Fujitsu 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Fujitsu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

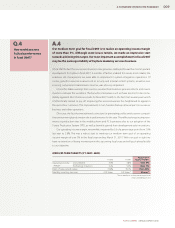

TARGET SALES AND PROFITS FOR FISCAL 2008

(Millions of Yen)

2008 Results 2009 2009/2008

Net sales ¥5,330,865 ¥5,350,000 +0.4%

Operating income 204,989 220,000 +7.3%

Net income 48,107 100,000 +107.9%

(Years ended March 31)

Since business profitability has stabilized, we raised the year-end dividend

to ¥5 per share in fiscal 2007. We plan to raise our annual dividend again in

fiscal 2008.

Our basic policy on dividends is to offer a stable return to shareholders from retained earnings,

while ensuring that we maintain sufficient internal reserves to strengthen our financial position

and actively develop our business, including business outside Japan.

Q.10

What is Fujitsu’s policy

on returning profits

to shareholders?

A.10

investments for growth, either to support customers’ global business expansion or to boost

competitiveness, to drop off suddenly.

Our services business, in particular, is showing steady improvement in profitability. We expect

to see benefits from a variety of measures we’ve taken, including infrastructure industrialization,

IT infrastructure optimization designed with a customer’s entire business system in mind, and

growth in outsourcing business in Europe and the United States. From these and other factors,

we are forecasting ¥185.0 billion in operating income from the services business, ¥44.5 billion more

than in 2007.

Looking at sales, although we expect growth in the services business and HDDs both in and

outside Japan, exchange rate fluctuations are likely to reduce the total by roughly ¥200 billion

and so we are forecasting net sales of ¥5,350 billion, on par with 2007. As for operating income,

we expect to meet our initial target of ¥220 billion for the year despite the impact of exchange

rate fluctuations, a more difficult pension asset management environment, and other adverse

factors. In addition to improved profitability in the services business, we expect earnings to rise

on the back of various measures we are promoting, among them Group-wide measures taken

from last year to reduce costs.

EARNINGS PER SHARE

(Yen)

(Plan)

(Years ended March 31)

2000 20022001 2003 2004 20062005 2007 2008 2009

0

3

6

9

12

10 10

5

0

3

666

8

10

013

ANNUAL REPORT 2008FUJITSU LIMITED

013

A CONVERSATION WITH THE PRESIDENT