Duke Energy 2009 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2009 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 DUKE ENERGY CORPORATION / 2009 ANNUAL REPORT

STRATEGIC FOCUS COMMERCIAL BUSINESSES

Our smart grid is also critical for meeting the power

needs of plug-in hybrid electric and all-electric vehicles.

To better understand these game-changing technologies,

we are joining FPL Group to invest a combined $600 million

with the goal that 100 percent of all new fleet vehicles

purchased will be plug-in electric vehicles or plug-in hybrid

electric vehicles by 2020. We also foresee great potential

for job creation, as our nation builds the new recharging

infrastructure for these vehicles.

Through the end of 2009, we had invested

approximately $90 million to deploy limited-scale smart

grid projects. We continue to pursue smart grid deployments

in North Carolina, South Carolina, Kentucky and Indiana.

In December 2008, we received approval from the Public

Utilities Commission of Ohio to move forward with full-scale

deployment. After conducting successful pilot programs

in 2009, we expect to install 140,000 smart electric and

gas meters and other associated technologies in 2010.

Our Ohio deployment will grow to more than 1 million smart

meters and other components installed over the next five

years. We are recovering these investments through an

annual rate tracker in Ohio.

In 2009, the U.S. Department of Energy (DOE)

awarded us $200 million under the American Recovery

and Reinvestment Act to support our smart grid projects

in the Midwest, and another $4 million toward our

smart grid efforts in the Carolinas. We continue to work

with the DOE on finalizing the terms of the grant contract.

LETTER TO STAKEHOLDERS (CONTINUED)

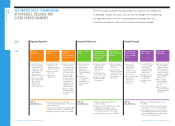

A: Our commercial businesses

consist of: Midwest Generation,

Renewables and Duke Energy

International (DEI). Combined,

these businesses provide diverse

geographic, technological and fuel-

sourcing advantages. This diversity

is key to generating strong cash

flows and earnings.

Q: What is the Midwest Generation

strategy?

A: Midwest Generation includes

about 4,000 megawatts (MW) of

predominantly coal-fired generation

plants that currently are dedicated to

Duke Energy Ohio customers, and

about 3,600 MW of gas-fired plants

located in Ohio and other Midwestern

states that serve wholesale markets.

This is a mature business that has

historically provided good cash flows

and earnings.

In Ohio, generation is deregu-

lated, which allows retail customers

to switch to alternative suppliers. In

2009, we mitigated this threat by

launching a strategy to attract custom-

ers through our own retail supplier.

We expect this business to continue

focusing on producing strong cash

flows and solid returns. We don’t

anticipate investing growth capital in

this business over the next several

years, and we’ll carefully manage our

operating and maintenance expenses.

Q: What is the Renewables strategy?

A: We launched our Renewables

business in 2007 with investments

in wind energy. We now have

approximately 735 MW of operating

wind projects in Texas, Wyoming and

Pennsylvania, and we expect to have

nearly 1,000 MW of commercial wind

power in operation by the end of

2010. Over the past two years,

we have created solar photovoltaic,

biomass and commercial transmission

businesses. Like our wind business,

the output from these projects will be

highly contracted with creditworthy

partners. Near-term growth in

renewables will be driven by favorable

federal and state public policy,

including renewable portfolio

standards and tax credits.

Q: What is the International strategy?

A: DEI consists of predominantly

hydroelectric generation assets in

Brazil, and a combination of hydro

and fossil generation in Peru and

other Latin American countries. DEI

provides diverse and consistent earn-

ings growth. Our strategy is to reinvest

internally generated capital into growth

projects that fit our business model

and meet our return expectations.

Q: What is the value proposition for your commercial businesses, and how do they grow

earnings and cash flow?