JP Morgan Chase 2009 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2009 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

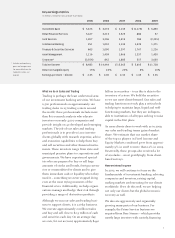

Treasury & Securities Services reported net

income of $1.2 billion with an ROE of 25%

Overall results

Treasury & Securities Services (TSS) delivered

solid but lower results, producing 2009 profits

of $1.2 billion vs. $1.8 billion in the prior year.

The business delivered net revenue of $7.3

billion, down 10% from the previous year. We

describe TSS as our “Warren Buett-style”

business because it grows with our clients

and with inflation; delivers excellent margins

and high returns on capital; and is hard for

would-be competitors to replicate because of

its global scale, long-term client relationships

and complex technology.

Our 2009 performance largely was driven

by weakened market conditions and lower

interest rates. Securities lending and foreign

exchange volumes and spreads, in partic-

ular, saw significant declines. TSS also saw

deposits level o after an exceptional period

in late 2008 and early 2009, when we were

a huge beneficiary of the markets’ flight

to quality. Despite the headwinds of 2009,

the underlying business drivers remained

strong: International electronic funds transfer

volumes grew 13%, assets under custody

increased 13% and the number of wholesale

cards issued grew 19%.

What we do in Treasury & Securities Services

More than 6,000 TSS bankers serve more than

40,000 clients from all of our other lines of

business in 60 locations around the world.

TSS provides clients with critical products and

services, including global custody in more than

90 global markets, holding nearly $15 trillion

in assets; corporate cash management, moving

an astounding $10 trillion a day of cash trans-

actions around the world for clients; corporate

card services, providing 27 million cards to

more than 5,000 corporate clients and govern-

ment agencies; and trade services, guaran-

teeing international payments for our clients,

who are many of the world’s largest global

companies. Following are some specific exam-

ples of how TSS supports a range of clients:

• We delivered unemployment and other

benefits to more than 12 million individuals

in 2009, as the national leader in bringing

electronic banking services to low-income

households through electronic benefits

transfer and debit and stored-value cards.

• We were selected by the Federal Reserve

to serve as custodian for its program to

purchase up to $1.25 trillion in mortgage-

backed securities in order to provide support

to the mortgage and housing markets.

• We are the leading cash management

provider to the U.S. Postal Service,

providing cash and check depository

services to nearly one-third of the U.S.

Postal Service’s 80 districts.

How we intend to grow

TSS essentially grows by following its clients

around the world, which means opening

new branches and constantly improving

products. In 2009, TSS opened new branches

in China, Denmark, Finland, Norway and

Sweden; launched new services in Tokyo,

South Korea, Brazil and Mexico; and expanded

capabilities in Australia, India, Europe, the

Middle East and Africa. We will continue this

expansion for the foreseeable future.

In addition, more than three years ago, TSS

and the Investment Bank formed a joint

venture to create our Global Corporate Bank.

With a team of more than 100 corporate

bankers, the Global Corporate Bank serves

multinational clients by giving them access

to TSS products and services and certain

IB products, including derivatives, foreign

exchange and debt. We intend to expand the

Global Corporate Bank aggressively over the

next several years by opening 20-30 locations

and adding 150 corporate bankers, allowing

us to cover approximately 1,000 new clients

(3,100 total, up from 2,100).