Hyundai 2000 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

2000 Annual Report •Hyundai-Motor Company

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

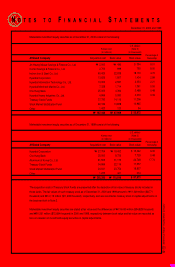

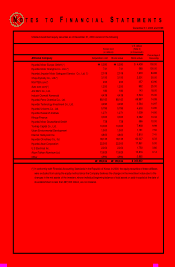

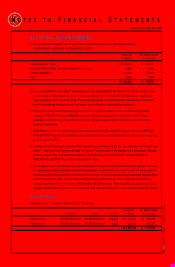

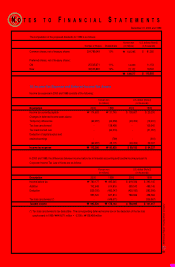

Jin Heung Mutual Savings & Finance Co., Ltd.

Comet Savings & Finance Co., Ltd.

Inchon Iron & Steel Co., Ltd.

Hyundai Corporation

Hyundai Information Technology Co., Ltd.

Hyundai Merchant Marine Co., Ltd.

Cho Hung Bank

Hyundai Heavy Industries Co., Ltd.

Treasury Stock Funds

Stock Market Stabilization Fund

Other

Percentage of

Ownership

9.01

9.00

4.70

2.99

2.21

0.55

0.48

0.36

Book value

$ 394

793

18,130

1,434

2,054

1,361

3,488

4,033

11,206

10,985

94

$ 53,972

Book value

₩496

999

22,838

1,807

2,587

1,714

4,394

5,080

14,116

13,838

120

₩

₩67,989

Acquisition costAffiliated Company

₩2,000

2,700

60,425

13,626

10,000

7,329

25,000

4,966

37,793

22,182

1,423

₩

₩187,444

U.S. dollars

(Note 2)

(in thousands)

Korean won

(in millions)

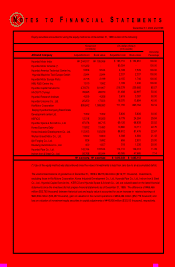

Marketable investment equity securities as of December 31, 2000 consist of the following:

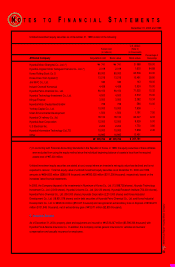

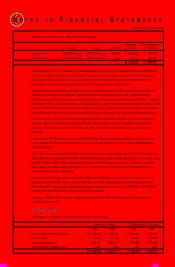

Hyundai Corporation

Cho Hung Bank

Aluminum of Korea Co., Ltd.

Treasury Stock Funds

Stock Market Stabilization Fund

Other

Percentage of

Ownership

6.00

0.48

17.74

Book value

$ 15,442

7,729

24,748

17,557

18,857

334

$ 87,973

Book value

₩19,452

9,736

31,175

22,116

23,754

421

₩

₩110,819

Acquisition costAffiliated Company

₩27,754

25,000

81,555

34,866

24,641

1,235

₩

₩202,380

U.S. dollars

(Note 2)

(in thousands)

Korean won

(in millions)

Marketable investment equity securities as of December 31, 1999 consist of the following:

The acquisition costs of Treasury Stock Funds are presented after the deduction of fair value of treasury stocks included in

those funds. The fair values of such treasury stock as of December 31, 2000 and 1999 amount to ₩11,049 million ($8,771

thousand) and ₩14,119 million ($11,208 thousand), respectively, and are recorded as treasury stock in capital adjustments on

the basis set forth in Note 2.

Marketable investment equity securities are stated at fair value and the differences of ₩119,455 million ($94,828 thousand)

and ₩91,561 million ($72,684 thousand) in 2000 and 1999, respectively between book value and fair value are recorded as

loss on valuation of investments equity securities in capital adjustments.