JP Morgan Chase 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260

|

|

the cost of this improved level of operation

and service per dollar of revenue is signifi-

cantly lower than in the past. To give just

one example, our total technology and opera-

tions and corporate overhead costs would be

more than $9 billion higher today if they were

running at the same cost per dollar of revenue

as in 2005.

Continuing to invest

Through the worst of the past two years, we

never stopped investing. This has included

acquisitions, foremost among them Bear

Stearns and Washington Mutual; investments

in infrastructure, including systems and tech-

nology; new products, for example in Card

Services; and the addition of bankers and

branches around the world. These investments

set us up for continued organic growth.

Preparing for tougher global competition

The competitive landscape is rapidly changing.

Many companies did not make it or had to

be dramatically restructured. We expect this

trend to continue in both the United States

and Europe. We and others who survived

benefited from market share gains (in fact,

we gained market share in virtually all of our

businesses). But we must be prepared for all

of our competitors to come roaring back. With

certain competitors and in certain parts of the

world, this already is happening. We do not

take this lightly.

Protecting the company in uncertain times

You read about it every day: continued global

trade imbalances, higher fiscal deficits run

by governments around the world, uncertain

interest rate movements and potential regula-

tory changes, among other issues. I could go on

for pages. Rest assured, we are paying very close

attention to the dicult issues we still face.

Following is a recap of our line of business

results. In this section, I will focus on

describing what we as a bank actually do,

which seems to be so often misunderstood.

As you read these results, I hope you will feel

as I do – that we have excellent franchises,

focused on doing a great job for our customers

(even though we do make mistakes), and that

we have been continuously and deliberately

investing for future growth.

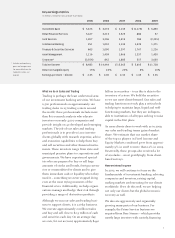

Net revenue

(in billions)

30

40

50

60

70

80

90

$100

20

10

20092005 2007

2006

$54.2

$71.4

2008

$67.3

$62.0

$100.4

Pretax preprovision profit

Managed net revenue* by line of business

Full year 2009

(in millions)

Investment

Bank

$28,109

Retail

Financial

Services

$32,692

Card Services

$20,304

Commercial Banking

$5,720

Treasury & Securities

Services

$7,344

Asset Management

$7,965

Corporate

$6,513

26%

30%

19%

5%

7%

7%

6% Asset Managemen

* For a discussion of managed basis presentation and a reconciliation

to reported net revenue, see pages 58-59 of this Annual Report.