Citibank 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

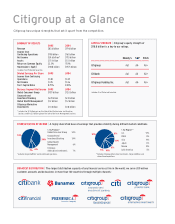

9 | Citigroup 2005

Among some of the issues that our

business faced last year were bankruptcy

spikes from the new U.S. law, and the

impact of Hurricane Katrina, both

of which affected our bottom line.

Nonetheless, we produced net income

of $10.9 billion on revenues of

$48.2 billion.

Whether helping a CitiGold® client

make investments in Moscow, a small

business obtain a loan in Hong Kong,

a fi rst-time borrower use CitiFinancial

for a scooter loan in India, or new

immigrants open their fi rst checking

accounts in New York, our businesses

offer more to the world’s consumers

than any other fi nancial institution.

Among other innovations in 2005, we

introduced the PayPass debit product

in the United States, the fi rst Cards

rewards program in Egypt, mobile

phone banking in Australia, and

CitiFinancial transaction windows

in post offi ces throughout Romania.

FOCUS ON OUR CLIENTS

2005 was a year of transition, as we

made major structural and managerial

changes. We reorganized our businesses

along client lines to capitalize on the

different opportunities that the retail

consumer markets offer.

Our U.S. Consumer business is

organized as follows: U.S. Retail

Distribution, composed of our

branch-based consumer businesses

and Primerica Financial Services; U.S.

Consumer Lending, which includes our

mortgage, auto, and student loan busi-

nesses; U.S. Cards; and U.S. Commercial

Business. This new structure allows us

to better integrate products and services

to meet the needs of our clients and

deepen our relationships with them.

PRODUCT BREADTH

In our Cards business, U.S. Cards offers

innovative products and services that

make us the world’s leading cards issuer.

Among our many initiatives in 2005,

we launched the SimplicitySM Card in

the United States in response to our

clients’ aversion to late fees and their

desire for swift, live, one-on-one service;

a Platinum Card in Singapore that

offers card holders extensive insurance

options; and the Citi Ultima Card in

Russia, aimed at meeting the needs of

the growing number of affl uent people

in that country.

We also extended the reach of existing

products. We expanded our CitiGold

offerings for affl uent individuals by

launching the product in Spain, open-

ing a CitiGold Center in Hong Kong,

and introducing CitiGold Member

Rewards in Indonesia. In the United

States, CitiGold is adding clients at the

fastest rate in many years.

Also in 2005, U.S. Cards announced that

for the fi rst time it will issue Citi prod-

ucts on the American Express Network.

The Citi American Express Cards will

be accepted at millions of locations and

at more than 1,700 American Express

Travel Services locations.

Despite some challenges in 2005, the Global Consumer Group remains

a leader in the financial services industry. With its unmatched size and

geographic reach, innovative products and services, and the industry’s

most valuable brand, our consumer business is poised for growth in

North America and around the world.

Global Consumer Group

Homeowners...Small Businesses...College Students...Retirees