Hyundai 2000 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

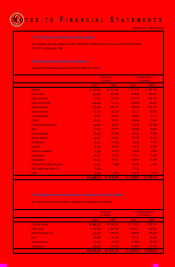

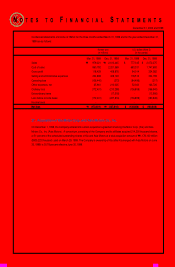

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

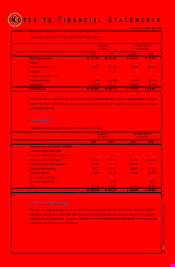

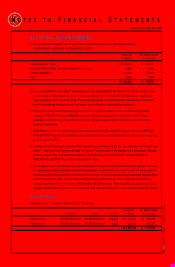

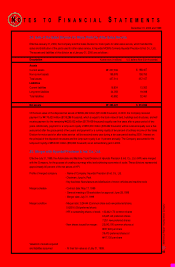

When each temporary difference reverses in the future, it will result in a decrease (increase) of taxable income and income tax

payable. Deferred income tax assets are recognized only when it is probable the tax benefits from temporary differences will

be realized in the future. As of December 31, 2000, the Company believes the deferred income tax assets of ₩240,853 million

($191,198 thousand) can be realized in the future. Additionally, the Company believes average ordinary income in the coming

years will exceed the amount of deferred taxes to be realized every year based on its assessment. Accordingly, the Company

has recognized deferred income tax assets as of December 31, 2000 and 1999 and as a result, its effective tax rate is 14.39

percent in 2000 and 16.34 percent in 1999.

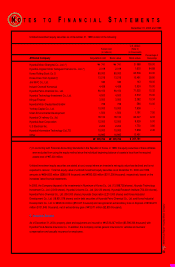

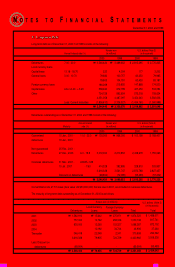

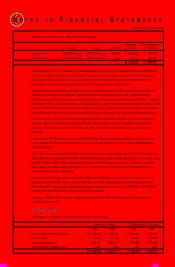

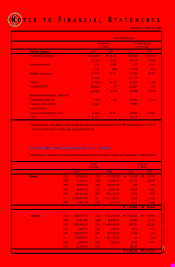

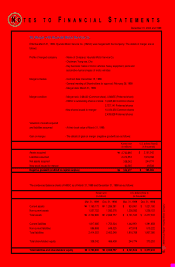

19. Related Party Transactions

Significant transactions with affiliated companies in 2000 and 1999 and outstanding balances as of December 31, 2000 and

1999 are summarised below:

(*) Sales in 2000 include the disposal value of the Motor Parts Division for after-sales service of ₩446,422 million, which

consists of the lump-sum royalty and the book value of the disposed net assets (See Note 24).

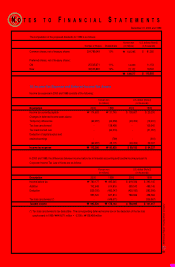

Description

Accumulated temporary

differences, net

Statutory tax rate (%)

Tax credit carried over

Deferred income tax assets

2000

$ 455,008

X 30.8

140,141

51,057

$ 191,198

1999

$ 294,443

X 30.8

90,688

51,057

$ 141,745

1999

₩370,910

X 30.8

114,240

64,316

₩

₩178,556

2000

₩573,174

X 30.8

176,537

64,316

₩

₩240,853

U.S. dollars (Note 2) (in thousands)Korean won (in millions)

Affiliated Company

Hyundai Motor America

Hyundai Motor India

HAOSVT

Kia Motor Corporation

KEFICO

Hyundai MOBIS (*)

(formerly Hyundai Precision Industries Co., Ltd.)

Hyundai HYSCO (formerly Hyundai Pipe Co., Ltd.)

2000

$ 969,743

40,354

213,470

277,033

(73,986)

(291,651)

485,589

(256,519)

(241,846)

1999

$ 1,678,116

86,509

96,065

178,102

(12,556)

(191,313)

93,998

(286,972)

(62,595)

1999

₩2,113,923

108,975

121,013

224,355

(15,817)

(240,997)

118,409

(361,499)

(78,851)

2000

₩2,967,908

86,292

268,908

800,383

(93,200)

(367,393)

611,697

(323,137)

(304,654)

U.S. dollars (Note 2) (in thousands)

Sales (Purchases)

Korean won (in millions)

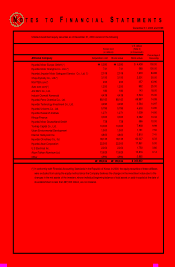

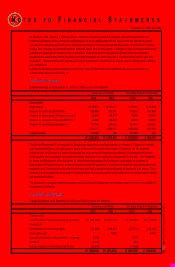

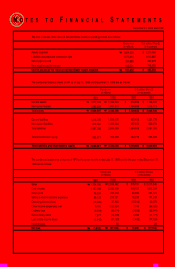

The changes in accumulated temporary differences in 2000 and 1999 are as follows:

The accumulated temporary differences as of December 31, 2000 and 1999 do not include the gain of ₩499,891 million

($396,833 thousand) in 2000 and ₩502,333 million ($398,772 thousand) in 1999 on the revaluation of land which may not be

disposed of in the near future.

Deferred income tax as of December 31, 2000 and 1999 are computed as follows:

Description

Beginning of period, net

Changes in the current year, net

End of period, net

2000

$ 294,443

160,565

$ 455,008

1999

$ 222,861

71,582

$ 294,443

1999

₩280,738

90,172

₩

₩370,910

2000

₩370,910

202,264

₩

₩573,174

U.S. dollars (Note 2) (in thousands)Korean won (in millions)