EasyJet 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

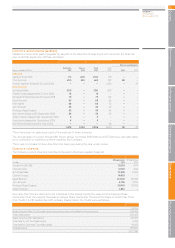

The potential vesting of outstanding awards if the

performance were based on that for the year under

review is as shown at the end of this section.

The performance criteria for vesting of these share

options and awards are as follows:

Long Term Incentive Plan (A)

Awards prior to those made during the year under

review were subject to the achievement of the

following Return on Equity targets:

Grant

date Basis year

Threshold

(25% vests)

Target

(50% vests)

Maximum

(100% vests)

5 July

2010

30 September

2012 9.0% 12.0% 15.0%

5 July

2010

30 September

2012 11.0% 13.0% 15.0%

Straight-line vesting will occur between the threshold,

target and maximum targets set out above.

The targets that applied to the awards of

performance shares made to Executive Directors

during the year under review were subject to the

achievement of the following Return on Capital

Employed targets:

Grant date Basis year

Threshold

(25% vests)

Target

(50% vests)

Maximum

(100% vests)

31 March

2011

30 September

2013 7.0% 8.5% 12.0%

31 March

2011

30 September

2013 10.0% 12.0% 13.0%

The comparison between ROCE and return on equity

depends on the capital structure. At the time that the

latest performance targets were set the same

performance would give rise to an ROCE approximately

two percent lower than return on equity

Matching Share Awards

Directors waived their bonuses for the year ended

30 September 2010, therefore no matching shares were

granted to Executive Directors in the year under review.

ABI Principles of Executive Remuneration

easyJet complies with the ABO Principles of Executive

Remuneration. These principles require that

commitments under all of the Company’s other share

ownership schemes, must not exceed 10% of the

issued share capital in any rolling 10 year period. The

requirement for shares under all current share

incentive schemes, (Long-term Incentive Plan,

Sharesave and Share Incentive Plan) will be satisfied

with shares purchases on the market. The remaining

three million options under the Discretionary Share

Option Schemes, when or if exercised, will continue

to be settled by the issue of new shares.

Potential vesting of outstanding awards

The extent of vesting is difficult to determine because

of the possible effect of economic uncertainty and

external factors of the remaining period to vesting.

On behalf of the Board

Keith Hamill

Remuneration Committee Chairman

14 November 2011

.

If the record financial performance of the year ended

easyJet plc

Annual report

and accounts 2011

GovernanceCorporate responsibility

Business review Performance and risk

Overview Accounts & other information

61

30 September 2013, 54% of the July 2010 grants and

94% of the March 2011 grants would vest. However,

current market forecasts consensus for future

performance would substantially reduce these

estimates the forecast vesting would be

approximately 15% and approximately 75% for the

July 2010 and March 2011 grants respectively.