Louis Vuitton 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Louis Vuitton annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 • ANNUAL REPORT 2002

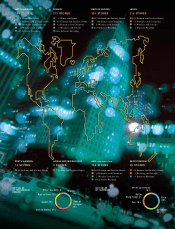

PASSIONATE ABOUT CREATIVITY THE LVM H SHARE

THE LVM H SHARE HOLDS UP WELL

IN DECLINING FINANCIAL M ARKETS

0

2,000,000

4,000,000

6,000,000

8,000,000

10,000,000

12,000,000

0

15

30

45

60

75

90

DNOSAJJMAMFJ

2002

Trading volume LVMH CAC 40 Index Average monthly volume

LVM H is one of the five French companies

included in the three main American, French and

European ethical indices.

A PROGRESSING DIVIDEND

(In euros)

2002 2001 2000 1999 1998

Net dividend*

0.80 0.75 0.75 0.68 0.62

Dividend

including tax credit*

1.20 1.125 1.125 1.02 0.93

Payout rate

48% 110% 43% 46% 58%

*Adjusted for a five-for-one stock split in July 2000 and a one-for-ten bonus allotment

in June 1999.

AN APPRECIABLE YIELD FOR

THE SHAREHOLDER

An LVMH shareholder who invested 1,000 euros

on January 1, 1998 would have 1,513 euros

at December 31, 2002 factoring in a one-for-ten

stock allotment in June 1999 and reinvested

dividends. His initial investment would, there-

fore, have grown an average 8.6% a year.

STOCK BUY-BACK PROGRAM

LVM H has implemented a stock buy-back

plan to buy back up to 10% of its capital.

This plan was approved at the Shareholders’

Meeting of May 15, 2002 and was registered with

the Commission des Opérations de Bourse

(COB). From January 1 to December 31, 2002,

LVMH SA sold a net total of 14,143,571 of its

own shares. The current stock buy-back plan

was registered with the COB under No. 02-453

on April 25, 2002.

AN UNFAVORABLE CONTEXT

In spite of lower interest rates and fiscal stimulus

measures, all three of the world’s principal

economic zones were simultaneously affected

for varying reasons by a slowdown in activity.

This depressed environment together with the

threat of a geopolitical conflict led to declines

in major equity markets for the third consecutive

year. The CAC 40 fell 34%, the Eurostoxx 50 lost

37% and the Dow Jones Industrial Average

declined 17% in particular.

OUTPERFORMED THE CAC

After climbing sharply at the beginning of the

year, LVMH’s share price followed the overall

market trend beginning in May, though it resisted

better than the market average. Thus, LVMH

outperformed the CAC 40 by 29% in 2002,

closing the year at 39.15 euros.

LVM H’s market capitalization stood at 19.2 bil-

lion euros at year-end, making it the eleventh

largest on the Paris stock exchange. LVMH

is included in the principal French and European

indices used by fund managers: CAC 40,

DJ EuroStoxx 50, MSCI Europe, FTSE Eurotop 100,

Euronext 100.

LVM H shares are traded on the Premier Marché

of Euronext Paris (Reuters code LVMH.PA,

Bloomberg code MC FP and Isin code

FR0000121014). In addition, options based

on LVMH shares are traded on the Paris Monep

options exchange.

THE LVM H SHARE AND THE PARIS CAC 40 INDEX SINCE JANUARY, 2002