EasyJet 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 EasyJet annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easyJet plc

Annual report

and accounts 2011

09

Overview Performance and risk Corporate responsibility Governance Accounts & other information

Business review

Chief Executive’s introduction

Introduction

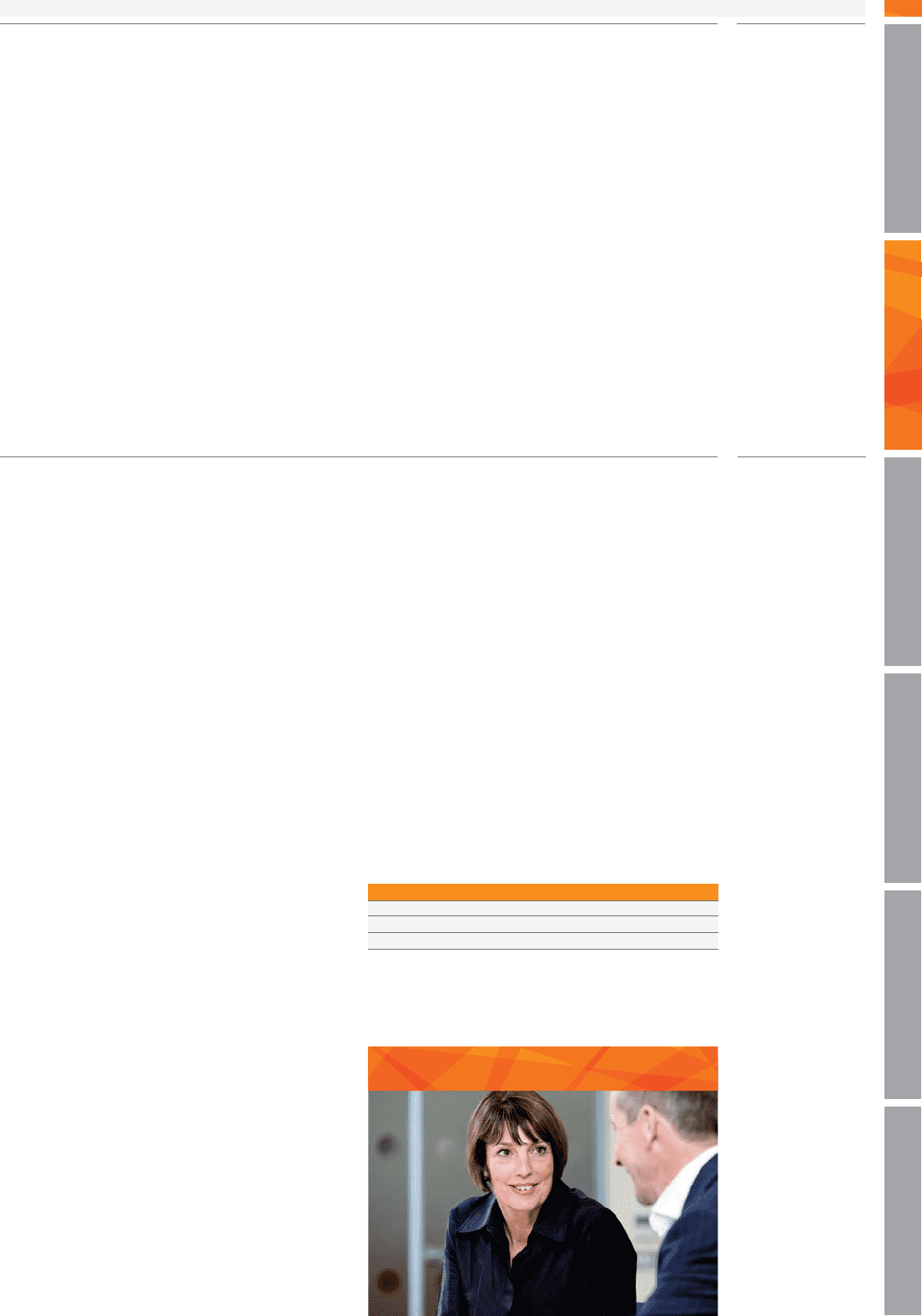

easyJet has made strong progress this year in the

execution of its strategy. Our strong operational and

financial performance is a result of the hard work and

commitment of easyJet’s people to make travel easy

and affordable for customers. The business has

strengthened despite the headwinds of fuel costs,

rising aviation taxes and a weak economy. The

management team has introduced an enhanced focus

on financial discipline, financial return and operational

performance and constantly takes a rigorous look at

the Company’s network and profitability.

Financial performance

easyJet delivered record profit before tax of £248

million up by £60 million from an underlying profit of

£188 million in 2010 despite a £100 million increase in

unit fuel costs. Underlying profit per seat (including fuel,

adjusting for last year’s volcano effect and loss on

disposal of A321 aircraft) rose by 61 pence to £3.97.

Thisstrong performance was driven by:

– Passenger numbers rose 11.8% to 54.5 million and

loadfactor improved by 0.3 percentage points to

87.3%. Passengers originating outside of the UK now

account for 56%, an increase of 3 percentage points

compared to the prior year. Passengers travelling

with easyJet on business increased by almost

onemillion to 9.5 million

– Total revenue per seat up 4.1% (3.4% on a constant

currency basis) to £55.27 as capacity investments

made in 2010 and the first half of 2011 matured,

combined with a strong performance from ancillary

revenue up 12.9% to £11.52 per seat following decisive

management action in the second quarter

– Underlying cost per seat (excluding fuel and currency

movement) fell by 1.3% for the full year and was flat

on a reported basis with strong performances in

ground handling, maintenance and disruption related

costs

easyJet delivered ROCE of 12.7% in the year and

generated cash from operations of £424 million

resulting in net cash as at 30 September 2011 of

£100 million.

Carolyn McCall OBE

Chief Executive

Returns to shareholders

In light of the strong performance of the business over

the past 12 months, management’s current medium–

term expectations for easyJet’s financial performance

and a prudent approach to maintaining balance sheet

strength, the Board has recommended a one-off

return to shareholders, structured as a special dividend,

of £150 million or 34.9 per share. Taken together with

the ordinary dividend of 10.5 pence per share this

provides an estimated total cash return to shareholders

for the year of £195 million or 45.4 pence per share to

be paid on 23 March 2012 to those shareholders on the

register at the close of business on 2 March 2012 with

an ex dividend date of 29 February 2012. The special

dividend will be accompanied by an associated share

consolidation. The consolidation factor will be

announced in due course.

Operational performance

Investment in operational robustness has delivered a

strong improvement in easyJet’s On Time Performance

(OTP) with a 13 percentage point improvement across

the network across the year with an increase of 25% in

the fourth quarter and our performance is now in line

or ahead of our key competitors.

OTP % arrivals within 15 minutes

Q1 Q2 Q3 Q4 Full year

2010 75% 66% 64% 60% 66%

2011 65% 81% 84% 85% 79%

The focus of the operations team in the coming

financial year will be on maintaining the current

performance whilst at the same time reducing cost

through standardisation and simplification.