ManpowerGroup 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 ManpowerGroup annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

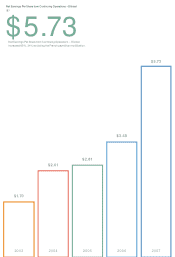

A closely watched metric within our company is our operating profi t

margin, which expanded 30 basis points to 3.3 percent, excluding the

favorable impact of the French payroll tax modifi cation. Our free cash

fl ow also improved dramatically to $341 million, a 22 percent increase.

The effi cient use of capital, coupled with the substantial increase in

operating profi t (excluding the impact of the payroll tax modifi cation),

yielded an increase in economic profi t of 52 percent.

Over the past decade, we have added specialty services to provide

clients with a broader array of solutions to their workforce management

challenges, and this effort has paid off. We have made acquisitions for

strategic value rather than simply to “buy” revenues. And we have

invested for the future to grow these businesses, as well as the new

services that we have launched organically, including permanent

recruitment, professional staffi ng and recruitment process outsourcing.

These investments have resulted in our specialty businesses growing

fi ve-fold over the last decade, and making a tremendous impact in 2007.

At the same time, revenues from our core temporary recruitment business

increased 17 percent worldwide in 2007 or 9 percent in constant currency,

demonstrating the continued secular growth.

A great example of our specialty business is our organizational

consulting services in leadership development, assessment and

coaching, delivered under our Right Management brand, which grew

16 percent in 2007 or 10 percent in constant currency. We are confi dent

these services will be substantial strategic and growth engines for us in

the future, as both emerging and mature markets continue to be

challenged and constrained by talent shortages, and have a growing

need to develop the next generation of leaders. Right Management also

launched a new, contemporary outplacement product called

RightChoiceTM in 2007, which has been extraordinarily effective in

increasing our market share, due to its appeal to both client companies

and individuals.

Meanwhile, 2007 was a year for investment in the future for our Jefferson

Wells brand, as we continued to expand our international network and

establish operations in new markets. This had a negative impact on

Jefferson Wells’ profi t, but we are confi dent the payoff will be handsome

for our clients and investors.

Over the past

decade, we have

added specialty

services to

provide clients

with a broader

array of solutions

to their workforce

management

challenges, and this

effort has paid off.

3

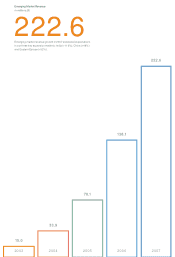

Shareholder’s Letter

2006

2007

2005

2004

2003

13.3%

11.4%

9.8%

10.9%

18.0%

14.9%(b)

Return on Invested Capital (ROIC)(a)

(a) Return on Invested Capital is defi ned as operating profi t after tax divided by the average monthly total

of net debt and equity for the year. Net debt is defi ned as total debt less cash and cash equivalents.

(b) Amounts exclude the impact of the payroll tax modifi cation in France. (See Note 1 to the consolidated

fi nancial statements for further information.)