Citibank 2005 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2005 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

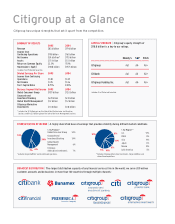

Citigroup at a Glance

53%

34%

7% 6% 5%

8%

14%

6%

10%

57%

% By Product* % By Region**

Global Consumer Group 53%

Corporate and

Investment Banking 34%

Global Wealth

Management 6%

Citigroup

Alternative Investments 7%

U.S. 57%

EMEA 8%

Asia 14%

Japan 6%

Mexico 10%

Latin America 5%

Citigroup has unique strengths that set it apart from the competition.

2005 2004

Revenue $83.6 billion $79.6 billion

Income from

Continuing Operations $19.8 billion $16.1 billion

Net Income $24.6 billion* $17.0 billion

Assets $1.5 trillion $1.5 trillion

Return on Common Equity 22.3% 17.0%

Stockholders’ Equity

1 $118.8 billion $115.5 billion

1 includes Trust Preferred Securities

Diluted Earnings Per Share 2005 2004

Income from Continuing

Operations $3.82 $3.07

Net Income $4.75 $3.26

Tier 1 Capital Ratio 8.79% 8.74%

Business Segment Net Income 2005 2004

Global Consumer Group $10.9 billion $12.0 billion

Corporate and

Investment Banking $6.9 billion $2.0 billion

Global Wealth Management $1.2 billion $1.2 billion

Citigroup Alternative

Investments $1.4 billion $0.8 billion

DIVERSIFICATION OF INCOME | A highly diversified base of earnings that provides stability during difficult market conditions.

SUMMARY OF RESULTS CAPITAL STRENGTH | Citigroup’s equity strength of

$118.8 billion1 is a key to our ratings.

Moody’s S&P Fitch

Citigroup Aa1 AA- AA+

Citibank Aa1 AA AA+

Citigroup Funding Inc. Aa1 AA- AA+

1includes Trust Preferred Securities

BROADEST DISTRIBUTION | The largest distribution capacity of any financial services firm in the world; we serve 200 million

customer accounts and do business in more than 100 countries through multiple channels:

*excludes Corporate/Other and discontinued operations

* includes the $2.1 billion gain on the Sale of the Life Insurance and Annuities

business and the $2.1 billion gain on the Sale of the Asset Management business

** excludes Citigroup Alternative Investments, Corporate/Other, and

discontinued operations