Duke Energy 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 DUKE ENERGY CORPORATION / 2009 ANNUAL REPORT

LETTER TO STAKEHOLDERS (CONTINUED)

In January 2010, we announced our first commercial

photovoltaic solar venture, the Blue Wing Solar Project in

San Antonio, Texas. This 14-MW, 139-acre solar photovoltaic

farm includes a 30-year power purchase agreement with

San Antonio-based CPS Energy, one of the largest municipal

utilities in the United States. Our solar strategy also involves

joint development of commercial projects in the United States

with China-based ENN Group.

Last year, the U.S. Department of Energy awarded us a

matching grant worth $22 million to design, build and install

one of the nation’s first demonstrations of energy storage at

our 153-MW Notrees wind farm in Texas. If it proves to be

cost-effective, we could adopt similar storage solutions at

some of our other power plants.

Also in 2009, ADAGE, the biopower company we own

with AREVA, began the permitting process to build two

55-MW carbon-neutral biomass plants in Florida that will

generate electricity by burning wood waste. In early 2010,

ADAGE and John Deere announced an alliance for collecting,

bundling and transporting wood debris from regional logging

operations in western Washington to fuel a proposed 55-MW

biomass power plant in that region.

Finally, we became the lead investor in GreenTrees,

a program that aims to offset carbon emissions through the

reforestation of 1 million acres in the southeastern United

States. Our initial investment funded the planting of more

than 1 million trees on approximately 1,700 acres

in Arkansas.

WHAT IF WE’RE WRONG ABOUT CLIMATE CHANGE?

I have described our strategy for providing our customers with

affordable, reliable and cleaner energy.

But what if we’re wrong about the imperative to reduce

CO2 and other greenhouse gas emissions? That is the subject

of a high-profile debate, as the integrity of scientific research

supporting the threat of climate change continues to

be scrutinized.

I have thought about this long and hard. What if we

are dead wrong? Would the course we’ve charted for our

company and our customers be misguided? Would we

change our plans if it were unlikely that Congress or the

EPA would ever regulate carbon emissions?

My answer is “no.”

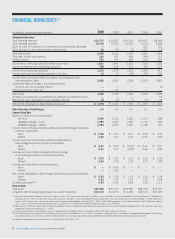

A: Our financial objectives include

growing our earnings and dividends,

allocating capital efficiently and

earning competitive returns, while

maintaining the strength of our balance

sheet. Our financial strategy supports

our historical focus of providing

affordable, reliable and increasingly

clean energy to our customers, while

earning good returns for our investors.

Q: How do you balance short-term

economic pressures with the long-term

investments needed to meet the needs

of your customers, and achieve

business growth?

A: We achieve that balance by

maintaining flexibility in our allocation

and spending of capital. In 2010,

about $3 billion is committed to

building our two cleaner-coal plants

and two gas plants in our regulated

operations, and renewable wind

and solar projects being built under

long-term contracts in our commercial

businesses. About $2 billion is

allocated for customer additions

and maintenance costs. In the short

term, we have some flexibility on

the timing of this spend.

We have the greatest flexibility

in allocating our discretionary capital.

Our 2010 plan includes $200 million

of growth capital that has not yet

been designated to specific projects.

Additionally, we have broad ranges

for discretionary spending in 2011

and 2012, the years in which we will

be deploying more capital to complete

the fleet and grid modernization

projects in our regulated operations.

As we demonstrated in 2009, we

have the flexibility to increase or

decrease this discretionary spending

as the environment dictates.

STRATEGIC FOCUS FINANCIAL STRENGTH

Q: How will Duke Energy maintain its financial strength?