Eversource 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Eversource annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INVESTING IN OUR REGION’S FUTURE

NORTHEAST UTILITIES 2004 ANNUAL REPORT

Table of contents

-

Page 1

NORTHEAST UTILITIES 2004 A NNUAL REPORT INVESTING IN OUR REGION'S FUTURE -

Page 2

...Fortune 500 diversified energy company located in Connecticut with operations throughout the Northeast. Through our regulated and competitive subsidiaries, NU provides Energy for a Changing World, with a full range of energy products and services to millions of residential and business customers. NU... -

Page 3

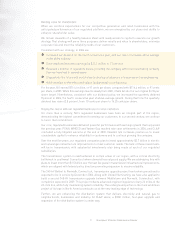

... data) 2004 2003 % Change Operating Revenues Operating Income Net Income Fully Diluted Earnings per Common Share Fully Diluted Common Shares Outstanding (Weighted Average) Dividends per Share Sales of Electricity (Regulated Retail, kWh-millions) Electric Customers (Average) Gas Customers (Average... -

Page 4

...energized by our plans and ability to enhance shareholder value." Charles W. Shivery Chairman, President and CEO TO OUR SHAREHOLDERS, EMPLOYEES, CUSTOMERS A N D BU SI N E S S PA RT N E R S 2004 was a year of mixed results for Northeast Utilities. On the regulated side of our business, results were... -

Page 5

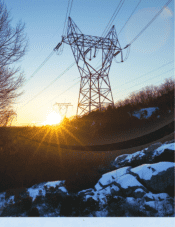

... of technology. Further, we are enhancing the distribution system that delivers electricity and natural gas to neighborhoods, businesses and industry. At CL&P alone, a $900 million, four-year upgrade and expansion of the distribution system is under way. 3 NORTHEAST UTILITIES 2004 ANNUAL REPORT -

Page 6

... community. The new facility is expected to deliver both supply and price benefits to our customers and is the largest construction project in Yankee's history. Our investment in the region carries us well beyond poles, wires and pipes. Northeast Utilities companies are basic building blocks of the... -

Page 7

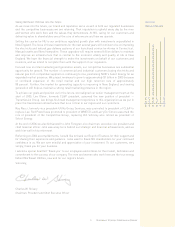

...success of our company. The men and women who work here are the true energy behind Northeast Utilities, now and for our region's future. Sincerely, REVENUES (DOLLARS IN MILLIONS) Charles W. Shivery Chairman, President and Chief Executive Officer 5 NORTHEAST UTILITIES 2004 ANNUAL REPORT 99 00 01... -

Page 8

6 -

Page 9

... and Norwalk, with an estimated in-service date of 2008. Moving from land to sea, we are working to replace an undersea electric transmission line between Norwalk and Northport, Long Island, New York. We expect the cable to be in service by mid-2008. 7 NORTHEAST UTILITIES 2004 ANNUAL REPORT -

Page 10

... companies - CL&P, PSNH, WMECO and Yankee Gas. By consolidating six call centers into two, integrating Customer Service and Information Technology support, and implementing one customer information system across these businesses, we save money while further enhancing customer service and business... -

Page 11

... and operation of the electric system. Using new "smart" technology, operators have more information available to analyze trouble spots, remotely de-energize selected lines and, during outages, switch customers to other circuits to restore service faster. 9 NORTHEAST UTILITIES 2004 ANNUAL REPORT -

Page 12

10 -

Page 13

... in the company's history. Site preparation work was well under way during 2004, paving the way for construction of the facility to begin in early 2005. The new plant will give Yankee the flexibility to buy natural gas in periods of low demand, store it as a liquid and use it to meet customer needs... -

Page 14

... front and center with companies and the consultants who advise them on where best to locate new offices and factories. NU's initiative burnishes New England's image nationwide and overseas to attract investments and jobs. f Working together, these business partners brought WMECO's headquarters to... -

Page 15

13 NORTHEAST UTILITIES 2004 ANNUAL REPORT -

Page 16

.... NU leads the way in mutual aid storm support, both providing and receiving help when nature delivers damaging storms and large scale outages. f Each year, we reach out to fifth grade students across our service area to teach valuable lessons in electrical safety. CL&P lead lineman Lambert... -

