FTD.com 2011 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2011 FTD.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

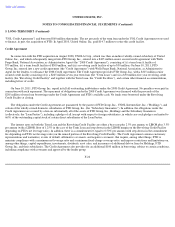

9. STOCK-BASED COMPENSATION PLANS (Continued)

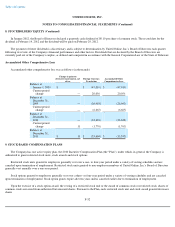

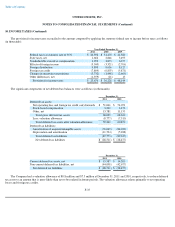

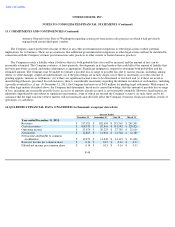

The fair value of stock options granted during the year ended December 31, 2011 was estimated using the Black-Scholes option pricing

model with the following weighted-average assumptions:

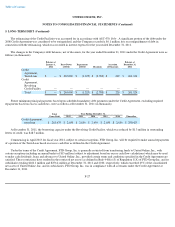

Recent Awards

On February 23, 2012, the Compensation Committee of the Board of Directors of United Online, Inc. approved stock option grants to

certain executive officers totaling 0.6 million shares, which will be made and effective February 29, 2012, provided the executive officer remains

an employee of the Company through such date. Each stock option entitles the recipient to receive one share of common stock upon exercise of

the vested award and payment of the exercise price. The stock options will vest as to one-third of the total number of options awarded annually

over a three-year period beginning February 15, 2012.

Employee Stock Purchase Plans

In 2010, the Company adopted the 2010 Employee Stock Purchase Plan to replace the 2001 Employee Stock Purchase Plan. The 2010

Employee Stock Purchase Plan had 4.5 million shares of the common stock reserved and 4.1 million shares available for issuance at

December 31, 2011. The 2001 Employee Stock Purchase Plan expired in 2011 following the completion of the final purchase thereunder.

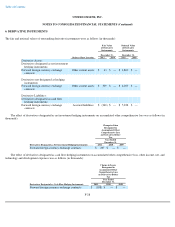

Under the employee stock purchase plans, each eligible employee may authorize payroll deductions of up to 15% of his or her

compensation to purchase shares of common stock on two purchase dates each year at a purchase price per share equal to 85% of the lower of

(i) the closing market price per share of the common stock on the employee's entry date into the two-year offering period in which the purchase

date occurs or (ii) the closing market price per share of the common stock on the purchase date. Each offering period has a 24-month duration

and purchase intervals of six months.

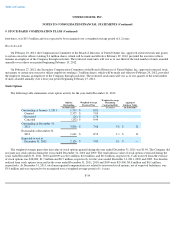

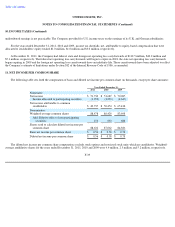

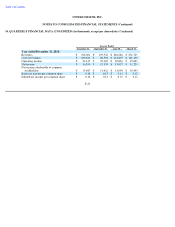

The fair value of employee stock purchase plan shares was estimated using the Black-Scholes option pricing model with the following

weighted-average assumptions:

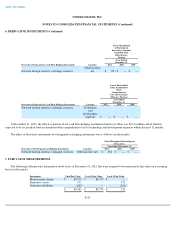

The assumptions presented in the table above represent the weighted average of the applicable assumptions used to value employee stock

purchase plan shares. The Company calculates expected volatility based on historical volatility of the common stock. The expected term

represents the amount

F-35

Risk

-

free interest rate

2.69

%

Expected term (in years)

6.0

Dividend yield

5.7

%

Volatility

47.0

%

Year Ended December 31,

2011

2010

2009

Risk

-

free interest rate

0.4

%

0.7

%

0.8

%

Expected term (in years)

0.5

-

2.0

0.5

-

2.0

0.5

-

2.0

Dividend yield

6.7

%

7.3

%

6.9

%

Volatility

46.6

%

57.6

%

58.5

%