Dell 1997 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marketable Securities

The fair value of the Company's investments in marketable securities at February

1, 1998 was $1.5 billion. The Company's investment policy is to manage its

marketable securities portfolio to preserve principal and liquidity while

maximizing the return on the investment portfolio through the full investment of

available funds. The Company diversifies the marketable securities portfolio by

investing in multiple types of investment-grade securities and through the use

of different investment brokers. The Company's marketable securities portfolio

is primarily invested in short-term securities with at least an investment grade

rating to minimize interest rate and credit risk as well as to provide for an

immediate source of funds. Based on the Company's marketable securities

portfolio and interest rates at February 1, 1998, a 175 basis point increase or

decrease in interest rates would result in a decrease or increase of $17

million, respectively, in the fair value of the marketable securities portfolio.

Although changes in interest rates may affect the fair value of the marketable

securities portfolio and cause unrealized gains or losses, such gains or losses

would not be realized unless the investments are sold.

FACTORS AFFECTING THE COMPANY'S BUSINESS AND PROSPECTS

There are numerous factors that may affect the Company's business and the

results of its operations. These factors include general economic and business

conditions; the level of demand for personal computers; the level and intensity

of competition in the personal computer industry and the pricing pressures that

may result; the ability of the Company to timely and effectively manage

17

<PAGE> 19

periodic product transitions and component availability; the ability of the

Company to develop new products based on new or evolving technology and the

market's acceptance of those products; the ability of the Company to manage its

inventory levels to minimize excess inventory, declining inventory values and

obsolescence; the product, customer and geographic sales mix of any particular

period; the Company's ability to continue to improve its infrastructure

(including personnel and systems) to keep pace with the growth in its overall

business activities; and the Company's ability to ensure its products and

information systems and those of its third party providers will be Year 2000

compliant. For a discussion of these and other factors affecting the Company's

business and prospects, see "Item 1 -- Business -- Factors Affecting the

Company's Business and Prospects" above.

ITEM 7A -- QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Response to this item is included in "Item 7 -- Management's Discussion and

Analysis of Financial Condition and Results of Operations -- Market Risk" above.

18

<PAGE> 20

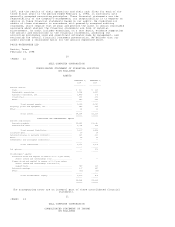

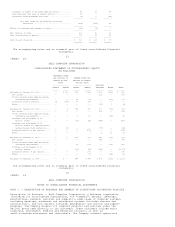

ITEM 8 -- FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

PAGE

----

Financial Statements:

Report of Independent Accountants......................... 20

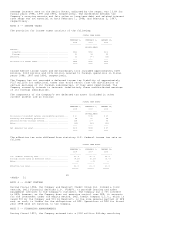

Consolidated Statement of Financial Position at February

1, 1998 and February 2, 1997........................... 21

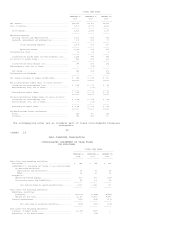

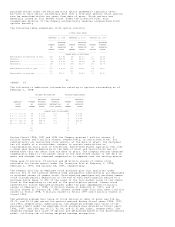

Consolidated Statement of Income for the three fiscal

years ended February 1, 1998........................... 22

Consolidated Statement of Cash Flows for the three fiscal

years ended February 1, 1998........................... 23

Consolidated Statement of Stockholders' Equity for the

three fiscal years ended February 1, 1998.............. 24

Notes to Consolidated Financial Statements................ 25

Financial Statement Schedule:

For the three fiscal years ended February 1, 1998

Schedule II -- Valuation and Qualifying Accounts....... 58

All other schedules are omitted because they are not applicable.

19

<PAGE> 21

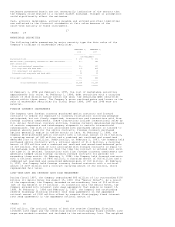

REPORT OF INDEPENDENT ACCOUNTANTS

To the Board of Directors and Stockholders of

Dell Computer Corporation

In our opinion, the consolidated financial statements listed in the accompanying

index present fairly, in all material respects, the financial position of Dell

Computer Corporation and its subsidiaries at February 1, 1998 and February 2,