Citibank 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 | Citigroup 2005

Our consumer business is focused

not only on the affl uent, but across a

broad economic spectrum. In 2005,

CitiFinancial introduced a real estate-

secured loan product in several markets,

including Hong Kong and Poland,

where such loans historically have not

been available. The loan gives bor-

rowers who have been shut out of the

housing market the opportunity to

own a home.

EXPANDING OUR REACH

Likewise, the growing branch networks

of CitiFinancial and Citibank are help-

ing millions of consumers reach their

fi nancial goals and fulfi ll their dreams.

Consider South America: in Brazil

in 2005, our retail bank grew to 60

branches and 230,000 clients. In

Colombia, we increased the number of

branches and ATMs by 50 percent. And

in Peru, we added nine branches and

launched several key products, includ-

ing personal loans, retail accounts, and

online capabilities.

In the United States, we also completed

the acquisition of First American Bank

in Texas, adding 106 branches in one of

our key U.S. markets.

We expect to expand our Citibank

and CitiFinancial presence signifi cantly

in 2006, adding hundreds of branches

globally. We are working to grow our

retail bank branch network substantially

in Brazil, Turkey, and Russia, among

other countries. We also plan to expand

our consumer fi nance branch presence

in Mexico, Poland, India, Spain, Korea,

and elsewhere.

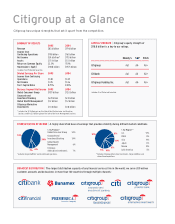

A FOUNDATION FOR GROWTH

One of the most valuable legacies of

our almost 200 years of banking is the

foundation we’ve built for growth for

the next 200: a worldwide network

of 7,919 retail branches and consumer

fi nance offi ces (includes automated

loan machines in Japan) serving mil-

lions of clients in 50 countries.

One of our priorities for 2006 and

beyond is to leverage this unique plat-

form to attract new clients and deepen

our relationships with existing clients.

We have the reach, products, and ser-

vices to succeed at both. What’s more,

we have the insight to fi nd innovative

ways to serve clients and to deliver these

services well—witness such unique

offerings as Citi Identity Theft Solutions,

the ThankYou Network, and Citibank®

Global Transfers.

SHARING EXPERTISE GLOBALLY

Citigroup is one of the world’s most

experienced fi nancial services compa-

nies, and our global footprint allows

us to share knowledge across borders.

Through our unrivaled risk and deci-

sion management expertise, we have

the ability to make loans to and open

accounts for consumers in any market.

Few companies have the advantages of

Citigroup when entering developing

markets such as India, Poland, or Brazil

and extending credit, opening checking

accounts, or issuing cards.

Small Businesses...College Students...Retirees...Homeowners...Small Bu