Fujitsu 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Fujitsu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

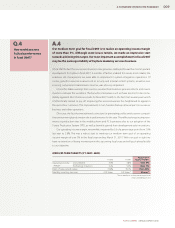

Status of Outsourcing at Fujitsu

Fujitsu has retained the top share*1 of Japan’s outsourcing market, in terms of rev-

enue, every year since fiscal 2003 (ended March 31, 2004), and boasts the fourth

leading share*2 of the market worldwide. In recent years, a growing need has

emerged among corporate IT systems divisions to outsource the operation of their

own IT systems, fueling annual growth in the market for such services in Japan. In

fiscal 2007, Fujitsu recorded ¥514.3 billion in revenues from outsourcing in Japan,

an increase of 9% year on year, and exceeding our revenue target of ¥510.0 billion

for this business. We anticipate ¥600.0 billion in outsourcing revenues in fiscal 2008

and ¥680.0 billion in fiscal 2009, driven by projected double-digit growth for both

years. We are also targeting an operating income margin of 10% or more for the

same two-year period.

Outside of Japan, the outsourcing business is conducted mainly through Fujitsu

Services, our UK-based subsidiary. Fujitsu Services has a wealth of experience in out-

sourcing for large government-related projects in the UK, and the company is now

expanding business with the corporate sector. For example, Fujitsu Services recently

received an order to deliver IT infrastructure services for news and information pro-

vider Reuters of the UK. Fujitsu Services also recently purchased TDS AG of Germany

and Mandator AB of Sweden in a bid to expand its capacity to offer services on a

global scale. Through these and other proactive steps to develop business, Fujitsu

Services recorded sales of £2,567 million for the fiscal year ended March 31, 2008.

*1 Source: IDC, August 2007

*2 Source: Gartner, April 2008, GJ08334

FUJITSU OUTSOURCING BUSINESS TARGETS JAPAN

Sales Growth:

Continue double-

digit sales growth

Operating Income:

Operating income

margin over 10%

Outsourcing

Business Domains

Data centers

On-site (LCM)

Support desks

Networks

APM

BPO

“Outsourcing” is the general term for corporate efforts to shift certain business func-

tions and resources to professionals outside one’s corporate domain, or to conduct

external procurement. Broadly speaking, outsourcing can be applied to the full spec-

trum of business functions, from general affairs, personnel and accounting, to sales

and production. In the IT field, however, outsourcing refers more specifically to the

strategic entrustment of information systems, from construction to operations, as

well as necessary equipment, to outside professionals.

Fujitsu is expanding its outsourcing business, having positioned it as a key business

to spearhead corporate growth going forward.

SALES OF FUJITSU SERVICES

(Millions of Pounds)

(Billions of Yen)

FEATURE 1: BUILDING ON OUR STRENGTHSFUJITSU’S OUTSOURCING BUSINESS

(Years ended March 31)

(Years ended March 31)

(Target) (Target)

GLOBAL OUTSOURCING

MARKET SHARE IN FISCAL 2007

REVENUE BASIS

Fujitsu

3.4%

Company A 11.8%

Company B 6.4%

Company C 4.0%

Company D 3.1%

Others 71.3%

(Source: Gartner, April 2008, GJ08334)

2004 2005 2006 2007 2008

0

600

1,200

1,800

2,400

3,000

1,735

1,986

2,294 2,465 2,567

2005 20072006 2008 2009 2010

0

200

400

600

800

380.0

460.0 510.0

415.0

600.0

680.0

016

ANNUAL REPORT 2008FUJITSU LIMITED