Home Depot 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

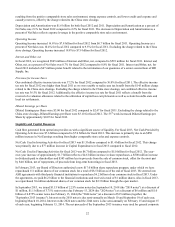

Executive Summary and Selected Consolidated Statements of Earnings Data

For the fiscal year ended February 2, 2014 ("fiscal 2013"), we reported Net Earnings of $5.4 billion and Diluted Earnings per

Share of $3.76 compared to Net Earnings of $4.5 billion and Diluted Earnings per Share of $3.00 for the fiscal year ended

February 3, 2013 ("fiscal 2012"). The results for fiscal 2012 included a total charge of $145 million, net of tax, related to the

closing of our remaining seven big box stores in China ("China store closings") in fiscal 2012, which had a negative impact

of $0.10 to Diluted Earnings per Share. Excluding the charge related to the China store closings, Net Earnings were $4.7

billion and Diluted Earnings per Share were $3.10 for fiscal 2012.

Net Sales increased 5.4% to $78.8 billion for fiscal 2013 from $74.8 billion for fiscal 2012. Our comparable store sales

increased 6.8% in fiscal 2013, driven by increased comparable store customer transactions and comparable store average

ticket. Comparable store sales for our U.S. stores increased 7.5% in fiscal 2013.

Fiscal 2013 consisted of 52 weeks compared with 53 weeks for fiscal 2012. The 53rd week added approximately $1.2 billion

in Net Sales and increased Diluted Earnings per Share by approximately $0.07 for fiscal 2012.

In fiscal 2013, we continued to focus on the following key initiatives:

Customer Service – Our focus on customer service is anchored on the principles of creating an emotional connection with

customers, putting customers first, taking care of our associates and simplifying the business. In fiscal 2013, we met our goal

of dedicating 60% of store labor hours to customer-facing activity, and we enhanced our Customer FIRST training for

associates to incorporate the interconnected retail experience. We also expanded our FIRST phones' functionality to process

Buy Online, Pick-up In Store ("BOPIS") and Buy Online, Ship to Store ("BOSS") orders, allowing our associates to close

these types of transactions immediately from wherever they are in the store. Also in fiscal 2013, we introduced Pro Xtra, a

new loyalty program that provides our professional customers with discounts on useful business services, exclusive product

offers and streamlined payment and receipt tracking tools.

Product Authority – Our focus on product authority is facilitated by our merchandising transformation and portfolio strategy,

which is aimed at delivering product innovation, assortment and value. As part of this effort, we introduced innovative new

products and great values for our professional, do-it-for-me and do-it-yourself customers in a variety of departments. Also in

fiscal 2013, we continued our appliance showroom resets and expanded our assortment of appliances available online,

resulting in double digit growth for appliances for fiscal 2013.

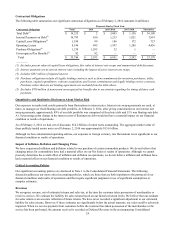

Disciplined Capital Allocation, Productivity and Efficiency – Our approach to driving productivity and efficiency is advanced

through continuous operational improvement in the stores and our supply chain, disciplined capital allocation and building

shareholder value through higher returns on invested capital and total value returned to shareholders in the form of dividends

and share repurchases. In fiscal 2013, we continued to make improvements to our forecasting and replenishment systems,

helping our business to react to and recover from sales spikes while keeping inventory under control. Our inventory turnover

ratio was 4.6 times at the end of fiscal 2013 compared to 4.5 times at the end of fiscal 2012.

We repurchased a total of 111 million shares for $8.5 billion through Accelerated Share Repurchase agreements and the open

market during fiscal 2013. In addition, in February 2014, we announced a 21% increase in our quarterly cash dividend to

$0.47 per share.

Interconnected Retail – Our focus on interconnected retail, which connects our other three key initiatives, is based on

building a competitive and seamless platform across all commerce channels. In fiscal 2013, we continued to enhance our

website and mobile experience resulting in improved customer satisfaction scores and online sales conversion rates. Sales

from our online channels increased over 50% for fiscal 2013 compared to fiscal 2012 and now represent approximately 3.5%

of our total Net Sales. We have also begun the development of three new direct fulfillment centers, the first of which opened

in February 2014. Each facility will have the capacity to hold approximately 100,000 product offerings available to be

shipped directly to customers, along with the capability to ship most orders the same day they are received.

In January 2014, we acquired Blinds.com, an online seller of window coverings. We believe that this acquisition will allow us

to offer customers a compelling shopping, sales and service experience for online window coverings purchases and help us to

develop best-in-class capabilities for selling customizable and configurable products online.

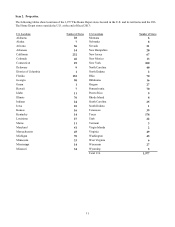

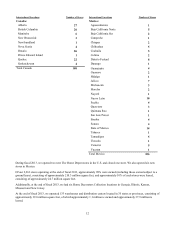

In fiscal 2013, we opened eight new stores, including six new stores in Mexico and two new stores in the U.S., and closed

one store in the U.S., for a total store count of 2,263 at the end of fiscal 2013. As of the end of fiscal 2013, a total of 286 of

our stores, or 12.6%, were located in Canada and Mexico.