Page 17

... in our service area. In the fall of 2004, 225 NU workers performed extraordinary power restoration work to help Florida recover from three devastating hurricanes. Crews numbering 21 from CL&P, 16 from PSNH and nine from WMECO safely worked in dangerous conditions, stifling heat, humidity and... -

Page 18

... The Connecticut Light and Power Company (CL&P) Largest electric utility in Connecticut, delivering energy to nearly 1.2 million residential and commercial customers in 149 cities and towns. www.cl-p.com B U S I N E S S E S Public Service Company of New Hampshire (PSNH) Largest electric utility... -

Page 19

2004 F I N A N C I A L I N F O R M A T I O N MANAGEMENT 'S DISCUSSION C O M PA N Y R E P O R T REPORTS OF ON AND A N A LY S I S 18 45 46 48 50 50 51 52 53 54 88 89 INTERNAL CONTROLS OVER FINANCIAL REPORTING INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM C O N S O L I DAT E D B A L A N C E S H ... -

Page 20

..., Inc. (Select Energy), approximately $158 million of revenues collected from customers in 2003 and early 2004. • The Connecticut Department of Public Utility Control (DPUC) issued a final decision on August 4, 2004 on CL&P's petition for reconsideration of the DPUC's December 2003 rate order. The... -

Page 21

... resulted in an annualized delivery rate increase of $3.5 million beginning October 1, 2004 and approval of another rate increase of $10 million on June 1, 2005. • On September 24, 2004, PSNH filed a petition with the NHPUC requesting a change in the transition energy service rate for residential... -

Page 22

... NU Enterprises 2004 loss includes an after-tax loss of $48.3 million, or $0.38 per share, associated with mark-to-market accounting for certain natural gas positions established to mitigate the risk of electricity purchased in anticipation of winning certain levels of wholesale electric load in New... -

Page 23

... 2004 and which serves a market that NU believes to be growing; • The competitiveness and opportunities for increased value for the 1,443 MW of generation currently owned by NU Enterprises; • The strategic fit of the energy services businesses; and (Millions of Dollars) Merchant Energy Energy... -

Page 24

...Northeast and Middle Atlantic states, and the company expects to build on that market presence. Additionally, the number of commercial and industrial customers buying their electricity and natural gas from competitive suppliers is continuing to rise. Select Energy's retail marketing revenues in 2004... -

Page 25

... at a fixed interest rate of 5.25 percent. Proceeds were used to repay short-term debt and fund PSNH's capital expenditure program. In October 2004, PSNH received the approvals necessary to begin the construction related to the conversion of one of the coal-fired units at Schiller Station to burn... -

Page 26

...waste fund from wholesale utility customers under FERC-approved contract rates.The wholesale utility customers in turn collect these payments from their retail electric customers. The Nuclear Decommissioning and Plant Closure Costs The Connecticut Yankee Atomic Power Company (CYAPC) is currently in... -

Page 27

... project. On October 1, 2004, CL&P and the Long Island Power Authority (LIPA) jointly filed plans with the Connecticut Department of Environmental Protection to replace an undersea 13-mile electric transmission line between Norwalk, Connecticut and Northport - Long Island, New York, consistent with... -

Page 28

...-fired generating station would be required to cease operation in October 2006. NGC's capital expenditures in 2005 are projected to total approximately $10 million. Transmission Access and FERC Regulatory Changes NU companies CL&P, WMECO and PSNH are members of the New England Power Pool (NEPOOL... -

Page 29

... tariff that is expected to increase 2005 revenues by approximately $8 million over 2004 transmission revenues. A significant portion of NU's transmission businesses' revenue is from charges to NU's electric distribution companies CL&P, PSNH and WMECO. These companies recover transmission charges... -

Page 30

.... The OCC claims that the decision improperly implements an EAC charge under Connecticut law, fails to properly define and identify the fees that CL&P will be allowed to collect from customers and improperly calculates base rates for purposes of determining the rate cap. Management believes that... -

