Dell 1997 Annual Report Download - page 42

Download and view the complete annual report

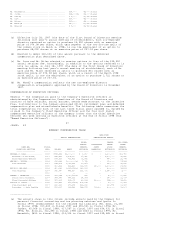

Please find page 42 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Paul O. Hirschbiel, Jr...................................... 203,424(c)(f) *

Michael H. Jordan........................................... 435,200(c) *

Thomas W. Luce III.......................................... 1,120(c) *

Klaus S. Luft............................................... 201,600(c) *

Claudine B. Malone.......................................... 108,000(c) *

Alex J. Mandl............................................... 0 *

Michael A. Miles............................................ 399,958(c)(g) *

Morton L. Topfer............................................ 964,914(c)(h) *

Kevin B. Rollins............................................ 538,322(c) *

Thomas J. Meredith.......................................... 1,402,983(c)(i) *

Phillip E. Kelly............................................ 225,926(c) *

Directors and executive officers as a group (24 persons).... 110,123,270(c) 17.1%

---------------

* Less than 1%.

(a) As of March 31, 1998, unless otherwise indicated.

(b) Based on the number of shares outstanding (640,316,904) at the close of

business on March 31, 1998, unless otherwise indicated.

(c) Includes the following number of shares subject to options that were

exercisable at or within 60 days after March 31, 1998: Mr. Dell, 1,232,000;

Mr. Carty, 235,200; Mr. Hirschbiel, 110,400; Mr. Jordan, 355,200; Mr. Luce,

1,120; Mr. Luft, 201,600; Ms. Malone, 48,000; Mr. Miles, 202,720; Mr.

Topfer, 309,388; Mr. Rollins, 536,000; Mr. Meredith, 556,187; Mr. Kelly, 0;

and all directors and executive officers as a group, 4,503,358. Also

includes the following number of shares held for the person's account in the

Company-sponsored 401(k) retirement savings plan: Mr. Dell, 24,830; Mr.

Topfer, 4,190; Mr. Rollins, 458; Mr. Meredith, 9,456; Mr. Kelly, 2,958; and

all directors and executive officers as a group, 66,454.

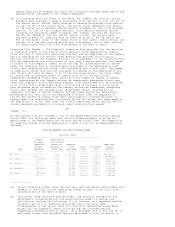

(d) Does not include 1,620,000 shares held in a trust of which Mr. Dell is the

grantor, 1,520,000 shares held in a trust of which Mr. Dell's spouse is the

grantor or 10,112,128 shares held by Mr. Dell's spouse.

(e) Based on a Schedule 13G filed with the Securities and Exchange Commission on

February 13, 1998 and reflecting ownership of common stock, and the

percentage of shares outstanding, as of December 31, 1997. The following

information is taken from that filing. The Schedule 13G was filed by The

Equitable Companies Incorporated ("Equitable"); AXA-UAP, which beneficially

owns a majority interest in Equitable; and Alpha Assurances Vie Mutuelle,

AXA Assurances I.A.R.D. Mutuelle, AXA Assurances Vie Mutuelle and AXA

Courtage Assurance Mutuelle, as a group (collectively, the "Mutuelles AXA"),

which beneficially own a majority interest in AXA-UAP. The reporting persons

reported (1) deemed sole voting power over 18,866,442 shares, (2) deemed

shared voting power over 5,684,760 shares, (3) deemed sole investment power

over 35,908,752 shares and (4) deemed shared investment power over 16,910

shares. Alliance Capital Management L.P., a subsidiary of Equitable was

reported as the deemed holder of sole voting power over 18,712,642 of such

shares, shared voting power over 5,684,760 of such shares, sole investment

power over 35,908,752 of such shares and shared investment power over 7,260

of such shares.

(f) Includes 5,760 shares held in family trusts of which Mr. Hirschbiel is the

trustee.

53

<PAGE> 55

(g) Includes 40,000 shares held by Mr. Miles' spouse and 1,238 shares held

through the Company's deferred compensation plan for non-employee directors.

(h) Includes 32,368 shares held by a family limited partnership of which Mr.

Topfer is the general partner.

(i)Includes 636,220 shares held by a grantor trust of which Mr. Meredith is the

trustee and Mr. Meredith and members of his family are the beneficiaries.

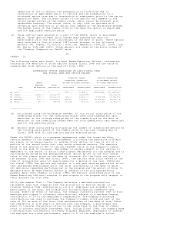

ITEM 13 -- CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Thomas W. Luce III, a director of the Company, is affiliated with the law firm

of Hughes & Luce, L.L.P., Dallas, Texas, which provided certain legal services

to the Company during fiscal 1998. The dollar amount of fees that the Company

paid to that firm during fiscal 1998 did not exceed 5% of that firm's gross

revenues for its last full fiscal year.

PART IV

ITEM 14 -- EXHIBITS, FINANCIAL STATEMENT SCHEDULES AND REPORTS ON FORM 8-K

FINANCIAL STATEMENTS

The following financial statements are filed as a part of this Report under