Duke Energy 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6 DUKE ENERGY CORPORATION / 2009 ANNUAL REPORT

LETTER TO STAKEHOLDERS (CONTINUED)

Our strategies are clear:

Modernize our facilities to repower the regions we serve,

■

improve reliability, create new jobs and reduce our

environmental impact.

Execute on a new regulatory model for energy efficiency

■

to help our customers save money and make the

communities we serve more energy efficient.

Keep our commercial businesses profitable and

■

focused on earning solid economic returns.

Engage on the front lines of the climate change, ■

energy and environmental debates to help protect

the interests of our stakeholders, especially our

customers and investors.

The table on pages 2 and 3 of this report summarizes

our strategic initiatives, which I discuss in greater detail

below. Some of these are early-stage initiatives designed to

create options, such as our ongoing efforts to expand energy

efficiency. Some remain central to our strategy regardless

of what happens, such as modernizing our generation fleet

and our grid, and expanding our renewable energy portfolio.

Finally, other initiatives, such as our proposed nuclear

plant projects, have a longer time frame. To succeed in

these efforts, we must be alert to changes that may require

course adjustments.

2009 RESULTS

Last year was difficult for both our customers and our

industry. On a weather-normalized basis, our customers’

demand for power was down approximately 4 percent,

primarily due to declines in manufacturing load. Cooler

summers in both the Midwest and the Southeast also

reduced electricity demand.

We can’t control the economy or the weather, so

throughout the year, we focused on what we could control.

We aggressively managed our costs — reducing our

planned operating and maintenance expenses by more

than $150 million, exceeding our $100 million target.

Our regulated operations also maintained high

operational performance. Our nuclear fleet had one of the

best years in its history, and our fossil plants had their best

year for availability and reliability in 10 years.

Our commercial businesses include our growing

renewable energy portfolio, our international assets in Latin

America, our competitive fossil generation and retail sales

business in Ohio, and our natural gas generation in the

Midwest. Last year, in total, our commercial businesses

increased both earnings and cash flows.

In our renewables business, we added just over 360 MW

of wind power and ended 2009 with approximately 735 MW

in commercial operation. In Latin America, our 4,000 MW

of highly contracted hydroelectric and gas plants generated

strong cash flows and earnings.

In Ohio, the recession drove down wholesale power

prices, and competitors set out to undercut our locked-in

rates. We met this challenge by launching a strategy to

attract customers seeking competitive suppliers with our

own competitive retail supplier, Duke Energy Retail Sales.

As you would expect, this required us to reduce our margins

in order to retain some of our customers. In 2010, we will

continue our efforts to mitigate customer switching, as

well as position and maximize the value of our Ohio and

Midwest businesses in the wholesale generation market.

With our sizable investments to modernize our energy

infrastructure, capital is our lifeblood. Thanks to our strong

balance sheet, we had remarkable access to the capital

markets. We issued $3.75 billion of fixed-rate debt at an

average 5.2 percent interest rate in 2009. Over the past

two years, we issued more than $7 billion of fixed-rate

debt at favorable rates and terms, and $600 million of equity

through our dividend reinvestment plan (DRIP) and other

internal plans. At year-end, our debt to total capitalization

ratio was 44 percent, and we maintained our investment-

grade corporate credit ratings.

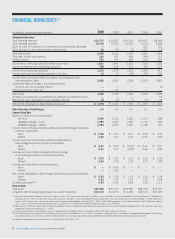

Due to our employees’ extraordinary efforts last year,

we exceeded our 2009 employee incentive target by

2 cents, earning $1.22 per share on an adjusted diluted

basis. Reported diluted earnings per share (EPS) were

83 cents for 2009.

Our total shareholder return — the change in stock

price plus dividends — was up 22 percent for the year.

That compares favorably with the Philadelphia Utility Index

(made up of 20 peer companies, including Duke Energy),

which was up only 10 percent in 2009. Over the past

three years, Duke Energy has achieved a positive 4 percent

shareholder return, while the utility index dropped nearly

5 percent.

Even though our adjusted earnings have been essentially

flat over the last three years, we grew our dividend an average

of approximately 4 percent each year during this period.

The one area where we didn’t meet expectations is

employee and contractor safety. After a fatality-free 2008,

we suffered three contractor deaths in 2009. This reminds

us of the hazards involved in bringing energy to millions of