Duke Energy 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DUKE ENERGY CORPORATION / 2009 ANNUAL REPORT 7

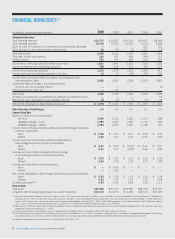

COMPARISON OF 2009 TOTAL SHAREHOLDER RETURN

(12 months ended Dec. 31, 2009)

Our total shareholder return — the change in stock price plus dividends — was up 22 percent for the year. That

compares favorably with the Philadelphia Utility Index (made up of 20 peer companies, including Duke Energy),

which was up only 10 percent in 2009. Over the past three years, Duke Energy has achieved a positive

4 percent shareholder return, while the utility index dropped nearly 5 percent.

people. Even though our injury rate trended to the lowest it’s

ever been, any injuries or fatalities are unacceptable. I have

challenged all of our employees and contractors to redouble

their efforts in this area.

For the fourth year in a row, Duke Energy was named

to the Dow Jones Sustainability Index for North American

companies in the electric utility sector. Early in 2010,

Corporate Knights magazine named us one of the 100 most

sustainable companies in the world. And, in March 2010,

we were named one of the 100 Best Corporate Citizens for

the second consecutive year by Corporate Responsibility

(CR) magazine.

I invite you to review our 2009|2010 Sustainability

Report, available on www.duke-energy.com, to learn more

about our commitment to do business in ways that are good

for people, the planet and profits.

2010 OUTLOOK

In the latter half of 2009, it seemed that the economy might

be stabilizing. However, with double-digit unemployment in

several of our jurisdictions, we expect economic growth for

the next few years to be anemic. Our 2009 year-end results

and our current economic projections lead us to a 2010

earnings outlook range of $1.25 to $1.30 EPS on an adjusted

diluted basis. This range puts us on track to grow long-term

adjusted diluted EPS at a compound annual growth rate of

4 to 6 percent, from a 2009 base year.

In 2010, we will need to fund about $3.5 billion to

complete our construction programs and address the negative

cash flow impacts of the ongoing economic downturn.

Externally, we expect to issue approximately $2.3 billion in

new debt securities and raise approximately $400 million of

new equity through our DRIP and other internal stock plans.

The remainder will come from the utilization of cash we real-

ized from prefunding some of our 2010 financing needs in

2009. The equity we plan to issue will help maintain our

strong balance sheet.

We are committed to growing the dividend, but at a

slower rate than our growth in earnings. Over time, our

payout ratio will trend downward to levels more consistent

with our industry peers. Subject to board approval, we

estimate a 2 percent dividend increase in 2010.

IS THE ENERGY WE PROVIDE AFFORDABLE?

The first question we ask when we consider making a

long-term investment to achieve our mission is: Will it

provide affordable energy for our customers? Given our

long lead times for construction, we must consider both

present and future affordability.

We are investing today in more efficient coal-fired

plants and other technologies to maintain the fuel flexibility

of our generation fleet. This will help to mitigate the impact

of future price spikes for any one fuel, and smooth out

customer bills. Replacing some of our oldest coal-fired

DUKE ENERGY

CORPORATION

PHILADELPHIA STOCK

EXCHANGE UTILITY

SECTOR INDEX

S&P 500

INDEX

22%

10%

26%