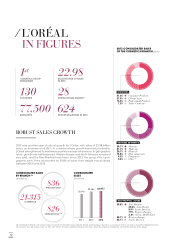

Loreal 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 Loreal annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

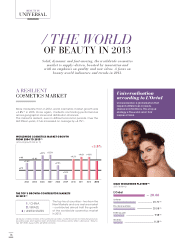

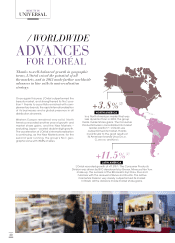

Thanks to well-balanced growth in geographic

terms, L’Oréal seized the potential of all

the markets, and in 2013 made further worldwide

advances in line with its universalisation

strategy.

Once again this year, L’Oréal outperformed the

beauty market, and strengthened its No.1 pos-

ition(1) thanks to a portfolio enriched with com-

plementary brands, the rapid internationalisation

of its businesses and a global presence in all

distribution channels.

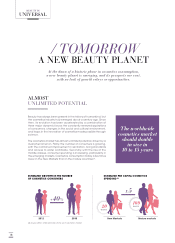

Western Europe remained very solid, North

America recorded another year of growth and

market share gains, and the New Markets –

excluding Japan – posted double-digit growth.

The acceleration of L’Oréal’s internationalisation

is continuing, as the New Markets were, for the

second year running, the group’s No.1 geo-

graphic zone with 39.8% of sales.

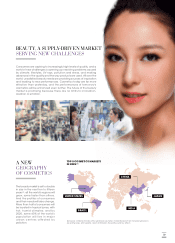

NORTH AMERICA

In a North American market that was

less dynamic than in 2012, the group

made market share gains. The Consumer

Products Division consolidated its market

leader position(3). L’Oréal Luxe

outperformed its market, thanks

inparticular to the good results of

itsAmerican brands URBAN DECAY,

CLARISONIC and KIEHL’S.

LATIN AMERICA

L’Oréal recorded growth of +11.5%(2). The Consumer Products

Division was driven by Bí-O deodorants by GARNIER, MAYBELLINE NEW YORK

make-up, the success of the BB creams by L’ORÉAL PARIS and

haircare with the renewal of Elvive and Fructis. The Active

Cosmetics Division very clearly outperformed its market.

In Brazil, all the divisions made market share gains.

+3.8%(2)

+11.5%(2)

⁄ WORLDWIDE

ADVANCES

FOR L’ORÉAL

20

BEAUTY IS

UNIVERSAL