Dell 1997 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.estimates presented herein are not necessarily indicative of the amounts that

the Company could realize in a current market exchange. Changes in assumptions

could significantly affect the estimates.

Cash, accounts receivable, accounts payable and accrued and other liabilities

are reflected in the financial statements at fair value because of the

short-term maturity of these instruments.

27

<PAGE> 29

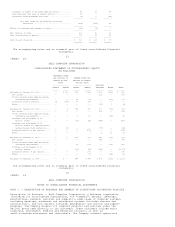

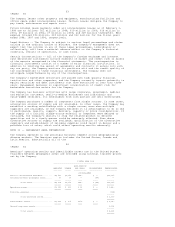

MARKETABLE SECURITIES

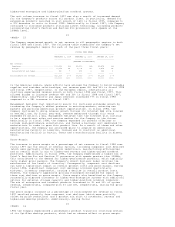

The following table summarizes by major security type the fair value of the

Company's holdings of marketable securities.

FEBRUARY 1, FEBRUARY 2,

1998 1997

----------- -----------

(IN MILLIONS)

Preferred stock............................................. $ 172 $ 172

Mutual funds, principally invested in debt securities....... 800 182

Debt securities:

State and municipal securities............................ 190 317

U.S. corporate and bank debt.............................. 307 415

U.S. government and agencies.............................. 40 98

International corporate and bank debt..................... 15 53

------ ------

Total debt securities....................................... 552 883

------ ------

Total marketable securities....................... $1,524 $1,237

====== ======

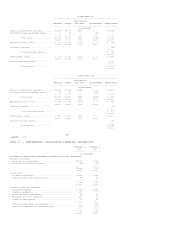

At February 1, 1998 and February 2, 1997, the cost of marketable securities

approximates fair value. At February 1, 1998, debt securities with a carrying

amount of $414 million mature within one year; the remaining debt securities

mature within three years. The Company's gross realized gains and losses on the

sale of marketable securities for fiscal years 1998, 1997 and 1996 were not

material.

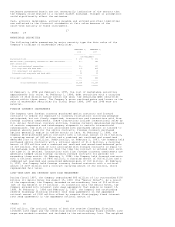

FOREIGN CURRENCY INSTRUMENTS

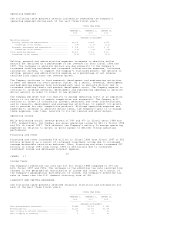

The Company uses foreign currency purchased option contracts and forward

contracts to reduce its exposure to currency fluctuations involving probable

anticipated, but not firmly committed, transactions and transactions with firm

foreign currency commitments. These transactions include international sales by

U.S. dollar functional currency entities, foreign currency denominated purchases

of certain components and intercompany shipments to certain international

subsidiaries. The risk of loss associated with purchased options is limited to

premium amounts paid for the option contracts. Foreign currency purchased

options generally expire in twelve months or less. At February 1, 1998, the

Company held purchased option contracts with a notional amount of $2.0 billion,

a carrying amount of $69 million and a combined net realized and unrealized

deferred loss of $2 million. Additionally, at February 2, 1997, the Company held

purchased option contracts with a notional amount of $1.2 billion, a carrying

amount of $33 million and a combined net realized and unrealized deferred gain

of $25 million. The risk of loss associated with forward contracts is equal to

the exchange rate differential from the time the contract is entered into until

the time it is settled. Transactions with firm foreign currency commitments are

generally hedged using foreign currency forward contracts for periods not

exceeding three months. At February 1, 1998, the Company held forward contracts

with a notional amount of $800 million, a carrying amount of $26 million and a

combined net realized and unrealized deferred gain of $10 million. At February

2, 1997, the Company held foreign currency forward contracts with a notional

amount of $207 million and a contract carrying amount of $12 million, which

represented fair value.

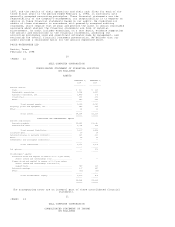

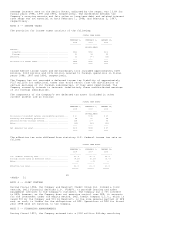

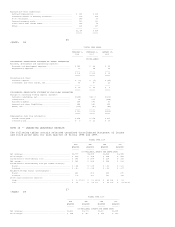

LONG-TERM DEBT AND INTEREST RATE RISK MANAGEMENT

During fiscal 1997, the Company repurchased $95 million of its outstanding $100

million 11% Senior Notes Due August 15, 2000 (the "Senior Notes"). As a result

of the repurchase, the Company recorded an extraordinary loss of $13 million

(net of tax benefit of $7 million). In connection with the Senior Notes, the

Company entered into interest rate swap agreements that expire on August 15,

1998. At February 1, 1998 and February 2, 1997, the Company had outstanding

receive fixed/pay floating interest rate swap agreements in the aggregate

notional amount of $100 million offset by receive floating/pay fixed interest

rate swap agreements in the aggregate notional amount of

28

<PAGE> 30

$100 million. The notional amount of both the receive fixed/pay floating

interest rate swaps and the offsetting receive floating/pay fixed interest rate

swaps was marked-to-market and included in the extraordinary loss. The weighted