ManpowerGroup 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 ManpowerGroup annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 15Management’s Discussion & Analysis Manpower 2007 Annual Report

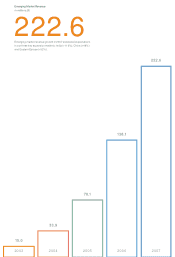

RESULTS OF OPERATIONS – YEARS ENDED DECEMBER 31, 2007, 2006 AND 2005

Consolidated Results – 2007 compared to 2006

Revenues from Services increased 16.7% to $20.5 billion. Revenues were positively impacted by changes in foreign currency

exchange rates during the period due to the weakening of the U.S. Dollar relative to the currencies in most of our non-U.S.

markets. In constant currency, revenues increased 9.0%. This revenue growth rate is a result of increased demand for our

services in most of our markets, including France, Other EMEA, Italy, Right Management and Other Operations, where revenues

increased 7.0%, 18.5%, 13.0%, 1.3% and 10.5%, respectively, on a constant currency basis. We also saw solid growth in our

permanent recruitment business which increased 33.9% on a consolidated basis in constant currency.

Gross Profi t increased 22.3% to $3.8 billion in 2007. In constant currency, Gross Profi t increased 14.7%. The Gross Profi t

Margin was 18.8%, an increase of 0.9% from 2006. Included in Gross Profi t for 2007 is the impact of a modifi cation to the

calculation of payroll taxes in France, which reduced the amount of payroll taxes, retroactive to January 1, 2006, through

September 30, 2007. The impact of this modifi cation was an increase in Gross Profi t of $157.1 million. (See Note 1 to the

consolidated fi nancial statements for further information). This represents a 77 basis point (0.77%) impact on Gross Profi t

Margin for 2007. The remaining increase in Gross Profi t Margin is primarily due to an increase in our temporary recruitment

business margin (+0.10%) and an increase in permanent recruitment business margin (+0.30%), offset by a change in the mix

of services provided (-0.27%) primarily due to a relatively lesser amount of revenues coming from Jefferson Wells and Right

Management where the gross profi t margin is generally higher than the Company average. Temporary recruitment margins

have increased as a result of improved pricing discipline in some markets, including France, and improved margins in other

markets as a result of lower direct costs.

Selling and Administrative Expenses increased 15.7% during 2007 to $3.0 billion in 2007. These expenses increased 8.9% in

constant currency. As a percent of revenues, Selling and Administrative Expenses were 14.7% in 2007 compared to 14.9% in

2006. Included in Selling and Administrative Expenses for 2007 are costs of $7.5 million related to the modifi cation to the payroll

tax calculation in France. This amount resulted in a 4 basis point (0.04%) increase in Selling and Administrative Expenses as a

percent of revenues. Included in Selling and Administrative Expenses for 2006 were $15.9 million of reorganization charges and

$9.2 million of global cost reduction project costs, which resulted in a 14 basis point (0.14%) increase in Selling and Administrative

Expenses as a percent of revenues for 2006. The remaining period-over-period decrease of 10 basis points (0.10%) is due

primarily to the favorable impact of our cost control efforts and productivity gains, as we have been able to increase the billable

hours from our temporary recruitment business as well as the number of our permanent placements without a similar increase

in branch headcount, offset by continued investments in certain markets.

Interest and Other Expense is comprised of interest, foreign exchange gains and losses, and other miscellaneous non-operating

income and expenses. Interest and Other Expense was expense of $34.2 million in 2007 compared to $50.2 million in 2006.

Net Interest Expense decreased $6.8 million to $29.0 million in 2007 from $35.8 million in 2006, as increases in interest

expense were offset by higher interest income as a result of our higher cash levels. Foreign exchange gains and losses primarily

result from intercompany transactions between our foreign subsidiaries and the U.S. Foreign exchange gains were $0.6 million

in 2007compared to losses of $3.2 million in 2006. Miscellaneous Expense, Net, consists of bank fees and other non-operating

expenses and, in 2007, was $5.8 million compared to $11.2 million in 2006.

We provided for income taxes from continuing operations at a rate of 38.7% in 2007 and 36.6% in 2006. The 2007 rate is higher

than the 2006 rate primarily due to the income tax cost associated with additional anticipated cash repatriations from our

foreign subsidiaries, additional valuation allowances recorded for non-U.S. operating losses, and the lower tax cost in 2006 of

the reorganization charges and the costs related to our global cost reduction initiative. Our 2007 annual effective tax rate is

higher than the U.S. Federal statutory rate of 35% due primarily to the impact of valuation allowances recorded for non-U.S.

operating losses, U.S. state income taxes and other permanent items.