Dell 1997 Annual Report Download - page 35

Download and view the complete annual report

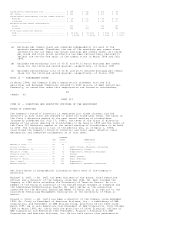

Please find page 35 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Claudine B. Malone, a non-employee director of the Company, failed to report on

her Form 4 for the month of September 1997 a sale of 28,800 (prior to the March

1998 split) shares of the Company's common stock that occurred on September 5,

1997. This failure was inadvertent, and the transaction has now been reported on

Ms. Malone's Form 5 filed with respect to fiscal 1998. This was the only

transaction that was not timely reported.

44

<PAGE> 46

ITEM 11 -- EXECUTIVE COMPENSATION

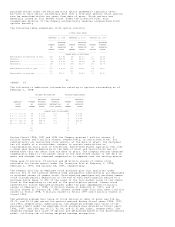

All common stock information has been adjusted to take into account the

two-for-one split of the common stock paid in July 1997 and the two-for-one

split of the common stock paid in March 1998.

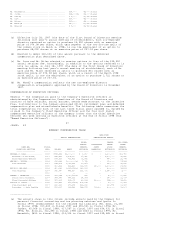

COMPENSATION OF DIRECTORS

The following is a description of the compensation arrangements for the

Company's non-employee directors. The compensation arrangements for the

non-employee directors are based on a "Service Year," which is the annual period

commencing at an annual meeting of the Company's stockholders and ending at the

next annual meeting of stockholders. Mr. Dell, who is the only director who is

also an employee of the Company, does not receive any additional compensation

for serving on the Board of Directors.

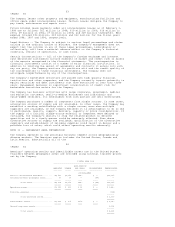

Annual Cash Payments -- Currently, each non-employee director (other than Mr.

Mandl) receives an annual retainer fee of $30,000 and an additional $1,000 for

each Board of Directors meeting attended in person. In November 1997, the Board

of Directors changed its non-employee director compensation arrangement,

increasing the annual retainer fee to $40,000 and eliminating the $1,000 meeting

fees. Any new non-employee director whose term begins during a Service Year will

be entitled to the full amount of the annual retainer fee if 50% or more of the

scheduled Board of Directors meetings for that Service Year are scheduled to

occur after the director's election; otherwise, the new non-employee director is

entitled to receive 50% of the annual retainer fee for that Service Year. The

annual retainer fee for a Service Year is payable at the first Board of

Directors meeting during the Service Year. For all non-employee directors other

than Mr. Mandl, this new arrangement will be effective for the Service Year that

begins in 1998 and for subsequent Service Years. Mr. Mandl, who was appointed to

the Board of Directors in November 1997, at the same time that the new

compensation arrangement was approved, is currently being compensated based on

the new arrangement.

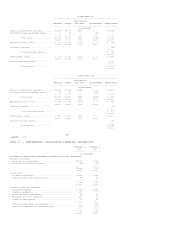

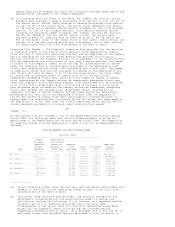

The Company maintains a deferred compensation plan for the non-employee

directors, pursuant to which the directors may elect to defer all or a portion

of their annual retainer fees. A director's deferred amounts are allocated by

the director to various investment funds and, along with any earnings, are

payable to the director upon termination of service as a member of the Board of

Directors or to the director's named beneficiary in the event of death.

Distribution of the deferred amounts and any earnings may be made, at the

election of the participating director, in a lump sum or in annual, quarterly or

monthly installments over a period of up to ten years.

A non-employee director may elect to receive an option to purchase the Company's

common stock in lieu of all or a portion of the annual retainer fee. The option

is granted on the date the annual retainer fee would otherwise have been paid.

The number of shares subject to the option is determined by dividing the amount

of the annual retainer fee subject to the election by the value of an option for

one share of common stock (calculated pursuant to the Black-Scholes model). The

exercise price of the option is the average of the high and low reported sales

price of the Company's common stock on the date of grant. The option vests and

becomes exercisable with respect to 20% of the shares on each of the first five

anniversaries of the date of grant and terminates on the tenth anniversary of

the date of grant.

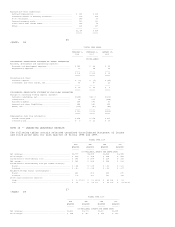

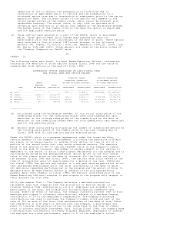

Option Awards -- As noted above, the Board of Directors changed its non-employee

director compensation arrangements in November 1997. Prior to that change,

non-employee directors were entitled to receive an initial option award covering

a specified number of shares of the Company's common stock upon election to the

Board of Directors and an annual option award covering a specified number of

shares for each year of service. The Company's Incentive Plan, which was

approved by the stockholders in June 1994 and which specified the compensation

arrangements for non-employee directors, originally provided that the

non-employee directors' initial option award was to cover 15,000 shares of

common stock and that each annual award was to cover 6,000 shares. The Incentive

Plan also provided, however, that those numbers were to be adjusted to take

45

<PAGE> 47

stock splits into account. As a result of adjustments for the two-for-one split

of the common stock paid in October 1995 and the two-for-one split of the common

stock paid in December 1996, the size of the initial and annual option awards

had grown to 60,000 shares and 24,000 shares, respectively. After the

announcement of an additional two-for-one split of the common stock in May 1997