Huntington National Bank 2012 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2012 Huntington National Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

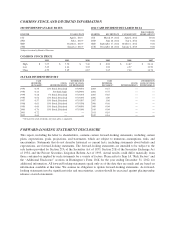

Excluding potential future automobile loan securitizations, we anticipate the increase in total loans will

outpace growth in total deposits modestly. This reflects our continued focus on the overall cost of funds as well

as the continued shift towards low- and no-cost demand deposits and money market deposit accounts.

Noninterest income over the course of the year, excluding the impact of any automobile loan sales, any net

MSR impact, and typical first quarter seasonality, is expected to be relatively stable. The anticipated slowdown

in mortgage banking activity is expected to be offset by continued growth in new customers, increased

contribution from higher cross-sell, and the continued maturation of our previous strategic investments.

Noninterest expense continued to run at levels above our long-term expectations relative to revenue. In

response to changes in our economic outlook, we have moderated the pace and size of our planned investments in

order to drive positive operating leverage again in 2013.

Commitment to Our Shareholders

We are committed to delivering long-term value to our shareholders. At Huntington, we believe that

balancing “doing the right thing” for our shareholders, colleagues, customers, and communities is the path to

developing a robust franchise that can produce the stable returns needed to create long-term value. Two examples

of that balance are 1) how our $4 billion commitment to small business lending in the Midwest has helped drive

the recovery of the local economy and also assisted Huntington in growing average commercial and industrial

loans by 16% over 2011; and 2) how the investments in our colleague wellness program lead to lower cost of

insurance and improved productivity through lower colleague turnover and higher colleague satisfaction.

The prudent deployment of capital is one of the most fundamental undertakings by the Board and executive

leadership. As I discussed above, we took actions in 2012 to increase the amount of capital returned to

shareholders. As we continue to generate capital, we will be prudent in its allocation. First, we will invest in our

core strategy, albeit at a slower pace than in 2012. Second, we will provide our shareholders a dividend. With the

regulators targeting a dividend payout ratio of up to 30%, as our income grows, then so should our dividend.

Last, we continue to evaluate other capital actions including share repurchases and mergers and acquisitions. As

we have shown over the last several years, we will continue to maintain a high level of discipline when

considering mergers and acquisitions.

Last year, I wrote about how we took steps to align executives’ interests with long-term shareholders’

interests by increasing common stock ownership by requiring that 50% of net shares received by senior

leadership through incentive plans be held until retirement. To further align these interests, in 2012, we

implemented performance share units as 50% of the long-term incentive program for key senior executives, as

well as extended our market leading ownership guidelines and hold until retirement requirements deeper within

the Company’s management structure.

I want to thank David Lauer, who is retiring from the Board effective at the annual meeting, for his

dedicated service and invaluable counsel to Huntington. David has been a leader in many critical areas, serving

not only as the chairman of the audit committee, but also as the lead of several other subcommittees over his

tenure. Through his referrals and support of our business initiatives, he has been an extraordinary friend and

ambassador for the Bank across the greater Columbus area. We are grateful for his service and extend our warm

wishes to him.

In addition to the personal pride I have for what the Huntington team has accomplished over the last several

years for our shareholders, I am especially proud of our colleagues for their deep commitment to our

communities. One example is Pelotonia, the annual bike tour that raises funds for the James Cancer Hospital and

Solove Research Institute, which continues to be a rallying point for Huntington’s colleagues. Since the inaugural

event in 2009, we have raised over $6.1 million towards curing cancer, and in 2012, more than 1,300 of our

approximately 11,000 colleagues rode in or volunteered for the event.

4