Hyundai 2000 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

2000 Annual Report •Hyundai-Motor Company

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

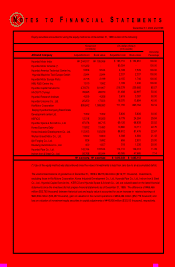

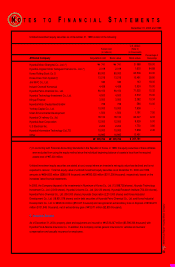

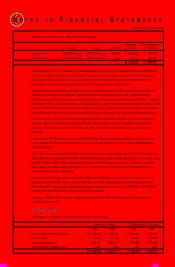

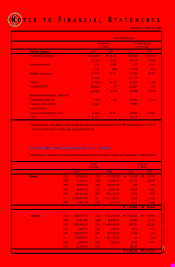

Hyundai Merchant Marine

Hyundai MOBIS (formerly Hyundai Precision & Ind. Co., Ltd.)

Overseas subsidiaries

Other

$ 448,117

10,075

293,316

7,586

$ 759,094

₩564,493

12,692

369,490

9,556

₩

₩956,231

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)

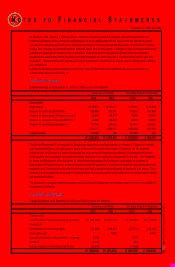

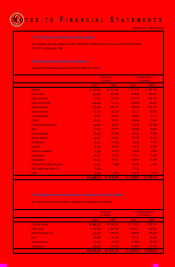

12. Commitments and Contingent liabilities

(1) The Company is contingently liable for guarantees of indebtedness, primarily for the following affiliates

(including foreign subsidiaries), as of December 31, 2000.

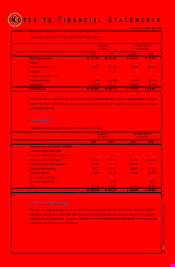

(2) Bank deposits[₩7,900 million ($6,271 thousand)], investment securities[₩206,784 million ($164,153 thousand), at cost],

5 blank checks, 57 blank promissory notes, 3 checks amounting to ₩15,139 million ($12,018 thousand), 1 promissory

notes amounting to ₩73,840 million ($58,618 thousand) and property, plant and equipment are pledged as collateral for

short-term borrowings, the local currency and foreign currency loans and other payables (see Note 6).

(3) The Company uses a customer financing system related to a long-term installment sales contract and has provided

guarantees of ₩1,081,275 million ($858,359 thousand) to the banks concerned as of December 31, 2000. These

guarantees are all covered by insurance contracts, which regulate a customer and the Company as a contractor and a

beneficiary, respectively.

(4) At December 31, 2000, the outstanding balance of accounts receivable discounted with recourse amounts to ₩971,025

million ($770,838 thousand), including discounted overseas accounts receivable translated using the foreign exchange rate

as of December 31, 2000.

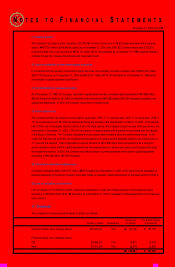

(5) In connection with the merger of Hyundai MOBIS (formerly Hyundai Precision & Ind. Co., Ltd. (HPI)) with the Company (see

Note 25), under the Korean Commercial Code, the Company becomes liable for the payment of the full amount of liabilities

previously owed by HPI. As a result, the Company is deemed to have assumed additional contingent liabilities of

₩299,780 million ($237,977 thousand)as of December 31, 2000.

(6) The Company, together with the previous major shareholders of Hyundai International Merchant Bank, agreed to reimburse

the agricultural and fishery special tax paid by Cho Hung Bank in connection with the taxable income from the liquidation of

Hyundai International Merchant Bank which arose from the merger of Hyundai International Merchant Bank, Kangwon Bank

and Cho Hung Bank in 1999. The total reimbursement unpaid as of December 31, 2000 is ₩36,192 million ($28,731

thousand) and the share of the Company is ₩3,480 million ($2,763 thousand). There is a law suit pending against this tax

imposition and the Company expects that the resolution of the case will not have any material effect on its financial position.

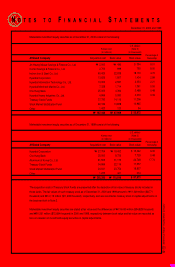

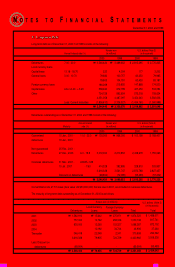

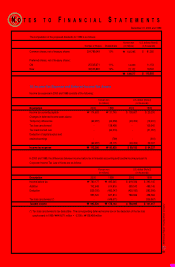

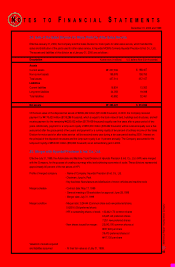

13. Capital Stock

Capital stock as of December 31, 2000 consists of the following:

Common stock

Preferred stock

$ 909,298

262,770

$ 1,172,068

U.S. dollars (Note 2)

(in thousands)

₩1,145,443

331,011

₩

₩1,476,454

Korean won

(in millions)

₩5,000

5,000

Par value

229,088,702 shares

66,202,146 shares

Issued

450,000,000 shares

150,000,000 shares

Authorized