Dell 1997 Annual Report Download - page 37

Download and view the complete annual report

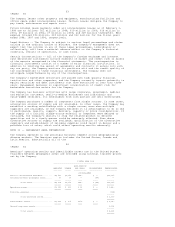

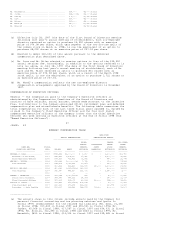

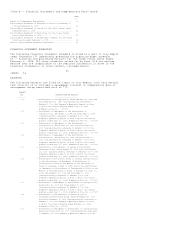

Please find page 37 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Mr. Hirschbiel....................................... $34,000 48,000 shares

Mr. Jordan........................................... $34,000(b) 48,000 shares

Mr. Luce(c).......................................... $ 5,000 49,722 shares

Mr. Luft............................................. $35,000 48,000 shares

Ms. Malone........................................... $35,000 48,000 shares

Mr. Mandl(d)......................................... $40,000 61,356 shares

Mr. Miles(c)......................................... $ 5,000 49,722 shares

---------------

(a) Effective July 18, 1997 (the date of the first Board of Directors meeting

following last year's annual meeting of stockholders), each non-employee

director received an option to purchase 24,000 shares with an exercise

price of $74.08 per share, which upon payment of the two-for-one split of

the common stock on March 6, 1998, is now the equivalent of an option to

purchase 48,000 shares at an exercise price of $37.04 per share.

(b) Elected to defer $30,000 of this amount pursuant to the deferred

compensation plan described above.

(c) Mr. Luce and Mr. Miles elected to receive options in lieu of the $30,000

annual retainer fee. Accordingly, in addition to the options referred to in

note (a) above, on July 18, 1997 (the date of the first Board of Directors

meeting following last year's annual meeting of stockholders), each of Mr.

Luce and Mr. Miles received an option to purchase 861 shares with an

exercise price of $74.08 per share, which as a result of the March 1998

stock split, is now the equivalent of an option to purchase 1,722 shares at

an exercise price of $37.04.

(d) Mr. Mandl's compensation reflects the new non-employee director

compensation arrangements approved by the Board of Directors in November

1997.

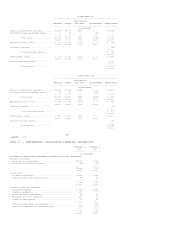

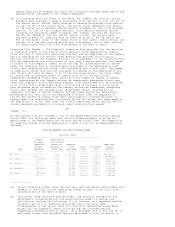

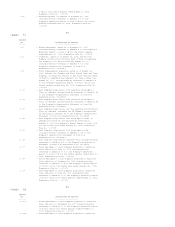

COMPENSATION OF EXECUTIVE OFFICERS

General -- The compensation paid to the Company's executive officers is

administered by the Compensation Committee of the Board of Directors and

consists of base salaries, annual bonuses, awards made pursuant to the Incentive

Plan, contributions to the Company-sponsored 401(k) retirement plan and deferred

compensation plan and miscellaneous benefits. The following table summarizes the

total compensation for each of the last three fiscal years awarded to, earned by

or paid to the Company's Chief Executive Officer and the four most highly

compensated executive officers of the Company (other than the Chief Executive

Officer) who were serving as executive officers at the end of fiscal 1998 (the

"Named Executive Officers").

47

<PAGE> 49

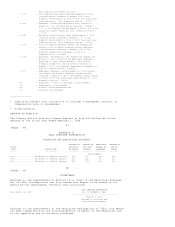

SUMMARY COMPENSATION TABLE

LONG-TERM

ANNUAL COMPENSATION COMPENSATION AWARDS

---------------------------------- -----------------------

OTHER SHARES ALL OTHER

ANNUAL RESTRICTED UNDER- OTHER

NAME AND FISCAL COMPEN- STOCK LYING COMPEN-

PRINCIPAL POSITION YEAR SALARY BONUS SATION(A) AWARDS(B) OPTIONS(C) SATION(D)

------------------ ------ -------- ---------- --------- ---------- ---------- ---------

MICHAEL S. DELL................ 1998 $788,462 $2,000,000 $ 1,650 $ 0 3,200,000 $10,759

Chairman of the Board, 1997 688,461 1,304,910 17,440 0 3,200,000 36,266

Chief Executive Officer 1996 568,629 731,421 92,541 0 480,000 22,044

MORTON L. TOPFER............... 1998 616,346 2,000,000(e) 7,749 0 150,000 17,568

Vice Chairman 1997 544,276 1,031,622 17,567 0 360,000 36,636

1996 490,892 631,429 116,515 640,000 2,200,000 27,652

KEVIN B. ROLLINS............... 1998 450,381 1,125,953(e) 141,206 0 400,000 12,633

Vice Chairman 1997 341,540 486,610 125,099 0 2,680,000 3,000

1996 -- -- -- -- -- --

THOMAS J. MEREDITH............. 1998 408,288 1,020,719(e) 825 0 80,000 10,826

Senior Vice President, 1997 383,547 545,232 14,314 0 240,000 19,037

Chief Financial Officer 1996 327,635 316,075 41,534 320,000 224,000 16,621

PHILLIP E. KELLY............... 1998 308,892 579,173(e) 405,538 0 60,000 10,323

Vice President and 1997 266,923 379,358 422,616 0 220,776 10,117

President -- Asia Pacific 1996 223,397 166,243 288,275 731,200 400,000 11,107

---------------

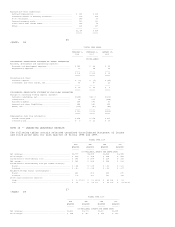

(a) The amounts shown in this column include amounts paid by the Company for

personal financial counseling and tax planning services and (prior to

fiscal 1997) reimbursement for the related tax liability (Mr. Dell, $1,650

in fiscal 1998, $17,440 in fiscal 1997 and $92,541 in fiscal 1996; Mr.

Topfer, $5,008 in fiscal 1998, $17,567 in fiscal 1997 and $34,031 in fiscal

1996; Mr. Rollins, $12,390 in fiscal 1998 and $643 in fiscal 1997; Mr.

Meredith, $825 in fiscal 1998, $14,314 in fiscal 1997 and $39,485 in fiscal