KeyBank 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

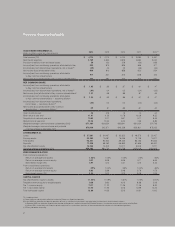

Five-year financial highlights

YEAR ENDED DECEMBER 31,

(dollars in millions, except per share amounts) 2014 2013 2012 2011 2010

(a)

Total revenue (TE) $ 4,114 $ 4,114 $ 4,144 $ 3,980 $ 4,491

Noninterest expense 2,759 2,820 2,818 2,684 3,034

Provision (credit) for loan and lease losses 59 130 229 (60) 638

Income (loss) from continuing operations attributable to Key 939 870 835 955 577

Income (loss) from discontinued operations, net of taxes(b) (39)40 23 (35)(23)

Net income (loss) attributable to Key 900 910 858 920 554

Income (loss) from continuing operations attributable

to Key common shareholders 917 847 813 848 413

Net income (loss) attributable to Key common shareholders 878 887 836 813 390

PER COMMON SHARE

Income (loss) from continuing operations attributable

to Key common shareholders $ 1.05 $ .93 $ .87 $ .91 $ .47

Income (loss) from discontinued operations, net of taxes(b) (.04).04 .02 (.04)(.03)

Net income (loss) attributable to Key common shareholders(c) 1.01 .98 .89 .87 .45

Income (loss) from continuing operations attributable

to Key common shareholders — assuming dilution $ 1.04 $ .93 $ .86 $ .91 $ .47

Income (loss) from discontinued operations,

net of taxes — assuming dilution(b) (.04).04 .02 (.04)(.03)

Net income (loss) attributable to Key common

shareholders — assuming dilution(c) .99 .97 .89 .87 .44

Cash dividends paid .25 .215 .18 .10 .04

Book value at year end 11.91 11. 25 10.78 10.09 9.52

Tangible book value at year end 10.65 10.11 9.67 9.11 8.45

Market price at year end 13.90 13.42 8.42 7.6 9 8.85

Weighted-average common shares outstanding (000) 871,464 906,524 938,941 931,934 874,748

Weighted-average common shares and potential

common shares outstanding (000) 878,199 912,571 943,259 935,801 878,153

AT DECEMBER 31,

Loans $ 57, 3 81 $ 54,457 $ 52,822 $ 49,575 $ 50,107

Earning assets 82,269 79,467 75,055 73,729 76,211

Total assets 93,821 92,934 89,236 88,785 91,843

Deposits 71,998 69,262 65,993 61,956 60,610

Key shareholders’ equity 10,530 10,303 10,271 9,905 11,117

Common shares outstanding (000) 859,403 890,724 925,769 953,008 880,608

PERFORMANCE RATIOS

From continuing operations

Return on average total assets 1.08 % 1.03 % 1.03 % 1.16 % .66 %

Return on average common equity 9.01 8.48 8.25 9.17 5.06

Net interest margin (TE) 2.97 3.12 3.21 3.16 3.26

From consolidated operations

Return on average total assets .99 % 1.02 % .99 % 1.04 % .59 %

Return on average common equity 8.63 8.88 8.48 8.79 4.78

Net interest margin (TE) 2.94 3.02 3.13 3.09 3.16

CAPITAL RATIOS

Key shareholders’ equity to assets 11.22 %11.0 9 %11. 51 %11.16 %12.10 %

Tangible common equity to tangible assets 9.88 9.80 10.15 9.88 8 .19

Tier 1 common equity 11.17 11.22 11. 36 11.26 9.34

Tier 1 risk-based capital 11.90 11.9 6 12.15 12.99 15.16

Total risk-based capital 13.89 14.33 15.13 16.51 19.12

TE = taxable equivalent.

(a) Financial data was not adjusted to reflect the treatment of Victory as a discontinued operation.

(b)

In April 2009, we decided to wind down the operations of Austin, a subsidiary that specialized in managing hedge fund investments for institutional customers.

In September 2009, we decided to discontinue the education lending business conducted through Key Education Resources, the education payment and financing unit of KeyBank.

In February 2013, we decided to sell Victory to a private equity fund. As a result of these decisions, we have accounted for these businesses as discontinued operations.

(c) EPS may not foot due to rounding.

2