Page 31

... net income or financial position. Distribution Rate Case Settlement Agreement: On December 29, 2004, the DTE approved a rate case settlement agreement submitted by WMECO, the Massachusetts Attorney General's Office, the Associated Industries of Massachusetts, and the Low-Income Energy Affordability... -

Page 32

... associated with certain wholesale natural gas positions. In 2003, NU Enterprises lost $3.4 million. This loss includes a $35.6 million charge associated with SMD. NU Enterprises' merchant energy retail marketing business earnings improved to net income of $4.9 million in 2004, compared with a loss... -

Page 33

... operating within NU's corporate risk tolerance. Select Energy generally acquires retail customers in small increments, which while requiring careful sourcing allows energy purchases to be acquired in small increments with low risk. However, fluctuations in prices, fuel costs, competitive conditions... -

Page 34

... on Select Energy's business. In addition, NU Enterprises has concluded that competition has increased significantly in the wholesale power market in New England over the last six months of 2004. This increase in competition may affect Select Energy's profitability by reducing the number of bids... -

Page 35

... 1Y, "Summary of Significant Accounting Policies - Counterparty Deposits," to the consolidated financial statements. Select Energy's Credit: A number of Select Energy's contracts require the posting of additional collateral in the form of cash or LOCs in the event NU's ratings were to decline and in... -

Page 36

...to operate and maintain the energy center. The transaction was structured in this manner to obtain tax-exempt rate financing and therefore to reduce the State of Connecticut's lease payments. This off-balance sheet arrangement is not significant to NU's liquidity, capital resources or other benefits... -

Page 37

... revenue requirements, net of revenue credits received from various rate components, including revenues received under the RNS rates. NU Enterprises recognizes revenues at different times for its different business lines. Wholesale and retail marketing revenues are recognized when energy is... -

Page 38

..., recent rate orders issued by the applicable regulatory agencies and the status of any potential new legislation. Regulatory liabilities represent revenues received from customers to fund expected costs that have not yet been incurred or are probable future refunds to customers. Management uses its... -

Page 39

... were changed, the resulting change in benefit obligations, fair values of plan assets, funded status and net periodic benefit credits or costs could have a material impact on NU's consolidated financial statements. Results: Pre-tax periodic pension expense/income for the Pension Plan, excluding... -

Page 40

... increase/(decrease) to the Pension Plan's and PBOP Plan's reported cost as a result of a change in the following assumptions by 50 basis points (in millions): At December 31, Pension Plan Postretirement Plan Assumption Change 2004 2003 2004 2003 Lower long-term rate of return Lower discount rate... -

Page 41

... and $253.8 million at December 31, 2004 and 2003, respectively. Regulatory agencies in certain jurisdictions in which NU's Utility Group companies operate require the tax effect of specific temporary differences to be "flowed through" to utility customers. Flow through treatment means that deferred... -

Page 42

... normal purchase and sales exception to fair value accounting for derivatives and the resulting recognition of losses or gains on changes in fair value of the contracts since inception. The methods of implementing the company's decision involving the wholesale marketing and services businesses are... -

Page 43

... a change in terms and conditions, such as acceleration of payment obligations. (d) Amounts are not included on NU's consolidated balance sheets. (e) Select Energy's purchase agreement amounts can exceed the amount expected to be reported in fuel, purchased and net interchange power because energy... -

Page 44

... of a wholesale power dispute associated with CL&P standard offer supply ($56 million), and an increased level of competitive energy services business ($42 million). Higher revenues for the merchant retail energy business resulted from higher electric volumes ($119 million), higher gas prices ($48... -

Page 45

... and net interchange power expense increased $686 million in 2003, primarily due to higher wholesale energy purchases at NU Enterprises ($630 million) and higher gas costs ($77 million), partially offset by lower nuclear fuel ($20 million). Amortization Amortization decreased $53 million in 2004... -

Page 46

... retirement of debt ($3 million), partially offset by higher competitive business interest as a result of higher debt levels ($6 million). Other Income/(Loss), Net Other income/(loss), net increased $15 million in 2004 primarily due to the recognition, beginning in 2004, of a CL&P procurement fee... -

