ManpowerGroup 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 ManpowerGroup annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Highlights

12,084.3

14,675.0

15,845.4

17,562.5

2006

2005

2004

2003

20,500.3

2007

Revenues from Services(a)

in millions ($)

2007 was a record year with the highest revenues in

Manpower’s history. Revenues from Services rose 16.7%

on the continued strength of our European operations.

259.1

397.8

428.8

532.1

2006

825.4675.8(b)

2007

2005

2004

2003

Operating Profit

in millions ($)

Operating Profi t increased 55% over 2006, 27% excluding

the French payroll tax modifi cation, due to the growth in the

business, coupled with effective cost management.

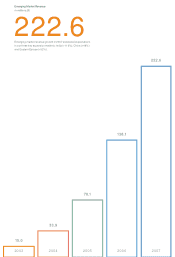

15.0

33.9

70.1

138.1

2006

222.6

2007

2005

2004

2003

Emerging Market Revenue

in millions ($)

Emerging market revenue growth in 2007 exceeded

expectations in our three key expansion markets: India

(+119%), China (+49%) and Eastern Europe (+52%).

(a) Revenues from Services includes fees received from our franchise offi ces of $26.5 million, $34.5 million, $35.8 million, $35.7 million and $35.7 million for 2003, 2004, 2005, 2006 and 2007, respectively.

These fees are primarily based on revenues generated by the franchise offi ces, which were $1,214.4 million, $1,487.1 million, $1,510.7 million, $1,497.0 million and $1,408.5 million for 2003, 2004, 2005, 2006

and 2007, respectively.

In the United States, where the majority of our franchises operate, Revenues from Services includes fees received from the related franchise operations of $21.9 million, $25.0 million, $24.9 million, $24.4

million and $24.2 million for 2003, 2004, 2005, 2006 and 2007, respectively. These fees are primarily based on revenues generated by the franchise operations, which were $1,026.2 million, $1,181.5 million,

$1,196.9 million, $1,146.1 million and $1,055.1 million for 2003, 2004, 2005, 2006 and 2007, respectively.

(b) Amounts exclude the impact of the payroll tax modifi cation in France. (See Note 1 to the consolidated fi nancial statements for further information.)

2.14%

2.71%

2.71%

3.03%2006

4.03%2007

2005

2004

2003

3.30% (b)

Operating Profi t Margin improved to 4.03% in 2007, or 3.30%

excluding the French payroll tax modifi cation refl ecting better

leveraging of our Selling and Administrative Expenses with the

strong revenue growth.

Operating Profit Margin

2,146.6 735.0

2,474.2 823.2

2006

2,669.3 914.5

2007

2005

2,174.0 901.82004

1,310.3 841.7

2003

Debt as a percentage of total capitalization was 26%

in 2007 compared to 25% in 2006 and 26% in 2005.

Total Capitalization

in millions ($)

equity debt

138.7

247.3

255.1

305.72006

484.72007

2005

2004

2003

396.1(b)

Net Earnings from Continuing Operations

in millions ($)

Net Earnings from Continuing Operations increased 59%,

30% excluding the French payroll tax modifi cation, while Net

Earnings grew from $398.0 to $484.7, an improvement of 22%.

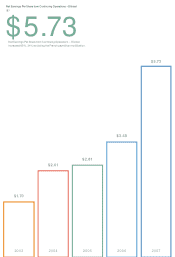

1.70

2.61

2.81

3.482006

5.73

2007

2005

2004

2003

4.68(b)

Net Earnings Per Share from

Continuing Operations - Diluted

($)

Net Earnings Per Share from Continuing Operations –

Diluted increased 65%, 34% excluding the French payroll

tax modifi cation.

2006

2007

2005

2004

2003

13.3%

11.4%

9.8%

10.9%

18.0%

14.9% (b)

Return on Invested Capital (ROIC)

Return on Invested Capital is defi ned as operating profi t after tax

divided by the average monthly total of net debt and equity for the year.

Net debt is defi ned as total debt less cash and cash equivalents.