Home Depot 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-1

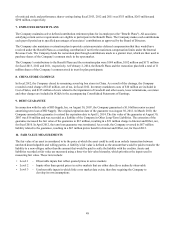

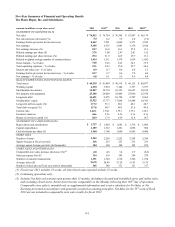

Five-Year Summary of Financial and Operating Results

The Home Depot, Inc. and Subsidiaries

amounts in millions, except where noted 2013 2012(1) 2011 2010 2009(2)

STATEMENT OF EARNINGS DATA

Net sales $ 78,812 $ 74,754 $ 70,395 $ 67,997 $ 66,176

Net sales increase (decrease) (%) 5.4 6.2 3.5 2.8 (7.2)

Earnings before provision for income taxes 8,467 7,221 6,068 5,273 3,982

Net earnings 5,385 4,535 3,883 3,338 2,620

Net earnings increase (%) 18.7 16.8 16.3 27.4 13.3

Diluted earnings per share ($) 3.76 3.00 2.47 2.01 1.55

Diluted earnings per share increase (%) 25.3 21.5 22.9 29.7 13.1

Diluted weighted average number of common shares 1,434 1,511 1,570 1,658 1,692

Gross margin – % of sales 34.8 34.6 34.5 34.3 33.9

Total operating expenses – % of sales 23.1 24.2 25.0 25.7 26.6

Interest and other, net – % of sales 0.9 0.7 0.8 0.8 1.2

Earnings before provision for income taxes – % of sales 10.7 9.7 8.6 7.8 6.0

Net earnings – % of sales 6.8 6.1 5.5 4.9 4.0

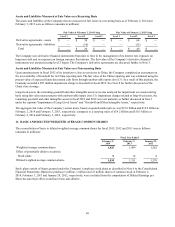

BALANCE SHEET DATA AND FINANCIAL RATIOS

Total assets $ 40,518 $ 41,084 $ 40,518 $ 40,125 $ 40,877

Working capital 4,530 3,910 5,144 3,357 3,537

Merchandise inventories 11,057 10,710 10,325 10,625 10,188

Net property and equipment 23,348 24,069 24,448 25,060 25,550

Long-term debt 14,691 9,475 10,758 8,707 8,662

Stockholders’ equity 12,522 17,777 17,898 18,889 19,393

Long-term debt-to-equity (%) 117.3 53.3 60.1 46.1 44.7

Total debt-to-equity (%) 117.6 60.7 60.3 51.6 49.9

Current ratio 1.42:1 1.34:1 1.55:1 1.33:1 1.34:1

Inventory turnover 4.6x 4.5x 4.3x 4.1x 4.1x

Return on invested capital (%) 20.9 17.0 14.9 12.8 10.7

STATEMENT OF CASH FLOWS DATA

Depreciation and amortization $ 1,757 $ 1,684 $ 1,682 $ 1,718 $ 1,806

Capital expenditures 1,389 1,312 1,221 1,096 966

Cash dividends per share ($) 1.560 1.160 1.040 0.945 0.900

STORE DATA

Number of stores 2,263 2,256 2,252 2,248 2,244

Square footage at fiscal year-end 236 235 235 235 235

Average square footage per store (in thousands) 104 104 104 105 105

STORE SALES AND OTHER DATA

Comparable store sales increase (decrease) (%)(3) 6.8 4.6 3.4 2.9 (6.6)

Sales per square foot ($) 334 319 299 289 279

Number of customer transactions 1,391 1,364 1,318 1,306 1,274

Average ticket ($) 56.78 54.89 53.28 51.93 51.76

Number of associates at fiscal year-end (in thousands) 365 340 331 321 317

(1) Fiscal year 2012 includes 53 weeks; all other fiscal years reported include 52 weeks.

(2) Continuing operations only.

(3) Includes Net Sales at locations open greater than 12 months, including relocated and remodeled stores and online sales,

and excluding closed stores. Retail stores become comparable on the Monday following their 365th day of operation.

Comparable store sales is intended only as supplemental information and is not a substitute for Net Sales or Net

Earnings presented in accordance with generally accepted accounting principles. Net Sales for the 53rd week of fiscal

2012 are not included in comparable store sales results for fiscal 2012.