FTD.com 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 FTD.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

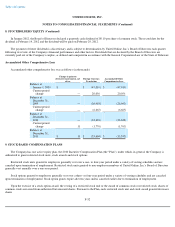

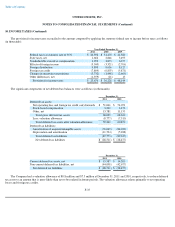

9. STOCK-BASED COMPENSATION PLANS (Continued)

of time remaining in the 24-month offering period. The risk-free interest rate assumed in valuing the employee stock purchase plan shares is

based on the U.S. Treasury yield curve in effect at the time of grant for the expected term. The Company determines the expected dividend yield

percentage by dividing the expected annual dividend by the closing market price of the common stock at the date of grant.

For the years ended December 31, 2011, 2010 and 2009, the Company recognized $1.2 million, $1.4 million and $2.8 million, respectively,

of stock-based compensation related to the employee stock purchase plans. At December 31, 2011, total unrecognized compensation cost related

to the employee stock purchase plan was $2.2 million and was expected to be recognized over a weighted-average period of 0.7 years.

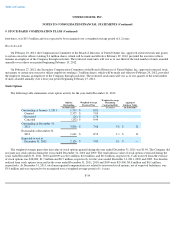

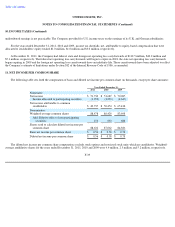

10. INCOME TAXES

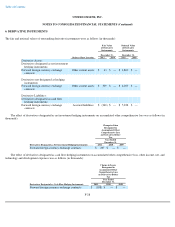

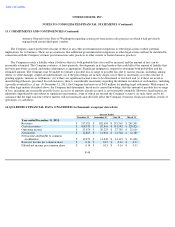

Income before income taxes was comprised of the following (in thousands):

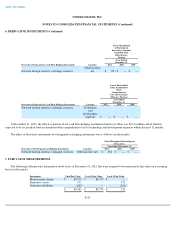

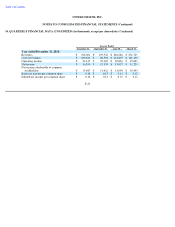

The provision for income taxes was comprised of the following (in thousands):

F-36

Year Ended December 31,

2011

2010

2009

Domestic

$

43,718

$

63,059

$

94,973

Foreign

31,688

26,856

23,256

Income before income taxes

$

75,406

$

89,915

$

118,229

Year Ended December 31,

2011

2010

2009

Current:

Federal

$

17,635

$

25,144

$

41,987

State

(4,536

)

2,743

6,617

Foreign

6,637

8,264

8,442

19,736

36,151

57,046

Deferred:

Federal

1,192

2,530

(5,822

)

State

3,805

(981

)

(1,533

)

Foreign

(1,057

)

(1,472

)

(1,547

)

3,940

77

(8,902

)

Provision for income taxes

$

23,676

$

36,228

$

48,144