Eversource 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

In New Hampshire, PSNH’s Northern Wood Power Project has begun the $75 million conversion of a

Portsmouth coal-fired generating unit to burn wood chips. The plant brings significant environmental

benefits and a $20 million boost to the state’s wood industry and economy. As Bill Dunlap, chairman

of the Society for the Protection of New Hampshire Forests, noted at the groundbreaking for this project,

“One of our missions is to preserve a sustainable forestry industry. The Northern Wood Power Project

is right in line with that mission and good for the environment. It’s a home run.”

On the gas side of our business, Yankee Gas broke ground early in 2005 to construct a $108 million

liquefied natural gas (LNG) storage facility in Waterbury, Connecticut. The LNG project has been a

model of collaboration and partnerships, bringing together government, business, regulators and the

Waterbury community. The new facility is expected to deliver both supply and price benefits to our

customers and is the largest construction project in Yankee’s history.

Our investment in the region carries us well beyond poles, wires and pipes. Northeast Utilities

companies are basic building blocks of the economic climate, quality of life and overall well-being of

the cities, towns and customers we serve. For us, doing well in business also means doing good, by

enriching our communities and making life better for those who count on us.

Supporting the United Way campaign is just one of the ways our employees make a positive difference.

In 2004, including matching corporate contributions and NU Foundation donations, the NU team

pledged more than $1.7 million to United Way and Combined Health Appeal charities to help people

across New England.

In 2004, the NU Foundation awarded a substantial grant to extend our environmental stewardship.

Our $500,000 grant to The Nature Conservancy initiates a large-scale, multi-state commitment to

improve the long-term viability of the Connecticut River, from the Canadian border to Long Island

Sound. The Connecticut River program will enhance conservation of New England’s most important

waterway.

Changing course with our competitive businesses

Poor performance in major areas of our competitive business in 2004 necessitated a change in

course. The wholesalegroup lost $17 million last year, compared with a loss of $3.7 million in 2003.

Despitethe hardwork and dedication of employees in this business, NUEI’s wholesale marketing

business is not expected to attain adequate profit margins given the wholesale merchant energy

environment. As a result, wewill exit the wholesale marketing business.

Our competitive energy services businesses lost $2.3 million in 2004. We have concluded that these

businesses are not central to NU’s long-term strategy and do not meet the company’s expectations

of profitability. We are exploring ways to divest of them in a way that maximizes shareholder value.

Despite these areas of disappointment, there were some bright spots at NUEI, with two segments of

our competitive businesses performing well.

Select Energy’s retail energy businessearned $4.9 million in 2004. We enjoy a very strong retail energy

marketing franchise in the Northeast and mid-Atlantic states, and we expect to build on that market

presence. Consequently, we will retain and grow this business. Select Energy’s retail group currently

serves some 30,000 commercial and industrial customer locations in the New England, New York and

PJM power pools.

Likewise, our competitive generating assets continue to perform well, and we will retain them. The

1,443 megawatts are primarily pumped storage, hydroelectric and coal-fired units, all of which are

competitive in today’s environment. They have solid operating histories, and we expect their value

could increase significantly in the coming years. In addition, we will retain our Northeast Generation

Services subsidiary to operate our generating plants.

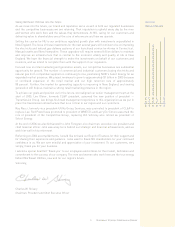

$0.10

$0.40

$0.45

$0.53

$0.58

$0.63

99

00

01

02

03

04

DIVIDENDS PER SHARE

(DOLLARS)

EARNINGS PER

COMMON SHARE

(DOLLARS)

$0.26

$(0.20)

$1.79

$1.18

$0.91

$0.91

99

00

01

02

03

04