Duke Energy 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

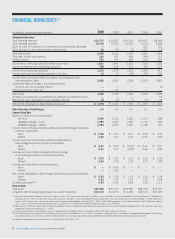

FINANCIAL HIGHLIGHTS( a , b )

4 DUKE ENERGY CORPORATION / 2009 ANNUAL REPORT

(In millions, except per-share amounts) 2009 2008 2007 2006 2005

Statement of Operations

Total operating revenues $12,731 $13,207 $12,720 $10,607 $6,906

Total operating expenses 10,518 10,765 10,222 9,210 5,586

Gains on sales of investments in commercial and multi-family real estate — — — 201 191

Gains (losses) on sales of other assets and other, net 36 69 (5) 223 (55)

Operating income 2,249 2,511 2,493 1,821 1,456

Total other income and expenses 333 121 428 354 217

Interest expense 751 741 685 632 381

Income from continuing operations before income taxes 1,831 1,891 2,236 1,543 1,292

Income tax expense from continuing operations 758 616 712 450 375

Income from continuing operations 1,073 1,275 1,524 1,093 917

Income (loss) from discontinued operations, net of tax 12 16 (22) 783 935

Income before cumulative effect of change in accounting principle

and extraordinary items 1,085 1,291 1,502 1,876 1,852

Cumulative effect of change in accounting principle,

net of tax and noncontrolling interest — — — — (4)

Extraordinary items, net of tax — 67 — — —

Net income 1,085 1,358 1,502 1,876 1,848

Dividends and premiums on redemption of preferred and preference stock — — — — 12

Net income (loss) attributable to noncontrolling interests 10 (4) 2 13 24

Net income attributable to Duke Energy Corporation $ 1,075 $ 1,362 $ 1,500 $ 1,863 $ 1,812

Ratio of Earnings to Fixed Charges 3.0 3.4 3.7 2.6 2.4

Common Stock Data

Shares of common stock outstanding (c)

Year-end 1,309 1,272 1,262 1,257 928

Weighted average — basic 1,293 1,265 1,260 1,170 934

Weighted average — diluted 1,294 1,267 1,265 1,188 970

Income from continuing operations attributable to Duke Energy Corporation

common shareholders

Basic $ 0.82 $ 1.01 $ 1.21 $ 0.92 $ 0.94

Diluted 0.82 1.01 1.20 0.91 0.92

Income (loss) from discontinued operations attributable to

Duke Energy Corporation common shareholders

Basic $ 0.01 $ 0.02 $ (0.02) $ 0.67 $ 1.00

Diluted 0.01 0.01 (0.02) 0.66 0.96

Earnings per share (before cumulative effect of change

in accounting principle and extraordinary items)

Basic $ 0.83 $ 1.03 $ 1.19 $ 1.59 $ 1.94

Diluted 0.83 1.02 1.18 1.57 1.88

Earnings per share (from extraordinary items)

Basic $ — $ 0.05 $ — $ — $ —

Diluted — 0.05 — — —

Net income attributable to Duke Energy Corporation common shareholders

Basic $ 0.83 $ 1.08 $ 1.19 $ 1.59 $ 1.94

Diluted 0.83 1.07 1.18 1.57 1.88

Dividends per share (d) 0.94 0.90 0.86 1.26 1.17

Balance Sheet

Total assets $57,040 $53,077 $49,686 $68,700 $54,723

Long-term debt including capital leases, less current maturities $16,113 $13,250 $ 9,498 $18,118 $14,547

(a) Significant transactions reflected in the results above include: 2009 impairment of goodwill and other assets (see Note 11 to the Consolidated Financial Statements, “Goodwill and

Intangible Assets”), 2007 spinoff of the natural gas businesses (see Note 1 to the Consolidated Financial Statements, “Summary of Significant Accounting Policies”), 2006 merger with

Cinergy, 2006 Crescent joint venture transaction and subsequent deconsolidation effective Sept. 7, 2006, 2005 DENA disposition, 2005 deconsolidation of DCP Midstream effective

July 1, 2005, and 2005 Duke Energy Field Services, LLC (DEFS) sale of Texas Eastern Products Pipeline Company, LLC (TEPPCO).

(b) Periods prior to 2009 have been recast to reflect the adoption of the noncontrolling interest presentation provisions of Accounting Standards Codification 810 – Consolidation, which was

adopted by Duke Energy effective Jan. 1, 2009.

(c) 2006 increase primarily attributable to issuance of approximately 313 million shares in connection with Duke Energy’s merger with Cinergy.

(d) 2007 decrease due to the spinoff of the natural gas businesses to shareholders on Jan. 2, 2007, as dividends subsequent to the spinoff were split proportionately between Duke Energy

and Spectra Energy, such that the sum of the dividends of the two stand-alone companies approximated the former total dividend of Duke Energy prior to the spinoff.

See Notes to Consolidated Financial Statements in Duke Energy’s 2009 Form 10-K.