Page 47

... the second and third quarters of 2004, management accounted for certain wholesale natural gas contracts using the accrual method of accounting. Using this method, changes in the fair value of the derivative contracts did not impact net income currently. As a result of further analysis performed... -

Page 48

... with the application of derivative accounting rules related to certain wholesale natural gas contracts entered into by the wholesale marketing portion of NU Enterprises' merchant energy segment. These deficiencies resulted in restatements of net income included in the Company's reports on Form... -

Page 49

... of Northeast Utilities: We have audited the accompanying consolidated balance sheets and consolidated statements of capitalization of Northeast Utilities and subsidiaries (a Massachusetts Trust) (the "Company") as of December 31, 2004 and 2003, and the related consolidated statements of income... -

Page 50

...,325 in 2004 and $40,846 in 2003 Unbilled revenues Taxes receivable Fuel, materials and supplies, at average cost Derivative assets - current Prepayments and other Property, Plant and Equipment: Electric utility Gas utility Competitive energy Other Less: Accumulated depreciation Construction work in... -

Page 51

...December 31, 2004 2003 (Restated)* Liabilities and Capitalization Current Liabilities: Notes payable to banks Long-term debt - current portion Accounts payable Accrued taxes Accrued interest Derivative liabilities - current Counterparty deposits Other Rate Reduction Bonds Deferred Credits and Other... -

Page 52

... 31, 2004 2003 2002 Operating Revenues Operating Expenses: Operation - Fuel, purchased and net interchange power Other Maintenance Depreciation Amortization Amortization of rate reduction bonds Taxes other than income taxes Gain on sale of utility plant Total operating expenses Operating Income... -

Page 53

... par value 832,578 Allocation of benefits - ESOP 567,907 Restricted shares, net (62,042) Tax deduction for stock options exercised and Employee Stock Purchase Plan disqualifying dispositions Capital stock expenses, net Other comprehensive income Balance as of December 31, 2004 129,034,442 1,356 186... -

Page 54

... assets Natural gas mark-to-market deposit Other current assets Accounts payable Accrued taxes Other current liabilities Net cash flows provided by operating activities Investing Activities: Investments in property and plant: Electric, gas and other utility plant Competitive energy assets... -

Page 55

...' Equity Preferred Stock: CL&P Preferred Stock Not Subject to Mandatory Redemption - $50 par value - authorized 9,000,000 shares in 2004 and 2003; 2,324,000 shares outstanding in 2004 and 2003; Dividend rates of $1.90 to $3.28: Current redemption prices of $50.50 to $54.00 Long-Term Debt: First... -

Page 56

... wholesale power purchase agreement CVEC had with CVPS. The $21 million payment is being recovered from PSNH's customers. NU Enterprises: NU Enterprises, Inc. is the parent company of Northeast Generation Company (NGC), Northeast Generation Services Company (NGS), Select Energy, Inc. (Select Energy... -

Page 57

...the state regulatory commissions. These regulated rates are applied to customers' use of energy to calculate a bill. In general, rates can only be changed through formal proceedings with the state regulatory commissions. Certain Utility Group companies utilize regulatory commission-approved tracking... -

Page 58

... comparability. Operating revenues and fuel, purchased and net interchange power for the years ended December 31, 2004, 2003 and 2002 reflect net reporting. The adoption of net reporting had no effect on net income. Accounting for Energy Contracts: The accounting treatment for energy contracts... -

Page 59

...71, "Accounting for the Effects of Certain Types of Regulation." The transmission and distribution businesses of CL&P, PSNH and WMECO, along with PSNH's generation business and Yankee Gas' distribution business, continue to be cost-of-service rate regulated. New Hampshire's electric utility industry... -

Page 60

...levels are charged to or credited to customers. Differences between the actual purchased gas costs and the current rate recovery are deferred and recovered or refunded in future periods. These amounts are recorded as recoverable energy costs of $13.7 million and $2.9 million at December 31, 2004 and... -

Page 61

...fair value of CL&P IPP contracts and PSNH purchase and sales contracts used for market discovery of future procurement activities that will benefit ratepayers in the future. The tax effects of temporary differences that give rise to the current and long-term net accumulated deferred tax obligations... -

