Duke Energy 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DUKE ENERGY CORPORATION / 2009 ANNUAL REPORT 3 2 DUKE ENERGY CORPORATION / 2009 ANNUAL REPORT

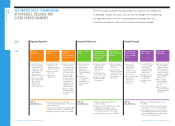

OUR STRATEGIC FOCUS – 2010 AND BEYOND

AFFORDABLE, RELIABLE AND

CLEAN ENERGY MANDATE

These two pages illustrate how we provide our customers with energy that

is affordable, reliable and clean. You can see our strategies for modernizing

our regulated facilities and for maximizing diverse earnings from our

commercial businesses, which lead to enhanced financial strength.

Regulated Operations Commercial Businesses Financial Strength

STRATEGIC

FOCUS

ACTIONS Modernize

infrastructure

Maintain operational

excellence

Shape federal and

state policies;

achieve constructive

regulatory outcomes

Compete effectively

in Ohio

Grow renewables

and underpin with

long-term contracts;

shape federal and

state policies

Reinvest offshore

cash in international

businesses

Allocate and rotate

capital efficiently

to earn competitive

returns

Maintain a strong

balance sheet

Grow earnings

and dividends

Achieved nonfuel base-rate increase ■

settlements in North Carolina, South Carolina,

Ohio and Kentucky

Energy efficiency framework approved in Ohio, ■

North Carolina, South Carolina and Indiana

Deploying smart grid in Ohio in early 2010 ■

Retained margin in Ohio with retail ■

customer strategy

Added more than 360 MW of wind energy ■

in 2009, and ended the year with

approximately 735 MW of wind power

in commercial operation in three states

Acquired first solar project in early 2010 ■

Grew dividend approximately 4 percent ■

in 2009

Issued $3.75 billion of fixed-rate debt at an ■

average rate of 5.2 percent during 2009

Since 2008, issued more than $7 billion of ■

fixed-rate debt at attractive rates and terms,

and issued $600 million in equity through

DRIP and other internal plans

2009 and

Early 2010 Progress

2009 and

Early 2010 Progress

2009 and

Early 2010 Progress

Retire and replace ■

older fossil generat-

ing units with new,

cleaner-coal, lower-

emitting gas units

and renewable

energy to meet

future peak demand

Replace analog grid ■

with a digital smart

grid to increase

reliability and

energy efficiency,

and to reduce costs

Maintain the high ■

reliability of our

generation fleet and

distribution system

Improve customer ■

satisfaction

Aggressively ■

manage costs

Achieve timely and ■

constructive recov-

ery of investments,

and close the gap

between allowed

and earned returns

Leverage energy ■

efficiency frame-

work that allows us

to earn returns on

energy efficiency

investments, reduc-

ing the need for

new power plants

Achieve workable ■

federal legislation

to regulate carbon

emissions

Use Duke Energy ■

Retail Sales

defensively and

offensively to

mitigate impact of

customer switching

in Ohio

Continue to ■

optimize Midwest

coal and gas

generation assets

in the wholesale

market

Bring approximately ■

250 megawatts

(MW) of wind

energy on line

each year

Expand into solar ■

and biomass energy

Achieve and utilize ■

federal and state

tax incentives

Maintain earnings ■

diversity and steady

cash flows

Grow these busi- ■

nesses by investing

in projects that fit

our business model

and our return

expectations

Deploy capital ■

to maintain an

approximately

75 percent

regulated, 25 per-

cent commercial

business mix

Achieve appropriate ■

risk-adjusted

returns in our

commercial

businesses

Issue $400 million ■

in equity in 2010

from dividend

reinvestment plan

(DRIP) and other

internal plans

Maintain current ■

investment-grade

credit ratings

Maintain strong ■

liquidity

Achieve a long-term ■

adjusted diluted

earnings per share

(EPS) compound

annual growth rate

of 4 to 6 percent

off a base of 2009

adjusted diluted

EPS of $1.22

Achieve 2010 ■

adjusted diluted

EPS of $1.25 to

$1.30

Grow dividend at a ■

rate slower than the

growth in adjusted

diluted EPS

OUR STRATEGIC FOCUS

FOLDOUT