Citibank 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We were once again the most profi table fi nancial

services company in the world in 2005 and we

returned the most capital to our shareholders of

any fi nancial services company, while continuing

to invest in our businesses.

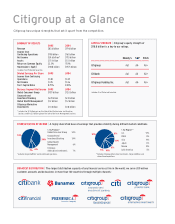

Income from continuing operations was $19.8

billion; our equity base increased to $118.8 billion;

and our balance sheet topped $1.49 trillion. In

2006, we announced an 11 percent increase to

our quarterly dividend, our 21st consecutive year

of common dividend increases.

I am proud of our achievements in 2005. In the

aftermath of our problems in Japan and Europe

in 2004, we took a long, hard look at ourselves

and developed our Five Point Plan that focused

on employee training, talent development, perfor-

mance reviews, improved communications, and

stronger controls. We committed ourselves to our

three Shared Responsibilities—to our clients, each

other, and our franchise. We met with our regula-

tors throughout the year and updated them on our

actions to strengthen Citigroup’s culture. By year-

end, we were confi dent our results were favorably

received and we will continue to work together

on areas of mutual interest and concern. And we

promoted a new generation of leaders, encouraging

the innovative thinking and fresh ideas that have

been hallmarks of our company.

2005 REVIEW

In 2005 we took a number of steps to prepare for

the future and lay a foundation for growth:

We allocated capital to highest-return and growth

opportunities and shifted our business mix toward

distribution. This was refl ected, for example, in the

sale of our Life Insurance and Annuities business as

well as the sale of our Asset Management business

for Legg Mason’s Wealth Management business.

Dear Shareholders,

2005 was one of Citigroup’s most important years. It was a year in which

we concentrated on how we do business and how we conduct ourselves as

employees of a great global institution. As a result, I fi rmly believe that we

are entering a renewed period of growth that will further fulfi ll the promise

on which our company was founded.