JP Morgan Chase 2009 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2009 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12

• We helped nance the construction of a

$22.3 million healthcare center in the Bronx,

New York, to serve an additional 18,000

patients per year.

• As part of more than $384 million in new

and renewed commitments to GNPH and

educational entities in Ohio, we provided

Kent State University with needed financing.

• We assisted Children’s Memorial Hospital

in Chicago in financing the construction

of a new $915 million building with a

$196 million credit facility.

How we intend to grow

Having successfully completed the conver-

sion of commercial client accounts acquired

through Washington Mutual, Commercial

Banking is well-positioned to grow. The busi-

ness already is taking advantage of Chase’s

retail branch network to expand its oerings

into ve new states – California, Washington,

Oregon, Georgia and Florida. We’ll now cover

these new markets by supporting a full range

of clients, from middle market companies to

large corporations. We are achieving this by

hiring exceptional commercial bankers – more

than 50 employees by the end of 2010 alone –

to serve these additional markets. Several years

from now, when this expansion ultimately is

completed, we expect it will generate hundreds

of millions of dollars in additional profits

annually.

On another front, when JPMorgan Chase and

Bank One merged, we set a target of more than

$1 billion in revenue from investment banking

products sold to Commercial Banking clients

(up from $552 million). This year, we exceeded

the goal and are poised to continue growing

this business.

Commercial Banking reported net income of

$1.3 billion with an ROE of 16%

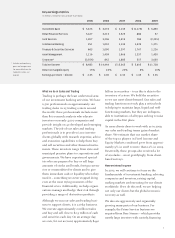

Overall results

In 2009, Commercial Banking overcame many

challenges to deliver exceptional financial

performance. Even as substantially higher

credit costs negatively aected quarterly

results, the business exceeded its annual plan

by focusing on client selection, marketing

its business aggressively, managing risks

and expenses, and excelling in client service.

Highlights included a 20% boost in revenue to

$5.7 billion; a 25% improvement in operating

margin to $3.5 billion; double-digit increases

in both average liability balances, up 10%, and

average loan balances, up 30%; and a 20%

jump in gross investment banking revenue

to $1.2 billion – a full 25% above plan. These

were fabulous results in any environment.

What we do in Commercial Banking

More than 1,400 bankers help fulll the

financing needs of nearly 25,000 clients and

over 30,000 real estate investors and owners.

The average length of a Commercial Banking

client relationship with us is more than 18 years.

In 2009, we added over 1,700 new Commercial

Banking clients and expanded more than 7,600

relationships. With a team of banking, treasury

and client service professionals situated in local

markets coast to coast and around the world,

Commercial Banking delivers nancial services

while steadfastly supporting communities. Last

year, Commercial Banking extended more than

$73 billion in new financing, which included

nearly $8 billion to the government, not-for-

profit and healthcare (GNPH) and education

sectors. For example: