Hyundai 2000 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2000 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

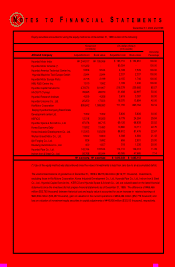

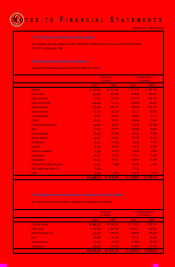

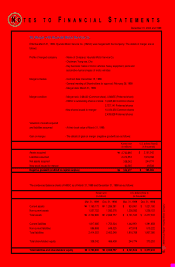

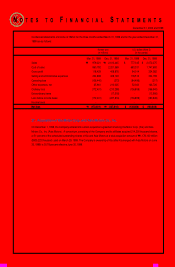

NOTES TO FINANCIAL STATEMENTS

December 31, 2000 and 1999

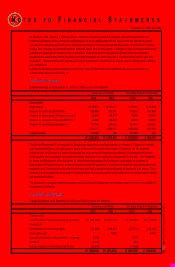

(1) Treasury stock

The Company has treasury stock consisting of 23,763,490 common shares and 4,178,600 preferred shares with a carrying

value of ₩437,050 million ($346,948 thousand) as of December 31, 2000, and 3,681,653 common shares and 2,102,610

preferred shares with a carrying value of ₩150,121 million ($119,172 thousand) as of December 31, 1999, acquired directly or

indirectly through the Treasury Stock Funds and Trust Cash Funds.

(2) Loss on valuation of investment equity securities

In connection with the valuation of investment equity securities, the Company recorded a valuation loss of ₩261,640 million

($207,700 thousand) as of December 31, 2000 and ₩132,517 million ($105,197 thousand) as of December 31, 1999 which

are reflected in capital adjustment (see Note 4).

(3) Consideration for conversion rights

As of December 31, 1999, the Company recorded in capital adjustment the convertible rights adjustment of ₩7,986 million

($6,340 thousand) related to the 263rd convertible bonds amounting to ₩31,825 million ($25,264 thousand) included in non-

guaranteed debentures. In 2000, the Company repaid the convertible bonds.

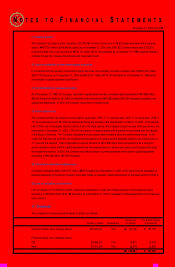

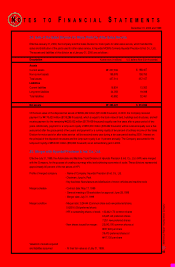

(4) Stock option cost

The Company entitled 104 directors to stock options (grant date : 2000. 3. 10, exercise date : 2003. 3. 10, expiry date : 2008. 3.

10), at an exercise price of ₩14,900 as determined during the meeting of the Shareholders on March 10, 2000. In the second

half of 2000, one of the eligible directors retired. If all of the stock options, which require at least two-year continued service, are

exercised as of December 31, 2000, 1,740,000 new shares or treasury shares will be granted in accordance with the decision

of the Board of Directors. The Company calculates the total compensation expense using the option-pricing model. In the

model, the Risk-free rate of 9.04%, the expected exercise period of 5.5 years and the expected variation rate of stock price of

71.1 percent are adopted. Total compensation expense amounts to ₩15,958 million and is accounted for as a charge to

current operations and a credit to capital adjustment over the required period of service (two years) from the grant date using

the straight-line method. In 2000, the Company recorded a charge of current operations and a credit to capital adjustment

amounting to ₩6,526 million ($5,180 thousand).

(5) Cumulative translation adjustments

Cumulative translation debits of ₩1,075 million ($853 thousand) as of December 31, 2000, which result from the translation of

financial statements of the branch located in the United States, is included in capital adjustments on the basis set forth in Note 2.

(6)Loss on valuation of derivatives

Loss on valuation of the effective portion of derivative instruments for cash flow hedging purpose from forecasted exports,

amounting to ₩55,676 million ($44,198 thousand) as of December 31, 2000, is included in capital adjustments on the basis set

forth in Note 2.

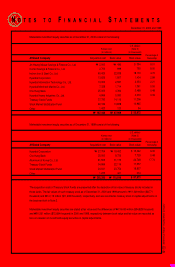

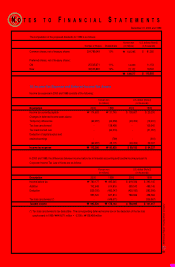

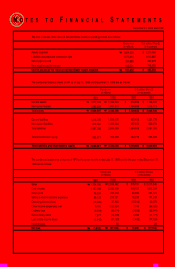

17. Dividends

The computation of the proposed dividends for 2000 is as follows:

Common shares, net of treasury shares

Preferred shares, net of treasury shares:

Old

New

₩123,195

15,913

26,279

₩

₩165,387

$ 97,797

12,632

20,862

$ 131,291

12%

13%

14%

205,325,212

24,482,541

37,541,005

U.S. dollars (Note 2)

(in thousands)

Korean won

(in millions)Dividend rateNumber of Shares