Dell 1997 Annual Report Download - page 24

Download and view the complete annual report

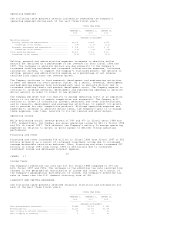

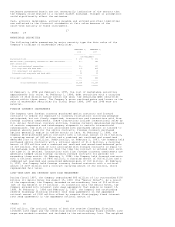

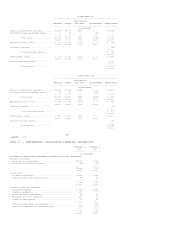

Please find page 24 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.credit facility and a $150 million 3-year revolving credit facility. During

fiscal 1998, the Company replaced the two separate facilities with one $250

million 5-year revolving credit facility. Additionally during fiscal 1996, the

Company entered into a transaction that gives the Company the ability to raise

up to $150 million through a receivables securitization facility. Commitment

fees for each of these facilities are paid quarterly and are based on specific

liquidity requirements. Commitment fees paid in both fiscal 1998 and 1997 were

not material to the Company. At both February 1, 1998 and February 2, 1997,

these facilities were unused.

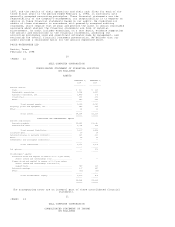

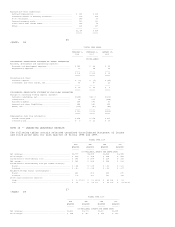

NOTE 6 -- PREFERRED STOCK

The Company has the authority to issue 5 million shares of preferred stock, par

value $.01 per share.

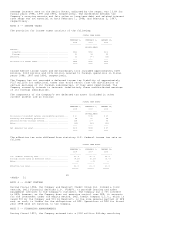

Series A Convertible Preferred Stock -- During fiscal 1996, the Company offered

to pay a cash premium of $8.25 for each outstanding share of Series A

Convertible Preferred Stock that was converted to common stock. Holders of 1

million shares of Series A Convertible Preferred Stock elected to convert and,

as a result, received an aggregate of approximately 20 million shares of common

stock and $10 million in cash during fiscal 1996. During fiscal 1997, the

remaining 60,000 shares of Series A Convertible Preferred Stock were converted

into common stock in accordance with their terms, resulting in the issuance of

an additional 1 million shares of common stock.

Series A Junior Participating Preferred Stock -- In conjunction with the

distribution of Preferred Share Purchase Rights (see Note 9 -- Preferred Share

Purchase Rights), the Company's Board of Directors designated 200,000 shares of

preferred stock as Series A Junior Participating Preferred Stock ("Junior

Preferred Stock") and reserved such shares for issuance upon exercise of the

Preferred Share Purchase Rights. At February 1, 1998 and February 2, 1997, no

shares of Junior Preferred Stock were issued or outstanding.

NOTE 7 -- COMMON STOCK

Authorized Shares -- During fiscal 1998, the Company's stockholders approved an

increase in the number of authorized shares of common stock to one billion from

three hundred million at the end of fiscal 1997.

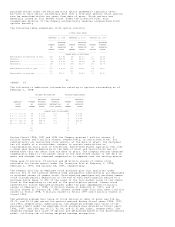

Stock Split -- On each of March 6, 1998 and July 25, 1997, the Company effected

a two-for-one common stock split by paying a 100% stock dividend to stockholders

of record as of February 27, 1998 and July 18, 1997, respectively. All share and

per share information has been retroactively restated in the Consolidated

Financial Statements to reflect these stock splits.

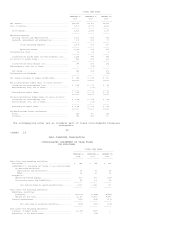

Stock Repurchase Program -- The Board of Directors has authorized the Company to

repurchase up to 250 million shares of its common stock in open market or

private transactions. During fiscal 1998 and fiscal 1997, the Company

repurchased 69 million and 81 million shares of its common stock, respectively,

for an aggregate cost of $1.0 billion and $503 million, respectively. The

Company utilizes equity instrument contracts to facilitate its repurchase of

common stock. At

30

<PAGE> 32

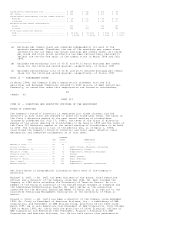

February 1, 1998 and February 2, 1997, the Company held equity instrument

contracts that relate to the purchase of 50 million and 36 million shares of

common stock, respectively, at an average cost of $44 and $9 per share,

respectively. Additionally, at February 1, 1998 and February 2, 1997, the

Company has sold put obligations covering 55 million and 34 million shares,

respectively, at an average exercise price of $39 and $8, respectively. The

equity instruments are exercisable only at expiration, with the expiration dates

ranging from the first quarter of fiscal 1999 through the third quarter of

fiscal 2000.

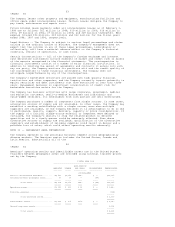

At February 2, 1997, certain outstanding put obligations contained net cash

settlement or physical settlement terms thus resulting in a reclassification of

the maximum potential repurchase obligation of $279 million from stockholders'

equity to put warrants. The outstanding put obligations at February 1, 1998

permitted net-share settlement at the Company's option and, therefore, did not

result in a put warrant liability on the balance sheet. The equity instruments

did not have a material dilutive effect on earnings per common share for fiscal

1998 or fiscal 1997.

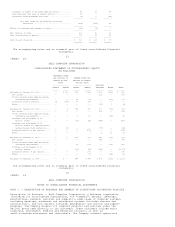

NOTE 8 -- BENEFIT PLANS

Incentive and Employee Stock Purchase Plans -- The Dell Computer Corporation

Incentive Plan (the "Incentive Plan"), which is administered by the Compensation

Committee of the Board of Directors, provides for the granting of incentive

awards in the form of stock options, stock appreciation rights ("SARs"),

restricted stock, stock and cash to directors, executive officers and key

employees of the Company and its subsidiaries, and certain other persons who

provide consulting or advisory services to the Company.

Options granted may be either incentive stock options within the meaning of

Section 422 of the Internal Revenue Code or nonqualified options. The right to