JP Morgan Chase 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 JP Morgan Chase annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260

|

|

15

In 2010, we plan to expand Private Banking

globally by adding more than 500 bankers,

investors and client service employees. In addi-

tion, we intend to continue to invest in the

growth of the brokerage business we acquired

from Bear Stearns. We anticipate a slowly

improving but volatile investment environ-

ment in 2010 – yet, nonetheless, we expect

Asset Management to continue to thrive by

helping millions of individuals, families and

institutions achieve their financial goals.

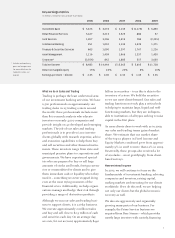

The Corporate sector reported net income

of $3.7 billion

Our Corporate sector, excluding merger-

related items, produced net income of $3.7

billion compared with $768 million in the

prior year. The Corporate sector comprises

three segments: Private Equity, unallocated

corporate expenses and our corporate invest-

ment portfolio. Our Private Equity segment

reported a net loss of $78 million vs. a net loss

of $690 million in 2008. Remember, however,

in 2007, we had an outstanding year with

pretax Private Equity gains of more than $4

billion. We know that Private Equity returns,

by their nature, are lumpy, but we expect to

average 20% returns over the years.

Our corporate investment portfolio, which

we own in order to manage excess cash, our

collateral needs and interest rate exposure,

grew from a low of $91 billion in March 2008

to an average of $324 billion in 2009. Our

investment portfolio produced exceptional

performance, the result of both managing

interest rate exposures and buying securities

that we thought were extremely safe invest-

ments and were trading at large discounts to

fair value (e.g., mortgage ABS, Triple-A credit

card ABS and Triple-A CLOs). The pretax

unrealized gain of this portfolio went from a

loss of $3.4 billion at the beginning of 2009 to

a gain of $3.3 billion at year-end. It’s impor-

tant to note that your company manages its

interest rate exposure extremely carefully and

believes that taking this exposure is funda-

mentally not how we make our money. Any

investor can take on interest rate exposure –

we do not consider that a business. We do not

borrow “cheap” from the Federal Reserve or

any other source; we borrow at market rates,

like everyone else does.

We may realize some of these Corporate

investment gains in 2010, but we do not expect

these exceptional results to continue. Over

the course of the year, Corporate quarterly

net income (excluding Private Equity, merger-

related items and any significant nonrecurring

items) is expected to decline to approximately

$300 million.