products Segment,

is now reported as a separate segment. Historical segment data has been restated to reflect

these changes.

During the third quarter of 2000, the Network Systems Segment changed its name to the Global

Telecom Solutions Segment. This was only a name change, and there have been no changes to the

financial information.

Summary financial data of Motorola Credit Corporation

Dollars in millions 2000 1999 1998

Total revenue $÷«265 $÷«159 $÷÷«72

Net earnings 147 53 21

Total assets 2,844 2,015 1,152

Total liabilities 2,417 1,768 977

Total stockholders’ equity 427 247 175

MOTOROLA, INC. AND SUBSIDIARIES 27

3

2