Home Depot 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

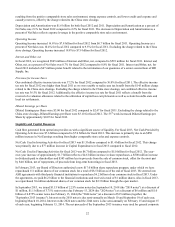

The assets of a store with indicators of impairment are evaluated by comparing its undiscounted cash flows with its carrying

value. The estimate of cash flows includes management’s assumptions of cash inflows and outflows directly resulting from

the use of those assets in operations, including gross margin on Net Sales, payroll and related items, occupancy costs,

insurance allocations and other costs to operate a store. If the carrying value is greater than the undiscounted cash flows, an

impairment loss is recognized for the difference between the carrying value and the estimated fair market value. Impairment

losses are recorded as a component of SG&A in the accompanying Consolidated Statements of Earnings. When a leased

location closes, we also recognize in SG&A the net present value of future lease obligations less estimated sublease income.

We make critical assumptions and estimates in completing impairment assessments of long-lived assets. Our cash flow

projections look several years into the future and include assumptions on variables such as future sales and operating margin

growth rates, economic conditions, market competition and inflation. A 10% decrease in the estimated undiscounted cash

flows for the stores with indicators of impairment would not have a material impact on our results of operations. Our

estimates of fair market value are generally based on market appraisals of owned locations and estimates on the amount of

potential sublease income and the time required to sublease for leased locations. A 10% decrease in estimated sublease

income and a 10% increase in the time required to sublease would not have a material impact on our results of operations. We

recorded impairments and lease obligation costs on closings and relocations in the ordinary course of business, as well as for

the China store closings in fiscal 2012, which were not material to the Consolidated Financial Statements in fiscal 2013, 2012

or 2011.

Goodwill and Other Intangible Assets

Goodwill represents the excess of purchase price over the fair value of net assets acquired. We do not amortize goodwill but

do assess the recoverability of goodwill in the third quarter of each fiscal year, or more often if indicators warrant, by

determining whether the fair value of each reporting unit supports its carrying value. Each year we may assess qualitative

factors to determine whether it is more likely than not that the fair value of each reporting unit is less than its carrying amount

as a basis for determining whether it is necessary to complete quantitative impairment assessments, with a quantitative

assessment completed at least once every three years. In fiscal 2013, we elected to estimate the fair values of our identified

reporting units using the present value of expected future discounted cash flows. We make critical assumptions and estimates

in completing impairment assessments of goodwill and other intangible assets. Our cash flow projections look several years

into the future and include assumptions on variables such as future sales and operating margin growth rates, economic

conditions, market competition, inflation and discount rates. A 10% decrease in the estimated discounted cash flows for the

reporting units would not result in an impairment. A 1.0 percentage point increase in the discount rate used would also not

result in an impairment.

The reporting units assessed for impairment during fiscal 2013 were U.S., Canada and Mexico. During fiscal 2013, we

determined that our goodwill balances for each of these reporting units were not impaired, as we determined the fair value for

each of these reporting units was substantially above its carrying value. In fiscal 2012, we recorded a charge of $97 million to

impair all of the goodwill associated with our former China reporting unit. There were no impairment charges related to our

remaining goodwill for fiscal 2013, 2012 or 2011.

We amortize the cost of other intangible assets over their estimated useful lives, which range up to ten years, unless such lives

are deemed indefinite. Intangible assets with indefinite lives are tested in the third quarter of each fiscal year for impairment,

or more often if indicators warrant. There were no impairment charges related to our other intangible assets for fiscal 2013,

2012 or 2011.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

The information required by this item is incorporated by reference to Item 7, "Management’s Discussion and Analysis of

Financial Condition and Results of Operations" of this report.