Dick's Sporting Goods 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Dick's Sporting Goods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

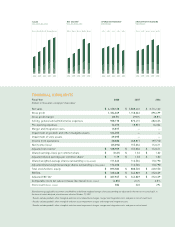

In total, our overall sales increased 6% to $4.1 billion driven b

y

the addition of 43 Dick’s

S

porting

G

oods stores, 1

0

G

olf

G

alaxy stores, and 15

C

hick’s

S

porting

G

ood’s stores,

which were included for a full year of sales followin

g

our acquisition of the stores in

November 2007. Despite a 4.8

%

decline in our full year comparable sales, we were able

to end the year with no borrowin

g

s under our $440 million line of credit facility and

reduce our average borrowings during the year by 20

%

.

To accomplish this, we had to be proactive and acknowled

g

e that we were in a very

di

ff

erent world. We worked with both our valued branded suppliers as well as our

overseas manufacturin

g

partners to reduce our inventory. At the end of the year, our

inventory was down 1

3

.9

%

on a consolidated basis and down 12.7

%

for Dick’s Sporting

Goods stores only. Our team was able to accom

p

lish this monumental feat while still

i

ncreas

i

ng our merchand

i

se marg

i

n by 16 bas

i

s po

i

nts and ma

i

nta

i

n

i

ng strong relat

i

onsh

i

ps

with our key vendors.

O

ur inventory level and the quality of that inventory allowed us to

be in a position to take advanta

g

e of off-price opportunities from our suppliers and deliver

great promot

i

onal values to our customers

.

O

ur growth for the foreseeable future should be viewed as organic; although, we may look

at opportunistic acquisitions as they become available. We ended the year with

3

84 Dick’s

Sportin

g

Goods stores, 89 Golf Galaxy stores, and 14 Chick’s Sportin

g

Goods stores.

During the year, we added 4

3

Dick’s Sporting Goods stores, approximately

3

5

%

of which

were in new markets while the balance helped fi ll in existin

g

markets.

J

effre

y

R. Hennion

E

x

ecu

tiv

e

Vi

ce

Pr

es

i

de

nt

&

C

hief Marketing Offi cer

L

ee J. Belitsk

y

Senior Vice President –

D

istribution

&

Transportation

K

athryn L.

S

utter

Se

ni

o

r Vi

ce

Pr

es

i

de

nt –

H

uman Resource

s

E

dward W. Stack

C

hairman

,

C

hief Executive

O

ffi ce

r

&

President

J

ose

p

h H.

S

chmidt

E

xecutive Vice President of O

p

erations

&

C

hief

O

perating

O

ffi ce

r

G

wendolyn K. Mant

o

E

x

ecu

tiv

e

Vi

ce

Pr

es

i

de

nt

&

C

hief Merchandisin

g

Offi cer

M

att

h

ew

J

.

Ly

nc

h

Se

ni

o

r Vi

ce

Pr

es

i

de

nt

&

C

hief Information Offi cer

T

imoth

y

E. Kullma

n

E

xecutive Vice President

,

F

inance

,

Administration

&

C

hief Financial Offi cer

2008 MANAGEMENT TEAM

( left to right )

NE DICK’S SPORTING GOODS, INC. 2008 ANNUAL REPORT 3