Page 62

... of fuel cell and power quality equipment. Yankee Energy System, Inc. maintains the other investment, a long-term note receivable from BMC Energy LLC (BMC), an operator of renewable energy projects. NEON: Under a 2002 common stock purchase agreement with NEON, NU invested $2.1 million in 2004 in... -

Page 63

... average rate is applied to eligible construction work in progress amounts to calculate AFUDC. N. Equity-Based Compensation NU maintains an Employee Stock Purchase Plan and other long-term, equity-based incentive plans under the Northeast Utilities Incentive Plan (Incentive Plan). NU accounts for... -

Page 64

... receivables to the financial institution under this arrangement qualifies for sale treatment under SFAS No. 140, "Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities - A Replacement of SFAS No. 125." NU Enterprises: SESI has a master purchase agreement with... -

Page 65

... account in the third quarter of 2004 and was refunded to CL&P's customers as a credit on bills from September to December of 2004. X. Marketable Securities NU currently maintains two trusts that hold marketable securities. The trusts are used to fund NU's Supplemental Executive Retirement Plan... -

Page 66

... are recorded in fuel, purchased, and net interchange power on the accompanying consolidated statements of income. The tables below summarize current and long-term derivative assets and liabilities at December 31, 2004 and December 31, 2003. The business activities of NU Enterprises that result in... -

Page 67

... natural gas service agreements with certain customers to supply gas at fixed prices for terms extending through 2006. Select Energy has hedged its gas supply risk under these agreements through NYMEX futures contracts. Under these contracts, which also extend through 2006, the purchase price... -

Page 68

... benefit retirement plan (Pension Plan) covering substantially all regular NU employees. Benefits are based on years of service and the employees' highest eligible compensation during 60 consecutive months of employment. Pre-tax pension expense/(income) was expense of $5.9 million in 2004, income... -

Page 69

...PBOP Plan). These benefits are available for employees retiring from NU who have met specified service requirements. For current employees and certain retirees, the total benefit is limited to two times the 1993 per retiree health care cost. These costs are charged to expense over the estimated work... -

Page 70

...assumptions were used in calculating the plans' year end funded status: Pension Benefits Balance Sheets 2004 At December 31, Postretirement Benefits 2004 2003 2003 Discount rate Compensation/progression rate Health care cost trend rate The components of net periodic (income)/expense are as follows... -

Page 71

... trend rate by one percentage point in each year would have the following effects: (Millions of Dollars) One Percentage Point Increase One Percentage Point Decrease Equity securities: United States Non-United States Emerging markets Private Debt Securities: Fixed income High yield fixed income Real... -

Page 72

... Employee Retirement Income Security Act and Internal Revenue Code. Postretirement health plan assets for non-union employees are subject to federal income taxes. currently evaluating the impact of SFAS No. 123R on the Employee Share Purchase Plan (ESPP) and the Incentive Plan. Management believes... -

Page 73

... NU retirement plan for which a minimum pension liability has been recorded. Recording this minimum pension liability resulted in a reduction of $0.1 million to accumulated other comprehensive income. NU maintains a plan for retirement and other benefits for certain current and past company officers... -

Page 74

... under the Utility Group - gas reportable segment; the merchant energy reporting unit, which is classified under the NU Enterprises - merchant energy reportable segment; and the energy services reporting unit, which is classified under NU Enterprises - services and other. NU has completed its... -

Page 75

... 2004 transition cost reconciliation filing into a single proceeding. The timing of this decision in the combined proceeding is uncertain, but management does not expect the outcome to have a material adverse impact on WMECO's net income or financial position. B. Environmental Matters General: NU... -

Page 76

... contractual commitments related to CL&P's standard offer, PSNH's short-term power supply management or WMECO's standard offer and default service. Natural Gas Procurement Contracts: Yankee Gas has entered into long-term contracts for the purchase of a specified quantity of natural gas in the normal... -

Page 77

... decommissioning. The Yankee Companies collect decommissioning and closure costs through wholesale, FERC-approved rates charged under power purchase agreements with several New England utilities, including NU's electric utility companies CL&P, PSNH and WMECO. These companies in turn pass these costs... -

