JP Morgan Chase 2009 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2009 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7

billion in securities – to us this is akin to the

inventory of a store. We hold the securities

so we can meet client demand. Our sales and

trading functions not only play a critical role

in helping to maintain large, liquid and well-

functioning markets, but they are indispens-

able to institutions of all types seeking to raise

capital in the first place.

As more clients chose to work with us in 2009,

our sales and trading teams gained market

share. We estimate that our market share

of the top 10 players in Fixed Income and

Equity Markets combined grew from approxi-

mately 9% in 2008 to more than 12% in 2009.

Deservedly, these groups also received a lot

of accolades – most gratifyingly, from client-

based surveys.

How we intend to grow

In 2010, we will continue to focus on the

fundamentals of investment banking: advising

companies and investors, raising capital,

making markets and executing for our clients

worldwide. If we do this well, we are helping

not only our clients but the global economic

recovery as well.

We also are aggressively and organically

growing many parts of our business. For

example, the Prime Services business we

acquired from Bear Stearns – which provides

mostly large investors with custody, financing

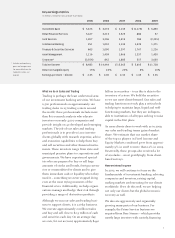

Key earnings metrics

(in millions, except for ratio and per share data)

What we do in Sales and Trading

Trading is perhaps the least understood area

of our investment banking activities. We have

6,500 professionals on approximately 120

trading desks in 25 trading centers around

the world; these professionals include more

than 800 research analysts who educate

investors on nearly 4,000 companies and

provide insight on 40 developed and emerging

markets. The job of our sales and trading

professionals is to provide 16,000 investor

clients globally with research expertise, advice

and execution capabilities to help them buy

and sell securities and other financial instru-

ments. These investors range from state and

municipal pension plans to corporations and

governments. We have experienced special-

ists who are prepared to buy or sell large

amounts of stocks and bonds, foreign curren-

cies or commodities for clients and to give

them immediate cash or liquidity when they

need it – something we never stopped doing

even at the most trying moments of the

financial crisis. Additionally, we help organi-

zations manage and hedge their risk through

providing a range of derivatives products.

Although we run our sales and trading busi-

ness to support clients, it is a risky business.

We execute approximately 2 million trades

and buy and sell close to $2.5 trillion of cash

and securities each day. On an average day,

we own, for our account, approximately $440

2005 2006 2007 2008 2009

Investment Bank $ 3,673 $ 3,674 $ 3,139 $ (1,175 ) $ 6,899

Retail Financial Services 3,427 3,213 2,925 880 97

Card Services 1,907 3,206 2,919 780 (2,225 )

Commercial Banking 951 1,010 1,134 1,439 1,271

Treasury & Securities Services 863 1,090 1,397 1,767 1,226

Asset Management 1,216 1,409 1,966 1,357 1,430

Corporate* (3,554 ) 842 1,885 557 3,030

Total net income $ 8,483 $ 14,444 $ 15,365 $ 5,605 $ 11,728

Return on tangible equity 15 % 24 % 22 % 6 % 10 %

Earnings per share — diluted $ 2.35 $ 4.00 $ 4.33 $ 1.35 $ 2.26

* Includes extraordinary

gains and merger costs.

For more details on the

Corporate sector, see

page 82.