Page 78

... rates. The wholesale utility customers in turn collect these payments from their retail electric customers. The Yankee Companies' individual damage claims attributed to the government's breach totaling $548 million are specific to each plant and include incremental storage, security, construction... -

Page 79

... 2004 of $49.3 million. For further information regarding these investments, see Note 8, "Marketable Securities," to the consolidated financial statements. Preferred Stock, Long-Term Debt and Rate Reduction Bonds: The fair value of NU's fixed-rate securities is based upon the quoted market price for... -

Page 80

... requirements on debt outstanding at December 31, 2004, for the years 2005 through 2009 and thereafter, are as follows: (Millions of Dollars) NU utilizes the specific identification basis method for the SERP securities and the average cost basis method for the WMECO prior spent nuclear fuel trust... -

Page 81

... The changes in the components of other comprehensive income/(loss) are reported net of the following income tax effects: (Millions of Dollars) 2004 2003 2002 Qualified cash flow hedging instruments Unrealized (losses)/gains on securities Minimum supplemental executive retirement pension liability... -

Page 82

...sold their collective 17 percent ownership interest in VYNPC. CL&P, PSNH and WMECO will continue to buy approximately 16 percent of the plant's output through March 2012 at a range of fixed prices. 15. Segment Information NU is organized between the Utility Group and NU Enterprises businesses based... -

Page 83

.... Utility Group revenues from the sale of electricity and natural gas primarily are derived from residential, commercial and industrial customers and are not dependent on any single customer. The NU Enterprises merchant energy business segment includes Select Energy, NGC, the generation operations... -

Page 84

... 31, 2004 Utility Group Distribution NU Electric Gas Transmission Enterprises Other (Millions of Dollars) Eliminations Totals Operating revenues Depreciation and amortization Other operating expenses Operating income/(loss) Interest expense, net of AFUDC Interest income Other income/(loss), net... -

Page 85

.... NU Enterprises - For the Year Ended December 31, 2004 Merchant Services Energy and Other Totals (Millions of Dollars) Operating revenues Depreciation and amortization Other operating expenses Operating income Interest expense Interest income Other (loss)/income, net Income tax (expense)/benefit... -

Page 86

... balances have been reclassified to conform to the current year's presentation. See reclassification below. For the Year Ended December 31, 2003 Previously As Reported Restated Consolidated Statement of Cash Flows Fuel, purchased and net interchange power Other Maintenance Amortization Income... -

Page 87

... 31, 2004 Operating Revenues Operating Income Net Income/(Loss) Basic and Fully Diluted Earnings/(Loss) Per Common Share 2003 Operating Revenues Operating Income Income/(Loss) Before Cumulative Effect of Accounting Change Cumulative Effect of Accounting Change, Net of Tax Benefit Net Income/(Loss... -

Page 88

... Accounting Changes, Net of Tax Benefits Extraordinary Loss, Net of Tax Benefit Net Income/(Loss) Basic Common Shares Outstanding (Average) Fully Diluted Common Shares Outstanding (Average) Dividends Per Share Market Price - Closing (high) (d) Market Price - Closing (low) (d) Market Price - Closing... -

Page 89

... and eliminations Total Electric Total Gas Total - Utility Group NU Enterprises: Retail Wholesale (a) Generation Services Miscellaneous and eliminations Total - NU Enterprises Other miscellaneous and eliminations Total Utility Group Sales: (kWh - Millions) Residential Commercial Industrial Other... -

Page 90

...cer Northeast Utilities Trustees as of March 15, 2005 Richard H. Booth (1) (2) President and Chief Executive Ofï¬cer, Hartford Steam Boiler Inspection & Insurance Company Electric & Gas Operating Company Officers CL&P - The Connecticut Light and Power Company PSNH - Public Service Company of New... -

Page 91

...and Massachusetts and 194,212 natural gas customers in Connecticut. It is one of the largest competitive energy suppliers in New England. Current NU subsidiaries are listed below: Electric and Gas Operating Subsidiaries The Connecticut Light and Power Company Public Service Company of New Hampshire... -

Page 92

P.O. Box 270 Hartford, Connecticut 06141-0270 1 800.286.5000 www.nu.com